Kickoff:

“Think of $100 not just as money, but as the seed of your financial forest.”

For Gen Z, navigating the world of investing can feel like stepping into uncharted territory—intimidating, exciting, and full of possibility.

The good news? You don’t need a fortune to start. Even $100 can open doors to wealth-building opportunities, laying the foundation for financial freedom.

This guide will show you how to turn that small investment into your first step toward a thriving financial future.

Why $100 Is Enough to Start Investing

Breaking the Myth: You Need Thousands to Start Investing

The misconception that investing requires deep pockets often discourages young people from exploring financial growth opportunities.

For Gen Z, this myth can feel particularly daunting amidst student loans, rising living costs, and limited disposable income.

However, innovative platforms like micro-investing apps and fractional shares have made it possible to start investing with as little as $1.

These tools break down barriers, making wealth-building accessible to everyone—regardless of their starting point.

Take, for example, platforms like Acorns or Robinhood that allow you to buy fractions of expensive stocks or automate small recurring investments.

This means that even with just $100, you can begin building a diversified portfolio.

Remember, investing isn’t reserved for the rich—it’s a strategy anyone can adopt.

The Power of Starting Early

One of the biggest advantages of starting with $100 is tapping into the exponential growth potential offered by compound interest.

Compounding essentially means earning returns not only on your original investment but also on the returns it generates over time.

Think of it as a snowball rolling down a hill, growing larger with every turn.

For instance, if you invest $100 today in an index fund with an average annual return of 8%, and add just $25 monthly, you could accumulate nearly $12,000 in 10 years.

The earlier you begin, the more time your money has to grow, turning small, consistent contributions into significant financial gains.

Building Confidence Without Risking Too Much

Starting with $100 allows you to dip your toes into the investing world without overwhelming risk. This approach lets you experiment, learn, and build confidence in your financial knowledge.

With low stakes, you can explore different investment types, from ETFs to dividend stocks, and discover what aligns best with your financial goals.

By breaking the myth of needing thousands and leveraging the power of early compounding, your $100 becomes the first building block of your wealth-building journey.

Next, let’s uncover practical strategies to turn that $100 into a portfolio you can be proud of!

Building Your Financial Foundation Before Investing

Step 1: Create a Budget

Before jumping into investing, it’s essential to have a solid understanding of your financial situation. Budgeting isn’t just a chore—it’s the blueprint for achieving financial freedom. Use budgeting tools or apps like Mint or YNAB (You Need a Budget) to:

- Monitor your income and spending habits.

- Identify areas where you can cut back and save more.

- Allocate a portion of your income specifically for saving and investing.

Creating a budget helps you take control of your money and ensures you’re not overextending yourself financially. Think of it as laying the groundwork for a stable financial future.

Step 2: Pay Down High-Interest Debt

Before you start investing, tackle any high-interest debt, such as credit card balances.

Here’s why: the interest you pay on debt often exceeds the returns you’d make from investments.

For example, if your credit card charges 20% interest annually, paying it off provides a guaranteed “return” of 20%—something even the best investments rarely achieve.

Develop a debt management strategy like the avalanche method (paying off high-interest debts first) or the snowball method (starting with smaller balances to build momentum).

Clearing high-interest debt not only improves your financial health but also frees up money for future investing.

Step 3: Establish an Emergency Fund

Investing without a financial safety net is risky.

Life is unpredictable, and an emergency fund acts as your financial cushion in case of unexpected expenses like medical bills or job loss.

Experts recommend saving 3–6 months’ worth of living expenses in a liquid and accessible account, such as a high-yield savings account.

An emergency fund ensures you won’t have to dip into your investments prematurely, preserving your financial plan and growth potential.

By budgeting smartly, managing debt, and securing an emergency fund, you create a strong financial foundation that sets you up for investing success.

Now, let’s explore how to make that first $100 work for you!

