Money H

Money—it’s a subject we can’t escape, yet so many of us feel unprepared to handle it.

If you’ve ever thought, “If only I made more money, I’d be set,” you’re not alone. But here’s the truth: no matter how much you earn, it’s your money habits that truly determine your financial success.

That’s right—your everyday behaviors and decisions around money matter more than your paycheck. And for Gen Z, navigating financial freedom in a world of side hustles, student loans, and TikTok money tips, developing strong money habits can make or break your financial future.

Let’s dive into why your habits hold the key to wealth and what you can do to level up.

Understanding the Basics of Money Habits

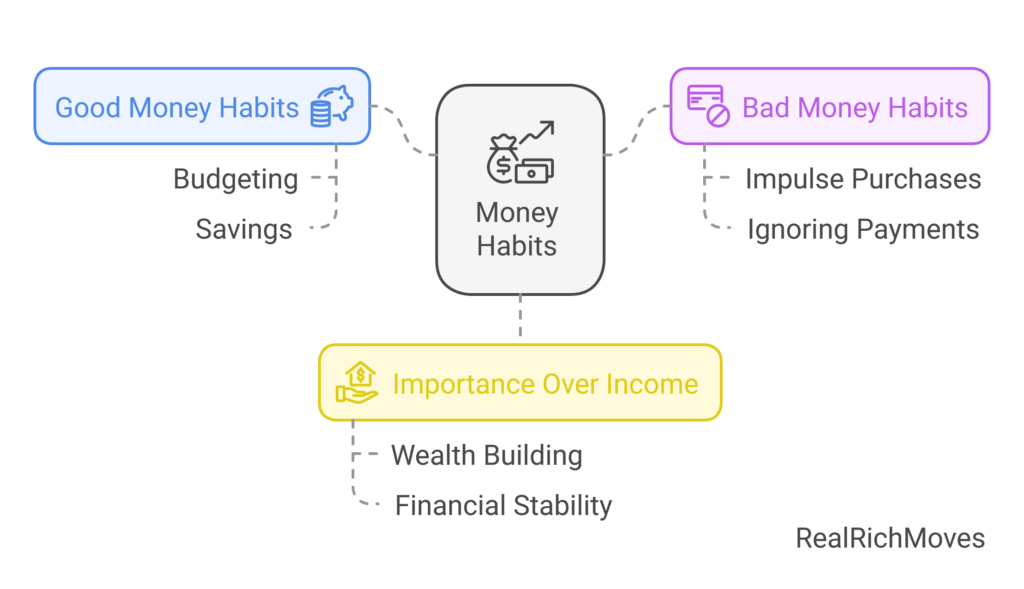

Money habits are at the heart of your financial life. They influence how you manage, save, and spend money and play a critical role in shaping your overall financial health. While many people focus on earning more, the reality is that your habits often matter more than the size of your paycheck. Let’s explore what money habits are, the difference between good and bad ones, and why they outweigh even a high income when it comes to building wealth.

What Are Money Habits?

Money habits are the repeated actions and behaviors you engage in with your finances, whether intentional or not. These habits are often so ingrained in your daily life that you may not even notice them. They can include simple routines, like checking your bank account balance every morning, or more complex practices, like setting up automatic transfers to a savings or investment account.

For example:

- Do you save a portion of every paycheck before spending on anything else?

- Do you track your monthly expenses to ensure you’re staying within your budget?

- Or, do you tend to shop impulsively online, only to wonder where your money went at the end of the month?

Every financial decision you make—no matter how small—stems from your habits. Over time, these habits create patterns that either help you build financial stability or lead to financial struggles.

What makes money habits so powerful is their cumulative effect. While one small purchase might not seem significant, consistently overspending on things you don’t need can drain your finances over time. Similarly, saving even a small amount regularly can lead to significant wealth thanks to compound growth.

The Difference Between Good and Bad Money Habits

Not all money habits are created equal. Some propel you toward your financial goals, while others hold you back. Recognizing the difference between good and bad money habits is essential for making positive changes in your financial life.

Good Money Habits

Good money habits are behaviors that help you manage your finances effectively and build long-term wealth. Examples include:

- Creating and sticking to a budget: A budget gives you a clear roadmap for your money, ensuring you’re intentional about every dollar.

- Saving regularly: Whether it’s for an emergency fund, a vacation, or retirement, saving consistently builds financial security.

- Paying bills on time: This avoids late fees and keeps your credit score healthy, which is critical for financial opportunities like getting a loan or renting an apartment.

- Investing for the future: Putting your money to work through investments helps it grow over time, allowing you to achieve financial freedom faster.

Bad Money Habits

On the other hand, bad money habits are behaviors that undermine your financial stability and create unnecessary stress. These include:

- Impulse spending: Buying things on a whim—especially on non-essentials—can quickly deplete your budget.

- Ignoring your financial situation: Avoiding bills, credit card statements, or your bank account balance can lead to missed payments, overdraft fees, and debt accumulation.

- Living paycheck to paycheck: Without a plan to save or invest, you remain vulnerable to financial emergencies.

- Relying on credit for non-essentials: Using credit cards to cover lifestyle expenses can lead to high-interest debt that’s difficult to pay off.

The good news? Bad habits can be replaced with good ones. The first step is awareness—acknowledging the habits that hurt your finances and committing to change.

Why Are Money Habits More Important Than Income?

It’s a common misconception that a high income automatically translates to financial success. While earning more money certainly provides more opportunities, it’s your habits—not your paycheck—that determine your financial stability and ability to build wealth.

The Pitfall of Poor Money Habits with High Income

A six-figure salary might sound like the ultimate financial goal, but it’s not a guarantee of wealth. Without smart money habits, even the largest paycheck can vanish quickly. Many high earners fall victim to lifestyle inflation, where their spending increases to match their income. Bigger homes, luxury cars, expensive vacations—these choices can drain even the most substantial earnings.

