How to

How to Save Mone

Preamble:

Saving Money Without Compromising Quality

“A penny saved is a penny earned.”

This timeless quote resonates more than ever with Gen Z, a generation juggling financial demands like student loans, education costs, and often unpredictable income from part-time jobs and side hustles. For many, groceries are a major part of monthly spending, but with intentional planning and smart choices, you can significantly cut costs without sacrificing the quality of your meals.

At RealRichMoves, we believe financial literacy starts with the basics—like optimizing your grocery budget. Our goal is to guide you through practical, actionable strategies to make every dollar count while maintaining a lifestyle that aligns with your values.

What This Guide Offers

- Smart Shopping Hacks: Learn how to spot deals, utilize coupons, and choose budget-friendly stores.

- Reducing Food Waste: Cut unnecessary expenses by planning meals and repurposing leftovers creatively.

- Leveraging Extra Income: Discover how small steps, like using savings from groceries to invest or pay off debt, can contribute to long-term wealth building.

Whether you’re looking to free up cash for online work opportunities, repay a loan, or just stretch your budget further, this comprehensive guide will equip you with the tools and tips to save money while maintaining your lifestyle. Let’s dive in and take charge of your financial future, one grocery trip at a time!

Why Grocery Savings Matter for Financial Success

The Role of Grocery Budgeting in Financial Planning

Saving on groceries isn’t just about keeping more cash in your pocket; it’s a cornerstone of effective financial planning. Smart grocery budgeting helps you optimize your income, allowing you to allocate those extra dollars toward building an emergency fund, paying off debt, or investing in your future. Whether you’re balancing student loans, pursuing education goals, or looking to grow your wealth building efforts, grocery savings create the breathing room needed to focus on long-term financial freedom.

Eye-Opening Statistics on Grocery Expenses

- The average Gen Z household in the USA spends between $250 and $350 monthly on groceries, accounting for a significant chunk of their income.

- Cutting grocery expenses by just 20% could free up an extra $600–$840 annually, money that can be redirected toward side hustles, investments, or paying down a loan.

Why It Matters

- Maximizing Every Dollar: Groceries are one of the easiest areas to trim expenses without sacrificing lifestyle quality.

- Boosting Financial Flexibility: Savings can help cover unexpected costs or be reinvested into your financial planning goals.

- Achieving Balance: A well-managed grocery budget bridges the gap between maintaining a nutritious diet and pursuing broader financial aspirations.

By taking control of your grocery spending, you’re not just saving money—you’re creating opportunities to secure a better financial future. Small, consistent changes here can ripple into substantial benefits across your entire budget.