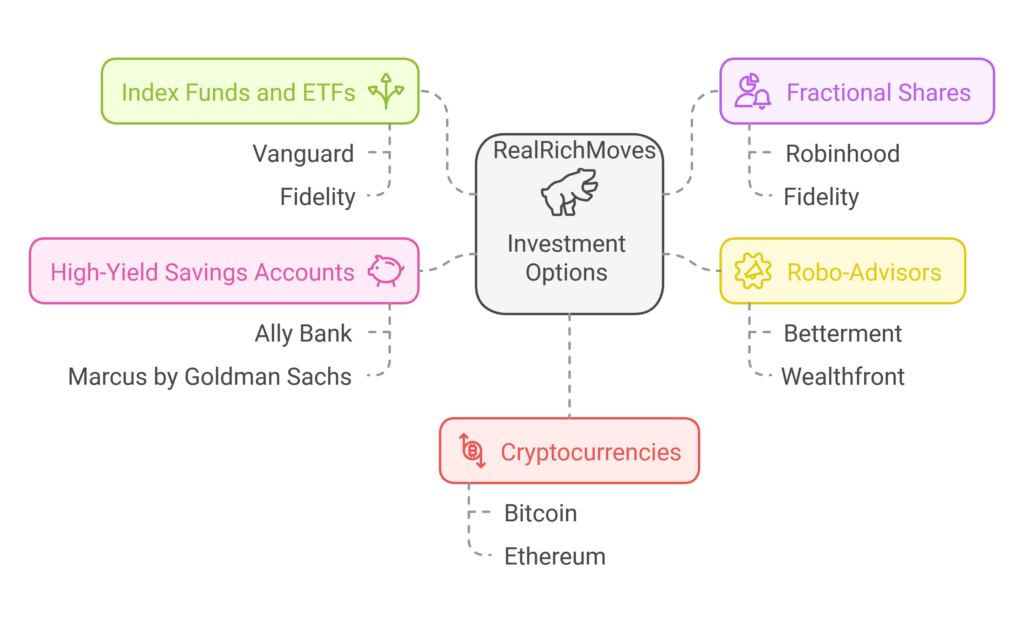

Where to Invest Your First $100

1. Index Funds and ETFs

Index funds and Exchange-Traded Funds (ETFs) are investment vehicles that pool money to track the performance of a specific index, such as the S&P 500.

They offer instant diversification by investing in a collection of stocks or bonds, making them a go-to option for beginner investors.

Why Choose Index Funds and ETFs?

- Built-in Diversification: With a single investment, you gain exposure to multiple companies or bonds, reducing the risk tied to individual assets.

- Cost-Effective: Index funds and ETFs generally have low expense ratios, meaning you keep more of your returns.

- Simplicity: They’re easy to understand, making them ideal for those new to investing.

- Consistent Growth: By mirroring market indices, these funds often deliver steady, long-term returns.

How to Start Investing in Index Funds and ETFs

- Choose a Platform: Platforms like Vanguard, Fidelity, or Charles Schwab allow you to invest in index funds and ETFs with little to no minimum investment requirements.

- Pick a Fund: Popular ETFs like VOO (Vanguard S&P 500 ETF) or SPY (SPDR S&P 500 ETF) provide access to the largest and most stable U.S. companies.

- Set Up Automatic Contributions: Regular investments amplify the benefits of dollar-cost averaging, helping you build wealth over time.

- Monitor and Rebalance: While index funds are relatively low maintenance, reviewing your portfolio periodically ensures it aligns with your financial goals.

Advantages of Starting Small with Index Funds and ETFs

- Beginner-Friendly: They’re straightforward and don’t require extensive market knowledge.

- Flexibility: You can start with as little as $100 and gradually increase your investment.

- Accessibility: Many platforms offer fractional shares, allowing you to invest even in high-priced ETFs.

Tips for Maximizing Returns

- Stick with Broad Market Funds: Funds like those tracking the S&P 500 offer diversified exposure to multiple industries.

- Reinvest Dividends: Many ETFs provide dividends; reinvesting them compounds your returns.

- Avoid Overtrading: Frequent buying and selling can incur fees and erode profits.

A Smart First Step Toward Wealth Building

Investing in index funds and ETFs with $100 isn’t just practical—it’s a smart strategy for consistent growth. Their low cost, ease of use, and diversification make them a cornerstone of financial planning.

✨ By choosing index funds and ETFs, you’re not just investing in assets—you’re investing in your financial future with simplicity and reliability.

2. Fractional Shares

What Are Fractional Shares?