Consider this: someone earning $150,000 a year but spending $160,000 is worse off than someone earning $50,000 and saving 20% of their income. Without good money habits, income alone won’t protect you from financial instability.

How Modest Incomes Build Wealth Through Habits

On the flip side, individuals with modest incomes can achieve significant wealth by adopting disciplined money habits. Living below their means, saving consistently, and avoiding debt allow them to build financial security over time.

For example:

- A teacher earning $45,000 a year might save $5,000 annually by living frugally. Over a decade, with interest and investments, that savings can grow exponentially.

- Investing small amounts regularly can lead to substantial growth thanks to the power of compounding.

In this way, financial habits have a far greater impact on long-term wealth than income alone.

The Bottom Line

Your financial habits are the foundation of your financial future. Whether you earn a modest salary or a high income, it’s how you manage your money that truly matters. By cultivating good money habits and breaking bad ones, you can create a solid financial plan, reduce stress, and work toward your goals—no matter your starting point.

So, where do you stand? Take a closer look at your current money habits, and start making intentional changes today. Small steps can lead to big results, setting you on the path to lasting financial success.

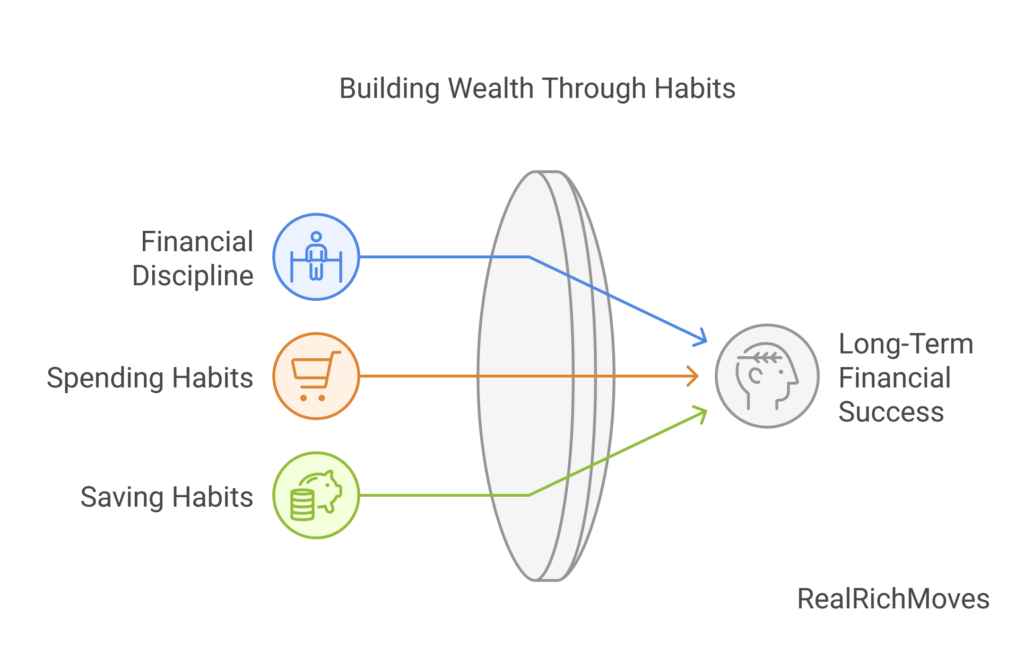

The Role of Financial Habits in Long-Term Success

When it comes to achieving lasting financial success, your habits matter far more than any short-term windfall or lucky break. Long-term financial health is built on the foundation of consistent, disciplined practices—your financial habits.

Whether it’s sticking to a budget, making intentional spending choices, or saving regularly, these habits shape your ability to grow wealth, handle setbacks, and ultimately achieve your financial goals.

Financial Discipline: The Foundation of Wealth

Think of financial discipline as the cornerstone of wealth-building. Just as a gym routine helps you build muscle and improve health, disciplined money habits keep your finances in peak condition. The key is consistency.

Financial discipline means sticking to your budget even when temptations arise. It’s about saying “no” to unnecessary purchases and prioritizing your long-term goals over instant gratification. For instance, instead of splurging on the latest tech gadget, disciplined individuals evaluate whether the expense aligns with their financial plans.

Discipline also helps you manage unexpected challenges. A car repair or a medical bill can derail your finances if you’re not prepared. However, disciplined habits like building an emergency fund provide a safety net that ensures you’re ready for life’s surprises.

The benefits compound over time. Just like regular exercise strengthens your body, disciplined money habits strengthen your financial position, making it easier to invest, save, and grow your wealth.

Spending Habits and Their Impact on Wealth

Your spending habits are a direct reflection of your priorities. Every time you make a purchase, you’re essentially casting a vote for what matters most to you. Are you prioritizing experiences, future goals, or financial security? Or are you spending impulsively on things that provide temporary satisfaction but little lasting value?

Unchecked spending habits can slowly erode your ability to build wealth. Frequent splurges on coffee runs, dining out, or the latest fashion trends might seem insignificant in the moment, but they add up over time. For example, spending $10 daily on takeout can cost over $3,500 a year—money that could have been invested or saved for future goals.

On the flip side, intentional spending habits pave the way to financial success. Being mindful of where your money goes allows you to redirect funds toward what truly matters—whether that’s saving for a down payment, paying off debt, or investing in your future. Adopting practices like meal prepping, comparing prices before making purchases, or creating a “fun money” category in your budget helps you strike a balance between enjoying the present and securing the future.

The bottom line? Thoughtful spending doesn’t mean cutting out all the fun; it means making choices that align with your values and financial goals.

Saving Habits: Building Financial Security

Savings are more than just a number in your bank account—they’re a crucial part of your financial foundation. Whether it’s an emergency fund, retirement account, or a vacation fund, consistent saving habits provide the security and flexibility to take on life’s challenges and opportunities.

For many Gen Zers, the idea of saving can feel daunting, especially with student loans, rent, and other financial pressures. But the truth is, every small step counts. Even saving as little as $5 or $10 a week can add up over time, thanks to the power of compound interest.