Fractional shares allow you to invest in a portion of a stock rather than buying a whole share.

This makes high-priced stocks like Apple, Amazon, or Tesla accessible even if you’re starting with a small amount, such as $100.

Why Choose Fractional Shares?

- Affordable Access to Top Companies: Stocks like Tesla or Apple can cost hundreds or thousands of dollars per share. Fractional shares let you invest in these giants with whatever amount you have.

- Diversification on a Budget: Instead of putting all your money into one company, fractional shares enable you to spread your investment across several stocks.

- Customizable Portfolio: You can invest based on dollar amounts rather than share quantities, tailoring your portfolio to suit your goals.

- Beginner-Friendly: Fractional shares eliminate barriers to entry, making investing approachable for those just starting out.

How to Start Investing in Fractional Shares

- Choose the Right Platform: Popular apps like Robinhood, Fidelity, and Schwab support fractional investing with no minimum requirement.

- Select Your Stocks: Research companies you believe in or align with your financial goals. For example, invest in industries you’re familiar with, like tech or retail.

- Decide Your Investment Amount: Allocate your $100 across several stocks or focus on a single company you’re confident about.

- Start Small and Scale Up: Begin with fractional shares to learn the market, and as you grow more confident, consider increasing your contributions.

Advantages of Fractional Shares

- Inclusivity: You can own a piece of any company regardless of the stock price.

- Flexibility: Build a diverse portfolio with minimal funds.

- Control: You can start with any amount, adjusting your investments based on your financial situation.

Smart Strategies for Fractional Investing

- Research Companies: Invest in businesses with strong fundamentals and growth potential.

- Reinvest Dividends: Some platforms allow you to reinvest dividends from your fractional shares, compounding your gains.

- Avoid Overconcentration: Even with fractional shares, diversify across industries to manage risks.

Where to Begin?

Platforms like:

- Robinhood: Offers commission-free fractional investing and an intuitive interface.

- Fidelity: Known for its robust tools and no-fee approach.

- Charles Schwab: Provides fractional shares with low barriers and excellent customer support.

Turning Small Investments into Big Opportunities

Fractional shares empower beginner investors to participate in the stock market without needing a large upfront investment.

By owning portions of top-performing companies, you’re setting the stage for long-term wealth building.

✨ With fractional shares, even your $100 can put you on the same playing field as seasoned investors, proving that every dollar invested counts.

3. Robo-Advisors

What Are Robo-Advisors?

Robo-advisors are automated investment platforms that use algorithms to manage your money. These tools create and maintain a diversified portfolio tailored to your financial goals, risk tolerance, and investment timeline, all without requiring extensive knowledge or effort on your part.

Why Choose Robo-Advisors?

- Ease of Use: Robo-advisors handle everything from selecting investments to rebalancing your portfolio.

- Low Barrier to Entry: Many platforms allow you to start investing with as little as $100.

- Affordable Fees: Robo-advisors charge lower fees than traditional financial advisors, helping you maximize returns.

- Personalized Strategy: They customize your portfolio based on your preferences, whether it’s growth, income, or sustainable investing.

How Robo-Advisors Work

- Initial Assessment: When you sign up, the platform asks questions about your financial goals, risk tolerance, and timeline.

- Portfolio Creation: Based on your responses, it builds a diversified portfolio of ETFs or index funds.

- Automatic Management: The system continuously monitors and adjusts your portfolio to keep it aligned with your goals.

- Rebalancing: When your portfolio drifts due to market fluctuations, the robo-advisor automatically adjusts your allocations.

Best Robo-Advisors for Beginners

- Betterment: Known for its user-friendly interface and personalized advice. It offers features like tax-loss harvesting and goal-based planning.

- Wealthfront: Offers a range of investment options, including risk-adjusted portfolios and financial planning tools.

- Acorns: Ideal for micro-investing, Acorns automatically invests your spare change from everyday purchases.

Advantages of Robo-Advisors

- Hands-Off Investing: Perfect for beginners or those with limited time to manage investments.

- Cost-Effective: Fees are typically a fraction of what traditional advisors charge, often around 0.25% annually.

- Accessibility: Most platforms are app-based, making it easy to track and manage investments from your phone.