Savings also give you the freedom to dream big. Want to start a business, travel the world, or buy your first home? Those goals are far more achievable when you’ve built a financial cushion. Without savings, taking risks often feels impossible.

Here’s the golden rule of saving: make it automatic. Set up an automatic transfer to your savings account each payday. This “set it and forget it” approach ensures you’re consistently building your safety net without having to rely on willpower.

In the end, saving is more than just a habit—it’s a mindset. It’s about preparing for the unexpected, creating opportunities, and giving yourself the peace of mind that comes with knowing you’re financially secure. Small, consistent savings today can pave the way for big opportunities tomorrow.

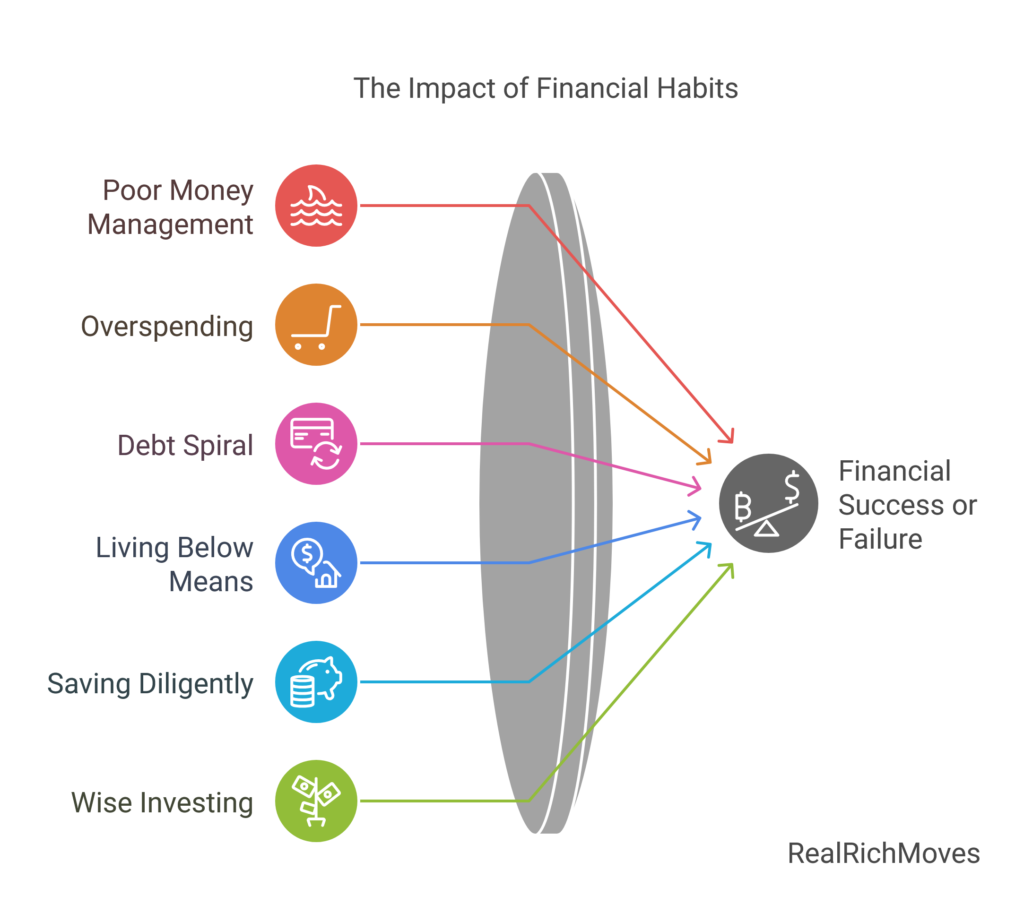

Money Habits vs. Income: Breaking Down the Numbers

When it comes to financial success, many people believe that earning more money is the ultimate solution. While a higher income can certainly provide more opportunities and financial flexibility, it’s not the cure-all it’s often made out to be.

The truth is, your money habits—how you manage, save, and spend—are far more critical to your financial well-being than the size of your paycheck. Let’s explore why a high income isn’t always a guarantee of wealth and how individuals with modest incomes can still achieve financial success.

Why High Earners Can Still Struggle

It’s easy to assume that people earning six or seven figures must be financially set for life, but that’s not always the case. The stories of celebrities, athletes, and lottery winners who end up bankrupt highlight a harsh reality: a high income alone doesn’t ensure financial security.

The primary culprit is often lifestyle inflation—the tendency to spend more as you earn more. When income increases, so do expenses: a bigger house, a luxury car, designer clothes, and extravagant vacations. Without proper money habits, these expenses can quickly outpace even a substantial income.

For example, consider a professional athlete earning millions annually but living a lifestyle that costs just as much—or more. Between lavish purchases, poor investments, and a lack of financial planning, their wealth can evaporate as quickly as it came. High earners are also more susceptible to taking on significant debt to maintain their lifestyles, leading to financial instability when their income decreases or unexpected expenses arise.

Ultimately, the issue isn’t how much money they make—it’s how they manage it. Without strong money habits like budgeting, saving, and controlling expenses, even the wealthiest individuals can find themselves struggling to stay afloat.

Low-Income Individuals Who Build Wealth

On the other end of the spectrum, there are countless examples of people with modest incomes who achieve remarkable financial success. What’s their secret? It’s not about luck or earning potential—it’s about cultivating solid financial habits.

Living Below Their Means:

One key habit of financially successful individuals is the ability to live below their means. This means spending less than they earn, even if their income is limited. By prioritizing needs over wants and avoiding unnecessary expenses, they free up money to save or invest.

For instance, a school teacher earning $45,000 annually may drive an older car, shop sales, and pack their lunch instead of dining out. These small sacrifices add up, allowing them to build an emergency fund, pay off debt, or invest for the future.