- Goal-Oriented Tools: Many platforms include features like retirement planning, saving for a house, or funding a vacation.

Tips for Using Robo-Advisors Effectively

- Start Small: Begin with your $100 and contribute regularly to grow your portfolio.

- Monitor Progress: Even though robo-advisors are automated, check your portfolio periodically to stay informed.

- Stay Consistent: Add funds consistently to maximize the benefits of dollar-cost averaging.

- Understand Fees: Compare platforms to ensure you’re getting the best value for your investment.

Are Robo-Advisors Right for You?

If you’re new to investing, short on time, or prefer a hands-off approach, robo-advisors are an excellent choice.

They offer simplicity, professional portfolio management, and flexibility for beginners.

✨ With robo-advisors, your $100 can unlock the door to smart, automated investing, making it easier than ever to take your first step toward financial freedom.

4. High-Yield Savings Accounts

What Are High-Yield Savings Accounts?

High-yield savings accounts (HYSA) are specialized bank accounts that offer significantly higher interest rates than traditional savings accounts.

While they aren’t technically investment vehicles, they’re an excellent way to grow your money with virtually no risk.

Why Choose High-Yield Savings Accounts?

- Low Risk: Your funds are insured by the FDIC (up to $250,000), ensuring your money is safe even if the bank fails.

- Steady Growth: HYSAs provide predictable returns through competitive interest rates, making them ideal for short-term goals or emergency funds.

- Accessibility: Unlike long-term investments, you can access your money anytime without penalties.

- No Minimums: Many HYSAs allow you to open an account with as little as $100.

How High-Yield Savings Accounts Work

- Interest Accrual: The bank pays interest on your balance, usually compounded daily and credited monthly.

- Online Platforms: Many high-yield accounts are offered by online banks, enabling them to provide higher rates due to lower operational costs.

- Flexible Use: Use the account to save for specific goals, like a vacation fund or an emergency buffer.

Top High-Yield Savings Account Options

- Ally Bank: Known for its competitive rates, user-friendly interface, and no monthly fees.

- Marcus by Goldman Sachs: Offers high rates and no minimum deposit requirements, making it ideal for beginners.

- Discover Bank: Provides great rates and access to robust financial tools without hidden fees.

Advantages of High-Yield Savings Accounts

- Zero Market Risk: Your balance won’t fluctuate like it might with stocks or ETFs.

- Convenient Access: Most accounts allow for quick transfers between savings and checking accounts.

- No Lock-In Period: Unlike CDs (Certificates of Deposit), HYSAs don’t require you to lock up your money.

- Boosts Savings Habits: The visibility of steady growth can motivate you to save more regularly.

When Should You Use a High-Yield Savings Account?

- Short-Term Goals: Perfect for saving for things like holiday gifts, vacations, or a small emergency fund.

- Pre-Investing Stage: If you’re not ready to invest in the market yet, parking your $100 in an HYSA is a smart move.

- Emergency Funds: Ideal for storing 3–6 months of living expenses in a safe and accessible manner.

Tips for Maximizing High-Yield Savings Accounts

- Compare Rates: Shop around to find the account with the highest APY (Annual Percentage Yield).

- Automate Contributions: Set up automatic transfers to grow your savings effortlessly.

- Avoid Monthly Fees: Choose accounts with no maintenance fees to keep more of your earnings.

- Monitor Rates: Keep an eye on changes to APYs and switch accounts if a better option arises.

Are High-Yield Savings Accounts Right for You?

If you’re looking for a secure way to grow your $100 while maintaining access to your funds, HYSAs are a perfect choice.

They’re ideal for financial goals that require safety and steady growth without the volatility of the market.

✨ With a high-yield savings account, your $100 doesn’t just sit idle—it works hard, growing steadily and safely, ready for your next financial move.

5. Cryptocurrencies

What Are Cryptocurrencies?

Cryptocurrencies are digital or virtual currencies that use blockchain technology to secure transactions and control the creation of new units.

Unlike traditional currencies, they operate on decentralized networks, offering unique opportunities for investment and innovation.

Why Invest in Cryptocurrencies?

- High Potential Returns: Cryptos like Bitcoin and Ethereum have delivered significant gains for early investors.

- Decentralized Nature: Free from government control, offering an alternative to traditional financial systems.

- Diverse Use Cases: Beyond investment, cryptocurrencies power technologies like decentralized apps (DApps) and smart contracts.

- Global Accessibility: Anyone with internet access can invest, providing a low barrier to entry.

Risks Associated with Cryptocurrencies

- Volatility: Prices can swing dramatically within short periods, posing a challenge for risk-averse investors.

- Security Concerns: If not stored properly, cryptocurrencies are susceptible to hacking or loss.

- Regulatory Uncertainty: Governments worldwide are still determining how to regulate the crypto market, which could impact its value.

- Complexity: Understanding how to buy, sell, and store cryptocurrencies can be daunting for beginners.

How to Start with Cryptocurrencies for $100

- Choose a Secure Platform: Platforms like Coinbase, Binance, or Kraken are beginner-friendly and prioritize security.

- Diversify Your Portfolio: Spread your $100 across multiple cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), or stablecoins like USDC.

- Start Small: Begin with a small investment to learn the ropes without overexposing yourself to risk.

- Educate Yourself: Understand the underlying technology and the market trends before diving in deeper.

Popular Cryptocurrencies for Beginners

- Bitcoin (BTC): The first and most well-known cryptocurrency, often considered a digital alternative to gold.

- Ethereum (ETH): Known for its smart contract functionality, enabling a wide range of applications beyond payments.

- Litecoin (LTC): A faster, more lightweight alternative to Bitcoin, great for smaller transactions.

- Cardano (ADA): Focused on sustainability and scalability, offering a more energy-efficient blockchain solution.

Best Practices for Crypto Investing

- Use Secure Wallets: Store your cryptocurrencies in a hardware or software wallet for enhanced security.

- Avoid FOMO (Fear of Missing Out): Don’t buy into hype without researching thoroughly.

- Keep Long-Term Goals in Mind: Treat cryptocurrency as part of a diversified financial plan rather than a get-rich-quick scheme.

- Monitor Market Trends: Stay informed about developments in the crypto space, as news can significantly impact prices.

Tips for Minimizing Risk in Crypto Investing

- Invest Only What You Can Afford to Lose: Cryptocurrencies are speculative; never put your essential savings at risk.

- Stick to Major Coins Initially: Begin with established cryptocurrencies with strong market credibility.

- Dollar-Cost Averaging: Spread your $100 investment over several transactions to mitigate price volatility.

Is Cryptocurrency Right for You?

If you’re comfortable with high-risk, high-reward investments and willing to put in the time to understand the market, cryptocurrency can be an exciting addition to your portfolio.

It’s a way to diversify your investments and tap into a rapidly evolving financial landscape.

✨ With cryptocurrencies, your $100 has the potential to grow exponentially—but only if you approach it with caution, strategy, and a willingness to learn.

Let’s take the next step toward financial freedom!

Strategies to Grow Your Investments

Start with Dollar-Cost Averaging

Dollar-cost averaging is a beginner-friendly approach where you invest a fixed amount at regular intervals, regardless of market conditions.

This strategy minimizes the risk of investing a lump sum during a market peak and ensures steady growth over time.

Example: Set aside $25 weekly or monthly and consistently invest it in index funds or ETFs. Over time, this builds a habit of investing while averaging out the cost of your investments.

Dollar-cost averaging takes the guesswork out of timing the market, making it an ideal strategy for long-term financial planning.

Leverage Micro-Investing Apps

Micro-investing apps are a game-changer for Gen Zers who want to grow their wealth effortlessly. These apps round up your everyday purchases to the nearest dollar and invest the spare change.

- Popular Options: Acorns and Stash are great tools for turning small, incremental savings into a growing portfolio.

- Why It Works: It aligns seamlessly with budgeting and spending habits, making investing feel like second nature.

Micro-investing apps make saving and investing as easy as buying your morning coffee.

Reinvest Dividends

Dividends are payouts that some investments provide to shareholders. Instead of pocketing these payouts, reinvest them to compound your returns.

How to Automate: Most investment platforms, like Vanguard and Robinhood, offer automatic dividend reinvestment options.

Impact: Over time, reinvested dividends can significantly boost your portfolio’s growth, contributing to wealth building without additional effort.