The Power of Consistent Saving and Investing:

Another crucial habit is consistent saving. Even small, regular contributions to a savings account or investment portfolio can grow significantly over time thanks to the power of compound interest. A person who saves $50 a month and invests it in a diversified portfolio can accumulate tens of thousands of dollars over a few decades.

Consider the story of Ronald Read, a janitor and gas station attendant who quietly amassed an $8 million fortune through frugal living and long-term investing. Despite his modest income, his disciplined approach to money allowed him to achieve what many high earners fail to accomplish.

Avoiding Debt:

Many low-income individuals who build wealth are diligent about avoiding high-interest debt. They prioritize paying off credit cards and avoid borrowing for unnecessary expenses. By steering clear of debt traps, they ensure that their hard-earned money goes toward building their future, not paying interest.

The Importance of a Mindset Shift:

For many, the journey to financial success starts with changing their perspective. Instead of focusing on what they can’t afford, they focus on making the most of what they have. This mindset shift enables them to find creative ways to save, grow their income, and achieve financial goals.

The Takeaway

Earning more money might seem like the answer to financial struggles, but without the right habits, even the highest income can lead to financial disaster. Conversely, individuals with modest incomes who practice good money management can achieve financial freedom and build lasting wealth.

The key isn’t how much you earn—it’s how you handle your money. With strong habits, discipline, and a focus on living within your means, you can take control of your finances and create a brighter financial future, no matter your income level.

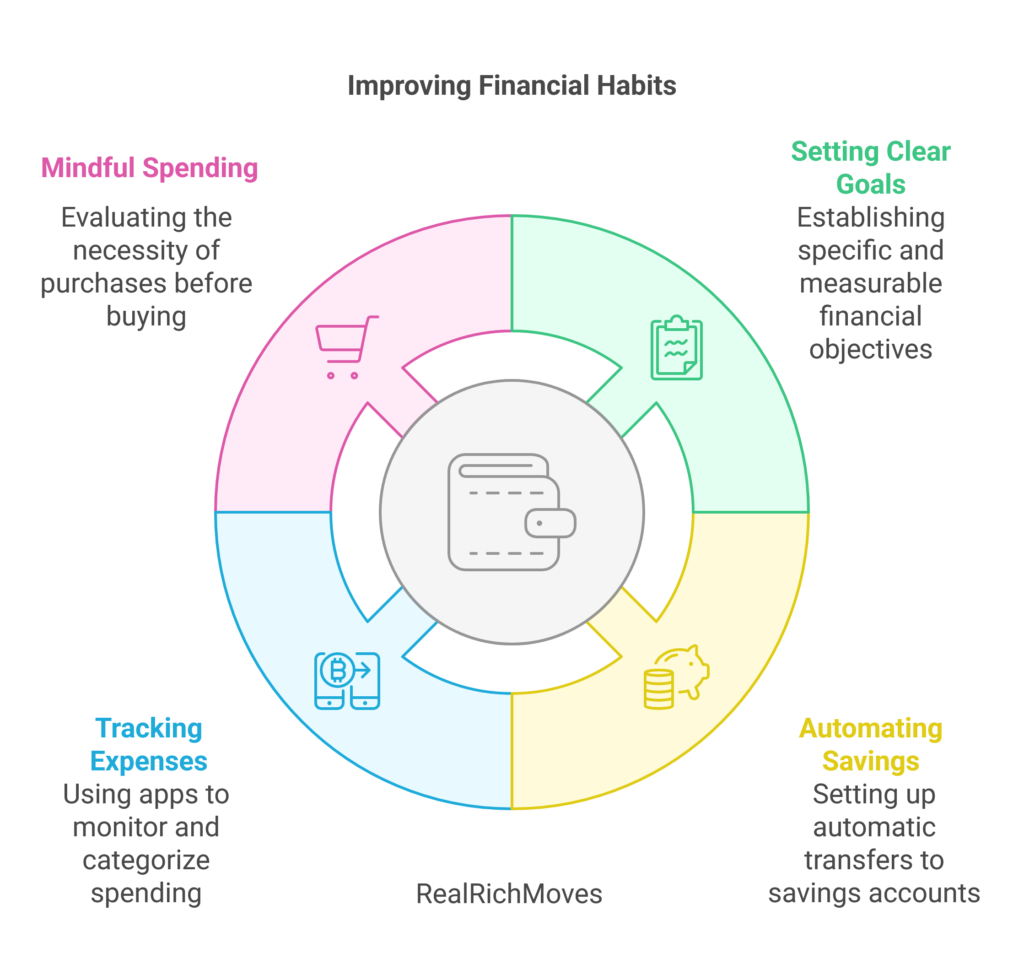

How to Build Better Money Habits

Improving your financial habits isn’t an overnight process, but with consistent effort, it can become second nature. Good money habits set the foundation for achieving your financial goals, reducing stress, and gaining control over your future. Here’s how you can begin the transformation step by step.

Assessing Your Current Financial Behavior

You can’t fix what you don’t measure. The first step to building better money habits is understanding your current financial behavior. This involves taking an honest look at how you spend, save, and manage your money.

Start by tracking your spending for at least one month. This might seem tedious, but it’s a powerful way to uncover patterns you may not even realize exist. Break your expenses into categories, such as groceries, dining out, transportation, subscriptions, and entertainment. Many people are shocked when they see how much of their income goes to things like food delivery, coffee runs, or streaming services.

Use tools like bank statements, budgeting apps, or a simple spreadsheet to get a complete picture of where your money is going. Once you have the data, ask yourself:

- Are there categories where I’m consistently overspending?

- Am I putting enough money toward savings and investments?

- Are my spending habits aligned with my long-term goals?

This level of self-awareness is the first and most critical step to making meaningful changes.

Setting Clear Financial Goals

Now that you know where you stand, it’s time to decide where you want to go. Setting clear, actionable goals gives you a sense of purpose and direction for your financial journey. The key to effective goal-setting is using the SMART framework:

- Specific: Define exactly what you want to achieve.

- Measurable: Set a number or target to track your progress.