Reinvesting dividends is a powerful way to supercharge your investment growth while sticking to a long-term financial plan.

Utilize Employer-Sponsored Accounts

Employer-sponsored accounts like a 401(k) or 403(b) are a no-brainer for anyone in the workforce. Even contributing a small amount can lead to substantial growth, especially if your employer offers matching contributions.

- Why It Matters: Every dollar you invest in these accounts is pre-tax, reducing your taxable income while building retirement savings.

- Getting Started: Begin with a $100 contribution and aim to increase it as your income grows.

Employer-sponsored accounts are an easy and effective way to balance saving, budgeting, and investing for your future.

Every strategy is a stepping stone toward achieving financial freedom. Ready to take control of your money and grow your investments?

But, Before getting started with investing, let’s see the common mistakes to avoid when starting with $100.

7 Common Mistakes to Avoid When Starting to Invest with $100

1. Emotional Investing

What Is Emotional Investing?

Emotional investing occurs when decisions are driven by feelings like fear, greed, or excitement instead of logical analysis. Whether it’s chasing market trends or panic-selling during a downturn, letting emotions dictate your strategy can lead to poor financial outcomes.

The Risks of Emotional Investing

- Chasing Hype: Jumping on the bandwagon of a trending stock or investment often leads to buying at inflated prices, leaving little room for growth.

- Panic Selling: Market dips can spark fear, prompting you to sell at a loss rather than holding on for recovery.

- Overconfidence: Believing you can outsmart the market may lead to risky bets without thorough research.

How to Keep Emotions in Check

- Stick to a Financial Plan: Create a clear investment strategy aligned with your goals, and refer back to it during uncertain times.

- Avoid Market Noise: Ignore sensational headlines or social media hype designed to provoke emotional responses.

- Practice Dollar-Cost Averaging: Investing regularly, regardless of market conditions, minimizes the impact of emotional decisions.

- Focus on Long-Term Goals: Remind yourself that short-term volatility is normal and that patience pays off in the long run.

- Use Automated Tools: Robo-advisors and auto-investing platforms can help eliminate emotional interference by handling decisions for you.

The Rewards of Rational Investing

When you make decisions based on research and a steady plan, you avoid costly mistakes and maximize the potential of your investments.

Staying calm and focused ensures you’re building a portfolio that serves your long-term interests.

✨ The market may fluctuate, but your strategy doesn’t have to—invest with your head, not your heart!

2. Neglecting Fees

What Are Investment Fees?

Investment fees are charges you pay for managing, buying, or maintaining your investments. These include transaction fees, management fees, and expense ratios.

While they may seem small, they can significantly impact your returns over time, especially for beginners starting with smaller amounts like $100.

Types of Fees to Watch For

- Transaction Fees: Charged every time you buy or sell an asset, such as stocks or ETFs.

- Expense Ratios: The annual fee charged by mutual funds or ETFs for managing your investments, expressed as a percentage of your holdings.

- Account Maintenance Fees: Some platforms charge ongoing fees just for keeping your account open.

- Advisory Fees: If you’re using a financial advisor or robo-advisor, you might pay a percentage of your portfolio value annually.

How Fees Impact Your Returns

- Erosion of Profits: Even a 1% annual fee can reduce your portfolio’s growth significantly over decades.

- Compounding Losses: High fees don’t just affect what you pay today; they reduce the amount available to grow through compounding.

Strategies to Minimize Fees

- Choose Low-Cost Platforms: Look for brokers and apps with commission-free trading and no account maintenance fees, such as Robinhood or Fidelity.

- Focus on Low-Expense-Ratio Funds: Index funds and ETFs often have much lower expense ratios than actively managed funds.

- Avoid Frequent Trading: Excessive buying and selling can rack up transaction fees. Adopt a long-term strategy to minimize costs.

- Use Fee Calculators: Many online tools can help you estimate how fees will impact your investments over time.

Why Being Fee-Savvy Matters

Every dollar saved on fees is a dollar that can work for you in building wealth. Keeping fees low ensures that your hard-earned money stays invested and continues to grow.

✨ Remember, it’s not just about how much you invest but how much you keep—cutting fees keeps more money in your pocket for wealth building!