- Achievable: Be realistic about what you can accomplish based on your current situation.

- Relevant: Ensure your goal aligns with your broader life values.

- Time-Bound: Set a deadline to create urgency.

For example, instead of saying, “I want to save money,” refine your goal to, “I’ll save $1,000 for an emergency fund in six months by setting aside $167 per month.”

Having clear goals helps you stay motivated and gives you a benchmark to measure your progress. Write your goals down, and revisit them regularly to ensure you’re staying on track.

Practical Tips for Building Good Money Habits

Building better money habits requires action. Here are some practical strategies to help you turn intentions into lifelong routines:

Automate Your Savings

One of the simplest ways to build a consistent savings habit is to automate it. Set up an automatic transfer from your checking account to a savings account every payday. By doing this, you’re “paying yourself first,” which ensures you prioritize saving before you’re tempted to spend. Start with an amount you can comfortably manage—whether it’s $20, $50, or 10% of your paycheck—and increase it over time.

Track Your Expenses

Knowledge is power when it comes to your finances. Use apps like Mint, YNAB (You Need A Budget), or PocketGuard to track your spending in real time. These tools categorize your expenses, highlight areas where you’re overspending, and even offer suggestions to optimize your budget. If you prefer a low-tech approach, a simple notebook or spreadsheet works just as well.

Tracking expenses doesn’t just give you clarity—it also creates accountability. When you see how much you’re spending on non-essentials like takeout or impulse buys, you’ll be more motivated to cut back and redirect that money toward your goals.

Practice Mindful Spending

In today’s fast-paced world of instant gratification, it’s easy to spend without thinking. A little mindfulness can go a long way in curbing unnecessary expenses. Before making a purchase, pause and ask yourself:

- Do I really need this, or am I buying it out of boredom, stress, or FOMO?

- Will this purchase bring long-term value or happiness?

- Is this aligned with my financial goals?

Mindful spending doesn’t mean depriving yourself—it means making deliberate choices that reflect your priorities. For instance, you might skip an impulse online shopping spree but allocate money for a concert or trip that genuinely excites you.

Adopt the “30-Day Rule”

For larger, non-essential purchases, try the 30-day rule: wait 30 days before buying. This cooling-off period helps you determine whether you truly need the item or if the desire to purchase it fades over time. More often than not, you’ll find that the impulse subsides, saving you money.

Build a “No-Spend” Challenge

Take on a no-spend challenge for a set period—like a week or a month—where you commit to avoiding all unnecessary purchases. This exercise not only helps you save money but also resets your spending habits and makes you more conscious of how you use your resources.

Reward Yourself for Milestones

Building good habits takes effort, and celebrating small wins can keep you motivated. Set milestones for your financial goals (e.g., saving your first $500) and reward yourself with something modest, like a favorite treat or a small outing. The key is to keep the reward aligned with your budget and values.

Staying Consistent

The most important part of building better money habits is consistency. Habits don’t change overnight, but with small, intentional steps repeated daily, you’ll create a new normal for your finances. When setbacks occur—and they will—don’t get discouraged. Reflect on what went wrong, adjust your approach, and keep moving forward.

Remember, the ultimate goal isn’t perfection—it’s progress. By assessing your behavior, setting clear goals, and implementing practical strategies, you can develop money habits that lead to long-term financial success and freedom.

Budgeting Strategies for Better Money Management

Budgeting is the cornerstone of financial success. It’s not just about crunching numbers—it’s about taking control of your money, aligning your spending with your values, and making progress toward your financial goals. Whether you’re living paycheck to paycheck or have disposable income to spare, a budget acts as your financial roadmap, helping you navigate expenses, avoid debt, and build wealth.

Let’s dive deeper into why budgeting is so important and explore effective budgeting methods tailored for Gen Z’s lifestyle and goals.

What is Budgeting, and Why Does it Matter?

Think of budgeting as your financial game plan. It’s a way of planning and tracking how you earn, spend, save, and invest your money. Without a budget, your finances can feel chaotic—like driving without a map and hoping you end up at the right destination.

Budgeting matters because it:

- Gives You Control: When you know where your money is going, you’re in the driver’s seat, not your expenses.

- Reduces Financial Stress: A clear plan helps you avoid surprises and feel confident about your finances.

- Aligns Spending with Goals: Budgeting ensures your spending reflects what’s important to you, whether it’s saving for a house, paying off debt, or traveling the world.

- Prevents Overspending: By setting limits for each category, you’re less likely to blow your paycheck on things you don’t need.

For Gen Z, budgeting is especially crucial because many are navigating financial independence for the first time. Student loans, rising living costs, and the temptation of social media-driven consumerism make having a budget more essential than ever.

Popular Budgeting Methods for Gen Z

There’s no one-size-fits-all approach to budgeting. The best method is one that fits your income, lifestyle, and financial goals. Here are two popular strategies that Gen Z can adapt to simplify money management:

Zero-Based Budgeting

Zero-based budgeting is a proactive approach where you assign every dollar of your income a specific job until there’s nothing left unallocated. This doesn’t mean you spend everything—it means every dollar is accounted for, whether it’s going to bills, savings, investments, or discretionary spending.

How it works:

- Calculate your total income for the month.

- List all your expenses, including fixed costs (rent, utilities) and variable expenses (groceries, entertainment).

- Assign every dollar of your income to a category until your income minus expenses equals zero.

For example, if you earn $3,000 a month, you might allocate:

- $1,200 for rent

- $300 for groceries

- $500 for savings

- $300 for debt repayment

- $200 for entertainment

- $500 for miscellaneous needs

Why it works for Gen Z:

- Provides total clarity over where your money goes.

- Forces you to prioritize your spending.

- Helps you build savings or pay off debt more aggressively.

The 50/30/20 Rule

The 50/30/20 rule is a simpler budgeting method that divides your income into three main categories:

- 50% for Needs: Essentials like housing, food, transportation, and insurance.