3. Lack of Diversification

What Is Diversification?

Diversification is the practice of spreading your investments across different asset classes, industries, or geographic regions to reduce risk.

Instead of putting all your eggs in one basket, diversification ensures that a downturn in one area doesn’t wipe out your entire portfolio.

Why Lack of Diversification Is Risky

- Single Asset Dependency: Investing all your $100 in one stock or asset ties your portfolio’s success to the performance of that single investment. If it fails, so does your portfolio.

- Higher Volatility: A non-diversified portfolio is more vulnerable to market fluctuations, leading to unpredictable returns.

- Missed Opportunities: Without diversification, you may miss out on potential growth from other sectors or asset classes.

How to Diversify Even with $100

- Invest in Index Funds or ETFs: These funds pool money into a broad range of stocks or bonds, giving you instant diversification. ETFs like the S&P 500 Index are excellent beginner-friendly options.

- Use Fractional Shares: Platforms like Robinhood or Fidelity allow you to buy small portions of expensive stocks, enabling you to diversify even with limited funds.

- Allocate Across Asset Classes: Consider splitting your investment among stocks, bonds, or even cryptocurrencies to balance risk and reward.

- Leverage Robo-Advisors: Automated platforms like Betterment or Wealthfront create diversified portfolios tailored to your goals and risk tolerance.

The Benefits of Diversification

- Reduced Risk: If one investment underperforms, gains in others can offset losses.

- Steady Returns: A diversified portfolio is more likely to deliver stable, long-term growth.

- Peace of Mind: Diversification minimizes the emotional stress of watching one investment closely and worrying about its performance.

Common Pitfalls to Avoid

- Over-Diversification: Spreading investments too thinly can dilute returns. Focus on quality over quantity.

- Neglecting Rebalancing: Regularly review and adjust your portfolio to maintain the desired level of diversification.

✨ A well-diversified portfolio doesn’t just protect your $100 investment—it maximizes its growth potential across a range of opportunities. Play smart, spread wisely, and let diversification work for you!

4. Lack of Patience

Why Patience is Key in Investing

Investing requires a long-term mindset. The market doesn’t operate on instant gratification, and expecting immediate results can lead to hasty decisions or unnecessary stress.

While it’s natural to want to see your $100 grow quickly, wealth building happens gradually, not overnight.

The Benefits of Staying Patient

- Compounding Gains: Time allows compounding to work its magic, turning small initial investments into substantial returns.

- Market Recovery: Markets fluctuate, but historically, they trend upwards over the long term. Patience helps you weather short-term volatility.

- Better Decision-Making: By waiting for your investments to mature, you avoid rash decisions that could jeopardize your financial plan.

Tips to Cultivate Patience

- Focus on Goals: Keep your financial planning objectives in mind. Remind yourself why you started investing in the first place.

- Monitor Less Frequently: Avoid checking your portfolio daily; instead, set periodic review intervals, like quarterly updates.

- Celebrate Progress: Recognize milestones, like your first dividend or reaching $500 in investments, to stay motivated.

By understanding that wealth building takes time, you empower yourself to make smarter, steadier financial decisions.

✨ Remember: Good things take time, and investing is no exception!

5. Allowing Emotions to Take Control

The Emotional Traps of Investing

Investing often stirs up powerful emotions, with fear and greed being the most common culprits. Fear can make you panic during market downturns, leading to selling at the worst possible time.

Greed, on the other hand, might push you to chase high-risk opportunities or hold onto investments longer than advisable, hoping for unrealistic gains.

Why Emotional Decisions Are Dangerous

- Fear-Induced Selling: During market corrections, fear can make you sell assets at a loss, locking in defeats that might have been temporary.

- Greedy Overreach: Chasing trends or “hot stocks” without proper research often leads to losses when the market cools.

- Impulsive Reactions: Reacting to short-term news or fluctuations without a strategy can destabilize your portfolio.

Strategies to Keep Emotions in Check

- Stick to a Plan: Develop a clear financial plan with defined goals, and rely on it during emotional times.

- Focus on the Long Term: Remember that market ups and downs are natural. Patience often leads to better outcomes.

- Educate Yourself: The more you understand the market, the easier it is to separate rational decisions from emotional impulses.

- Use Automation: Tools like robo-advisors or automatic investing features can help remove the emotional component from decision-making.

The Rational Investor’s Mindset

Recognizing that emotions are a part of investing is the first step. Channel your feelings into staying motivated to learn and grow, rather than reacting impulsively.

Consistent, research-backed decisions will always beat emotional guesswork in the long run.

✨ Control your emotions, and you’ll control your financial destiny!

6. Overlooking Regular Contributions

Why Consistency Matters in Investing

Starting with $100 is an excellent first step, but treating it as a one-time action won’t maximize your financial growth.

Consistent contributions, no matter how small, allow you to harness the power of compounding and steadily build wealth over time.

Neglecting this habit is like planting a seed but forgetting to water it—progress slows, and potential is wasted.

The Impact of Neglecting Regular Contributions

- Lost Momentum: Without additional investments, your portfolio’s growth relies solely on market performance.

- Delayed Financial Goals: Infrequent contributions can push back milestones like buying a home, retiring comfortably, or achieving financial freedom.

- Missed Compounding Opportunities: Regularly adding to your portfolio accelerates the growth of both your principal and reinvested earnings.

How to Stay Consistent with Contributions

- Automate Your Investments: Set up automatic transfers to your brokerage account or investment platform, ensuring you never miss a contribution.

- Start Small but Steady: Even $10 or $20 monthly can make a big difference over the years.

- Tie Contributions to Income Increases: Allocate a percentage of raises or bonuses to your investments.

- Budget for Investments: Treat contributions as a non-negotiable expense in your financial plan.

The Long-Term Benefits of Consistency

By committing to regular contributions, you turn investing into a habit, rather than a one-time decision.

This disciplined approach not only strengthens your financial foundation but also builds confidence in achieving your goals.

✨ Consistency is the fuel that turns small investments into big results—keep your financial engine running!

7. Lack of Investment Knowledge

The Risks of Blind Investing

Investing in something you don’t fully understand is like navigating without a map—you’re likely to make wrong turns and face unexpected setbacks.

Many beginner investors fall into this trap, tempted by trending stocks, cryptocurrencies, or complex financial products without grasping the underlying risks.

Common Pitfalls of Lack of Understanding

- Misjudging Risk: You might underestimate how volatile or speculative an investment is.

- Ignoring Fees: Some investments come with hidden costs, such as high management fees, that eat into your returns.

- Overestimating Returns: Believing in unrealistic promises of high rewards can lead to disappointment or significant losses.

How to Educate Yourself Before Investing

- Do Your Research: Learn about the asset class—whether it’s stocks, ETFs, or real estate. Understand how they generate returns and the associated risks.

- Read the Fine Print: For mutual funds or ETFs, review the prospectus to understand fees, objectives, and holdings.

- Follow Reputable Sources: Read articles, watch tutorials, and follow experts in the finance niche to gain valuable insights.

- Start Small: Begin with investments you’re comfortable with, like index funds or robo-advisors, while building your knowledge.

The Value of a Knowledge-First Approach

By taking the time to understand your investments, you reduce unnecessary risks and align your portfolio with your financial goals.

Knowledge empowers you to make informed decisions, ensuring every dollar you invest works effectively for you.

✨ Invest in your understanding before investing your money—your financial future will thank you!

FAQs – About Starting Investing with $100

Starting your investment journey with $100 may seem small, but the potential it unlocks is monumental. With platforms catering to low minimums and beginner-friendly options like index funds, ETFs, and micro-investing apps, anyone can begin their journey toward financial freedom.

Remember, the key to success is not the amount you start with but the consistency and discipline you maintain throughout the process. Investing is a marathon, not a sprint. Ready to take the first step? Let’s grow your financial future, one dollar at a time!

Summary: Turning $100 into the Gateway to Wealth

It might feel like $100 is just pocket change, but it’s the spark that can ignite your journey to financial freedom.

With beginner-friendly options like ETFs, fractional shares, and robo-advisors, you can grow your money while mastering the art of financial planning.

At RealRichMoves, we believe every small step counts—because your $100 today can become the foundation of tomorrow’s wealth.

Start now, and let’s turn your first $100 into a powerhouse for your future!