- 30% for Wants: Non-essential spending like dining out, entertainment, or hobbies.

- 20% for Savings or Debt Repayment: Building your emergency fund, investing, or paying off loans.

How it works:

If your monthly income is $3,000 after taxes, your budget would look like this:

- $1,500 for needs (rent, groceries, utilities).

- $900 for wants (subscriptions, travel, dining).

- $600 for savings or paying off debt.

Why it works for Gen Z:

- Easy to understand and implement.

- Provides flexibility for enjoying life while still focusing on financial goals.

- Helps balance needs and wants without guilt.

Other Budgeting Tips to Maximize Effectiveness

Budgeting methods provide structure, but these additional tips can make your plan even more effective:

Use Technology to Simplify Budgeting

Apps like Mint, YNAB (You Need a Budget), and PocketGuard can make budgeting less daunting. These tools automatically track your income and expenses, categorize spending, and help you stick to your plan.

Account for Irregular Expenses

Unexpected expenses—like car repairs or gifts—can throw off even the best budget. Create a “miscellaneous” category or set aside a small amount each month for irregular costs.

Revisit and Adjust Your Budget Regularly

Life changes—whether it’s a new job, a move, or an increase in expenses—mean your budget needs to adapt. Review it monthly to ensure it still aligns with your goals and circumstances.

Practice the Envelope System

For those who struggle with overspending, consider the envelope system. Allocate cash for specific categories (like groceries or entertainment) and use only what’s in the envelope. When the cash is gone, you stop spending.

Don’t Forget Fun Money

A strict budget doesn’t mean cutting out all enjoyment. Build a “fun money” category into your plan so you can indulge guilt-free in small pleasures, like a coffee date or a concert.

The Bottom Line on Budgeting

Budgeting is not about restricting yourself—it’s about empowering yourself to make intentional choices with your money. Whether you choose zero-based budgeting, the 50/30/20 rule, or another approach, the goal is the same: to create a plan that reflects your priorities and helps you achieve your financial goals.

For Gen Z, budgeting is a critical tool for navigating the challenges of student loans, rising costs, and balancing fun with responsibility. By finding a budgeting method that works for you and staying consistent, you can take control of your finances and build a strong foundation for the future.

Income vs. Spending: Where Should Your Focus Be?

When it comes to personal finance, many people focus on the wrong metric: income. While earning more money can open doors and create opportunities, it’s not the ultimate solution to financial success. The real key lies in managing the gap between what you earn and what you spend. Understanding and expanding this gap is the cornerstone of saving, investing, and building wealth.

Let’s explore why income isn’t the only factor that matters and how aligning your spending with your values can lead to greater financial satisfaction and stability.

Understanding the Gap Between Earnings and Expenses

Earning more money is often seen as the holy grail of financial success, but it’s not just about how much you bring in—it’s about how much you keep. This difference between your income and expenses is known as your savings gap, and it plays a crucial role in your ability to build wealth.

If your expenses rise to match—or even exceed—your income, you’re essentially treading water financially, no matter how high your paycheck. This phenomenon, known as lifestyle inflation, is common when people receive raises or bonuses. Instead of using the extra money to save or invest, they upgrade their lifestyle with bigger homes, better cars, or more frequent splurges.

On the other hand, keeping your expenses significantly lower than your income allows you to:

- Build an emergency fund for unexpected expenses.

- Save for major goals like buying a house or traveling.

- Invest in your future through retirement accounts or the stock market.

- Reduce financial stress and enjoy more flexibility in your life.

For example, someone earning $50,000 a year but spending $40,000 has a $10,000 gap that can be saved or invested. Meanwhile, someone earning $100,000 but spending $95,000 only has $5,000 left to work with. In this case, the first person is in a better position to build wealth despite earning half as much.

The takeaway? Financial freedom isn’t just about earning more—it’s about spending wisely to maximize the gap between your income and expenses.

How to Align Spending with Your Values

In today’s world of constant advertising and social media influence, it’s easy to fall into the trap of spending on things that don’t truly matter to you. From trendy gadgets to must-have fashion items, many purchases are driven by FOMO (fear of missing out) rather than genuine need or desire. This kind of impulsive spending can leave you feeling unfulfilled and financially strained.

To break free from this cycle, focus on aligning your spending with your values. When your money goes toward things that truly matter, it brings more joy and satisfaction, making it easier to resist unnecessary expenses. Here’s how to do it:

Identify What Matters Most to You

Take some time to reflect on your priorities. What brings you the most happiness and fulfillment? For some, it might be traveling and experiencing new cultures. For others, it could be saving for a secure retirement, pursuing education, or spending quality time with family and friends.

Once you’ve identified your core values, use them as a guide for your financial decisions. If an expense doesn’t align with your values, consider whether it’s truly worth it.

Shift Focus from “Things” to Experiences

Research shows that spending on experiences—like trips, concerts, or meaningful activities—tends to bring more long-term happiness than material possessions. Experiences often create lasting memories and strengthen relationships, making them a better investment in your overall well-being.

For example, instead of upgrading to the latest phone every year, you could use that money for a weekend getaway with friends. The phone might lose its novelty after a few months, but the memories of the trip could last a lifetime.

Practice Mindful Spending

Mindful spending is about being intentional with your money. Before making a purchase, ask yourself:

- Does this align with my values?

- Will it bring lasting happiness or just temporary satisfaction?

- Could this money be better used elsewhere (like savings or investments)?

By pausing to reflect, you can avoid impulse buys and make more thoughtful financial choices.

Budget for What You Love

Budgeting doesn’t have to feel restrictive. In fact, it’s a tool that allows you to spend guilt-free on what matters most. If dining out with friends or attending live events is important to you, allocate a portion of your budget specifically for those activities. This way, you can enjoy them without jeopardizing your financial goals.

The Balance Between Income and Spending

While earning more money can provide greater opportunities, it’s only part of the equation. If your spending isn’t under control, a higher income won’t necessarily improve your financial situation. On the other hand, even a modest income can lead to significant financial growth when paired with disciplined spending and intentional choices.

The key is to focus on what you can control—your spending habits—and ensure they align with your values and goals. By widening the gap between your income and expenses and directing that surplus toward saving and investing, you can set yourself up for long-term financial freedom.

The bottom line? It’s not about how much you make—it’s about how you use it.

The Psychology of Financial Behavior

Our financial behavior is deeply influenced by our emotions, habits, and thought processes.

While managing money might seem like a straightforward numbers game, the reality is much more complex. Understanding the psychology behind your financial decisions can help you break bad habits, adopt better ones, and create a healthier relationship with money.

Let’s delve into how emotional spending impacts your finances and how practicing mindful money management can transform your financial well-being.

How Emotional Spending Impacts Your Finances

Emotional spending, often referred to as “retail therapy,” happens when we buy things not out of necessity but as a way to cope with feelings like stress, sadness, boredom, or even happiness. While splurging on yourself can bring temporary relief or joy, the long-term financial consequences often outweigh the short-term emotional boost.

For example:

- After a tough day at work, you might treat yourself to an expensive dinner or order items from your favorite online store to lift your spirits.

- Seeing a friend post about a new gadget or outfit on social media might trigger feelings of inadequacy, prompting you to make a similar purchase to “keep up.”

- Celebrating a win or accomplishment might lead to overspending, such as treating yourself to a luxury item beyond your budget.

While these purchases might make you feel better in the moment, they often lead to buyer’s remorse—the sinking feeling that comes from realizing you’ve spent money on something unnecessary or unaffordable. Over time, repeated emotional spending can deplete your savings, rack up debt, and create financial stress.

Recognizing Emotional Triggers

The key to combating emotional spending is awareness. Start by identifying the situations or emotions that lead to impulsive purchases. Common triggers include:

- Stress or frustration.

- Peer pressure or FOMO (fear of missing out).

- Celebratory moods, where you feel justified in splurging.

Once you know your triggers, you can develop healthier ways to cope. Instead of shopping, try alternative stress-relief activities like exercising, journaling, or talking to a friend. If social media drives you to spend, consider limiting your screen time or unfollowing accounts that encourage unnecessary consumption.

Pause Before You Purchase

One effective way to curb emotional spending is to adopt the “24-hour rule” (or 48-hour, if you’re feeling ambitious). When you feel the urge to buy something, wait at least a day to see if the desire passes. Often, you’ll find that the impulse fades, saving you from an unnecessary expense.

Mindful Money Management

Mindfulness isn’t just for meditation—it’s a powerful tool for managing your finances. Mindful money management is about being intentional and thoughtful in your financial decisions, ensuring that your spending aligns with your goals and values.

The Power of Intentional Spending

Before making a purchase, ask yourself:

- Do I need this, or do I just want it?

- Is this purchase bringing me closer to my financial goals, or is it a distraction?

- Will this item or experience provide long-term value or happiness?

This moment of reflection can help you make choices that are more aligned with your priorities, reducing the likelihood of regret later. For instance, instead of impulse-buying the latest fashion trend, you might choose to save that money for a goal that matters more, like a vacation or an emergency fund.

Aligning Spending with Your Values

Mindful money management is about spending in ways that reflect your personal values. For example:

- If health and wellness are important to you, prioritize spending on quality groceries or a gym membership.

- If you value learning and self-improvement, invest in books, courses, or experiences that support your growth.

By aligning your money with what truly matters to you, you can create a sense of fulfillment and purpose in your financial decisions.

Strategies to Stay Intentional

Here are practical ways to incorporate mindfulness into your financial life:

- Create a Budget with Room for Joy: Allow yourself a designated amount for “fun” spending so you can enjoy small indulgences without guilt.

- Review Your Bank Statements Regularly: Look at your spending habits and assess whether they reflect your goals and values.

- Shop with a Plan: Make a list before shopping, whether online or in-store, and stick to it to avoid unplanned purchases.

- Embrace Delayed Gratification: If there’s something you really want, save for it over time instead of buying it on impulse.

The Bottom Line

Understanding the psychology behind your financial decisions is essential for building better money habits. Emotional spending may provide temporary relief, but it often leads to regret and financial strain. By recognizing your emotional triggers and practicing mindful money management, you can take control of your finances and align your spending with what truly matters to you.

Remember, money is a tool—not a cure for emotional needs. The more intentional you are with how you use it, the closer you’ll get to achieving financial stability and peace of mind.

The Connection Between Habits and Wealth Building

Building wealth isn’t just about luck or a high-paying job; it’s about the habits you cultivate and the consistency with which you stick to them. Your daily financial choices—big and small—play a significant role in determining your long-term financial success. Whether it’s saving a portion of your income, investing consistently, or controlling your spending, the habits you build today can set the stage for a lifetime of financial growth and stability.

The Snowball Effect of Consistent Habits

When it comes to wealth building, small, consistent actions often have the greatest impact over time. This concept is similar to a snowball rolling down a hill—it starts small but grows larger as it picks up momentum. In the financial world, this “snowball effect” is powered by consistency and compound growth.

Take saving, for example. Setting aside just $10 a week may not seem like much, but over time, that small habit can lead to significant savings. Here’s how:

- If you save $10 per week, that’s $520 per year.

- If you invest that $520 annually in a fund with an average return of 7%, it could grow to over $10,000 in 20 years!

The same principle applies to paying off debt. By consistently allocating extra funds to high-interest debt, you can reduce your balance faster, save on interest payments, and free up more money to invest or save in the future.

The magic of the snowball effect lies in momentum. Once you establish good financial habits, they become easier to maintain. Each small success builds confidence, reinforcing the habit and making it part of your routine.

Examples of Wealth-Building Through Habits

If you study the habits of self-made millionaires and financially successful individuals, a common theme emerges: their success is often the result of disciplined, intentional actions repeated over time. Let’s look at a few key habits that contribute to wealth building:

Saving Early and Regularly

The earlier you start saving, the more time your money has to grow. Many self-made millionaires attribute their success to adopting a “pay yourself first” mindset early in their lives. By prioritizing savings before other expenses, they create a strong financial foundation.

For example:

- If a 25-year-old saves $200 per month in a retirement account with a 7% annual return, they’ll have over $500,000 by age 65.

- If the same person waits until age 35 to start saving, they’ll only accumulate about $245,000—less than half—despite saving the same amount monthly.

This illustrates the power of starting early and letting compound interest do the heavy lifting.

Investing Regularly

Successful wealth builders don’t wait for the “perfect time” to invest—they adopt a habit of investing consistently, regardless of market conditions. This approach, known as dollar-cost averaging, reduces the impact of market volatility and ensures they’re always building their portfolio.

By consistently contributing to investment accounts like a 401(k), Roth IRA, or brokerage account, they benefit from long-term market growth and the compounding of reinvested dividends and returns.

Living Below Their Means

One of the most overlooked habits of wealth builders is living below their means. This doesn’t mean depriving themselves but rather avoiding lifestyle inflation—the tendency to increase spending as income rises.

For example, a professional earning $75,000 annually but living on $50,000 can save or invest the remaining $25,000. Over time, this surplus becomes the foundation for wealth. In contrast, someone earning $150,000 but spending $160,000 is likely to struggle financially despite earning double.

Tracking and Adjusting

Financially successful individuals regularly monitor their finances. They track their income, expenses, and investments to ensure they’re on track with their goals. This habit of checking in allows them to make adjustments as needed, whether that’s cutting back on unnecessary expenses or increasing contributions to their savings.

Why Habits Matter More Than Income

These examples highlight a critical point: wealth isn’t just about how much you earn—it’s about how you manage what you have. Many high-income earners struggle financially because they lack good habits, while others with modest incomes achieve financial freedom by consistently saving, investing, and living within their means.

Building wealth is a marathon, not a sprint. It’s the daily, disciplined actions—saving, budgeting, investing—that lead to long-term success. The sooner you start cultivating these habits, the sooner you’ll see their impact.

Takeaway

The connection between habits and wealth building is undeniable. By adopting small, consistent actions and sticking with them over time, you can create a financial snowball effect that grows your wealth and secures your future. Start small, stay consistent, and watch as your good habits transform your financial life.

Practical Steps to Start Today

Building better money habits doesn’t require a complete overhaul of your lifestyle overnight. In fact, small, practical steps taken consistently can lead to significant changes over time. These steps are easy to implement and can help you gain control of your finances without feeling overwhelmed. Let’s dive into how you can start today and build momentum toward long-term financial success.

Cut Back on One Expense

One of the simplest ways to free up extra cash is to identify a single expense you can reduce or eliminate. Start by looking at your discretionary spending—things like dining out, subscriptions, or impulse purchases. Choose one category where you can cut back and redirect that money toward savings, debt repayment, or other financial goals.

For example:

- If you usually spend $10 a day on coffee or takeout, cutting back to a few days a week could save you $20–$30 weekly. That’s $80–$120 a month you can now put toward something more meaningful.

- Canceling an unused subscription or switching to a more affordable streaming service can also add up over time.

Cutting back on just one expense isn’t about deprivation—it’s about making mindful choices. Over time, you’ll find it easier to scale back on other areas, further boosting your savings.

Set a Micro Goal

Big financial goals can feel intimidating, especially if you’re just starting. Instead, focus on setting small, achievable goals that give you quick wins and build confidence. These “micro goals” are stepping stones to larger milestones and help you establish positive momentum.

Examples of micro goals include:

- Saving $50 this month.

- Paying an extra $25 toward your credit card balance.

- Building a $100 emergency fund.

- Spending $20 less on non-essentials this week.

The key is to keep the goal realistic and actionable. Once you hit your target, celebrate your success and set a slightly bigger goal. These small wins not only improve your finances but also reinforce the habit of working toward your goals.

Try a Financial App

Managing money can feel daunting, but technology makes it easier than ever to stay on top of your finances. Financial apps are powerful tools that can help you track expenses, set budgets, and automate savings, all from your smartphone.

Here are a few popular apps to consider:

- Acorns: This app helps you start investing with spare change by rounding up your purchases to the nearest dollar and investing the difference. It’s perfect for beginners looking to build an investment portfolio without large upfront contributions.

- PocketGuard: Designed to simplify budgeting, PocketGuard shows you exactly how much disposable income you have after accounting for bills, goals, and necessities.

- Mint: A comprehensive tool that lets you track your income, expenses, savings, and even credit score in one place.

- YNAB (You Need A Budget): This app uses a proactive budgeting method, encouraging you to allocate every dollar to a specific purpose. It’s great for people looking to take full control of their finances.

Using a financial app not only streamlines money management but also provides insights into your spending habits. Over time, these insights help you identify patterns, make better decisions, and stay on track with your goals.

Start Small, Stay Consistent

The most important takeaway is to start small and stay consistent. Small changes—like cutting back on one expense, setting a micro goal, or using a financial app—may not feel impactful at first, but their effects compound over time. Consistency is the secret ingredient that turns these small steps into long-term habits.

Remember, every journey starts with a single step. By taking these practical actions today, you’re laying the foundation for a more secure and successful financial future. So, what are you waiting for? Pick one step and get started now!

FAQs: Why Your Money Habits Matter More Than Your Income

By addressing these common questions, readers can better understand the importance of money habits and how they can transform their financial futures.

Conclusion

At the end of the day, it’s not about how much money you make; it’s about how you manage it. Strong money habits are the foundation for financial freedom, regardless of your income. By building better habits, you can take control of your finances, reduce stress, and create the life you want.

So, what will you do differently today? It’s time to ditch the paycheck-to-paycheck cycle and start crafting habits that lead to lasting wealth.

Start your financial transformation today by tracking your spending and setting one new financial goal. It’s a small step with a huge payoff.