Smart Strategies to Save on Groceries Without Compromising Quality

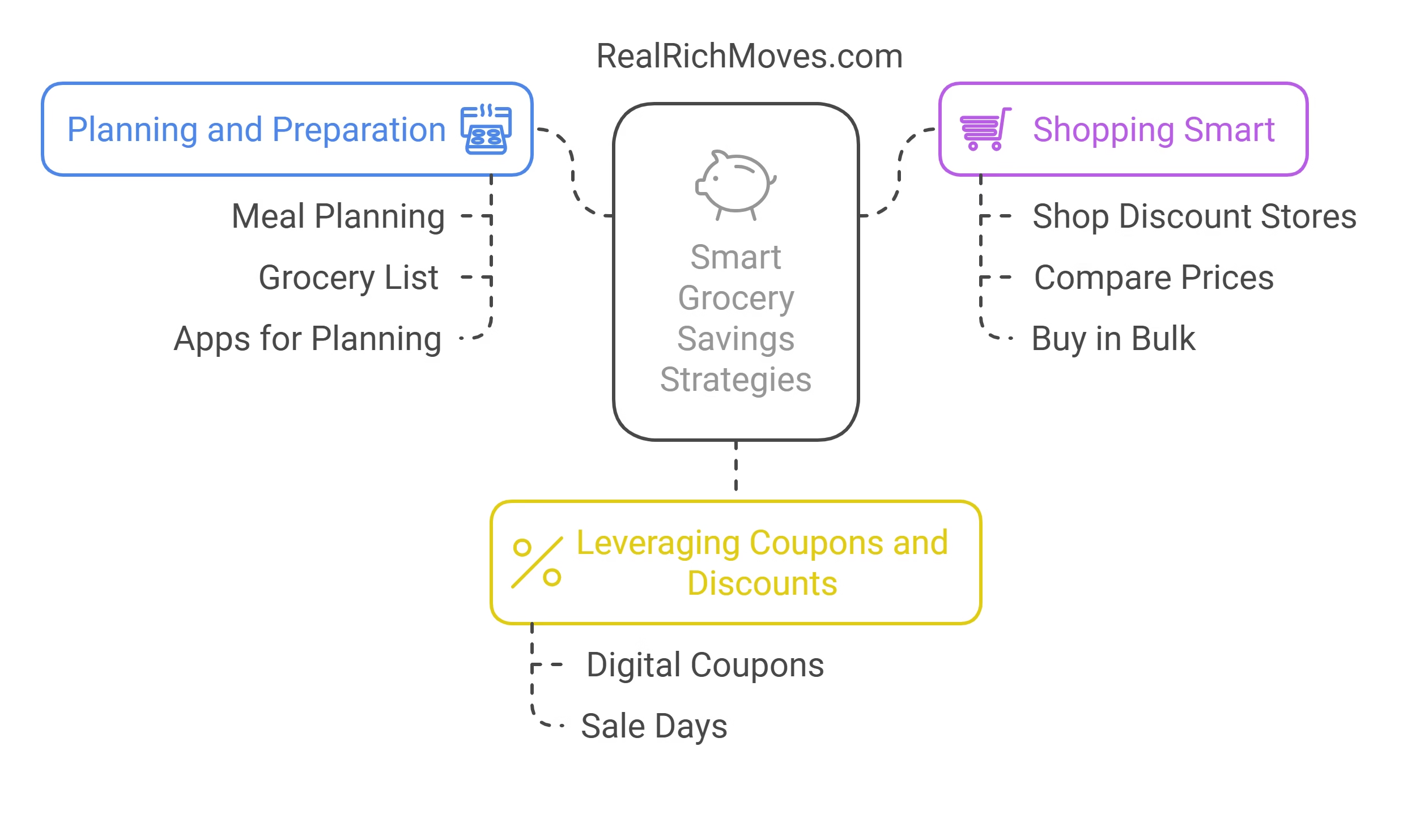

Step 1: Planning and Preparation – Setting the Foundation for Savings

- Master Meal Planning

- Plan weekly meals based on what’s already in your pantry and fridge to minimize food waste.

- Focus on versatile ingredients like eggs, rice, and vegetables that can work across multiple meals.

- Create a Winning Grocery List

- Write a detailed list before heading to the store to avoid impulse buys that inflate your bill.

- Categorize items by section (produce, pantry, frozen) to make shopping faster and more efficient.

- Tech-Enabled Planning

Step 2: Shopping Smart – Where and How to Maximize Value

- Opt for Discount Retailers

- Shop at budget-friendly stores like Aldi and Costco, which offer high-quality groceries at a fraction of the cost.

- Explore local farmers’ markets for fresh produce at competitive prices.

- Compare Prices Strategically

- Use price-comparison apps such as Flipp or Basket to identify the best deals near you.

- Check unit prices to ensure bulk purchases offer true savings.

- Bulk Buying Basics

- Buy non-perishable staples like pasta, rice, and beans in large quantities to save in the long run.

- Invest in airtight storage containers to keep bulk items fresh and organized.

Step 3: Leveraging Coupons and Discounts – The Secret Sauce

- Go Digital with Coupons

- Apps like Rakuten and Ibotta help you earn cashback and find digital coupons tailored to your shopping habits.

- Sign up for store loyalty programs to unlock exclusive discounts.

- Shop on Sale Days

- Plan your trips around store promotions or clearance sales to grab quality items at reduced prices.

- Look for “manager’s specials” on soon-to-expire items for steep discounts on perfectly good food.

- Maximize Reward Programs

- Use credit cards with cashback rewards on groceries to save even more on your purchases.

Key Takeaway:

Combining smart planning, savvy shopping, and effective use of discounts ensures you can enjoy quality groceries without breaking your budget. Every dollar saved here can be reinvested into other financial planning goals, like paying down a loan, starting a side hustle, or boosting your wealth-building efforts.

Quality Over Quantity – How to Buy Better Food for Less

Affordable Organic and Healthy Choices – Eating Well on a Budget

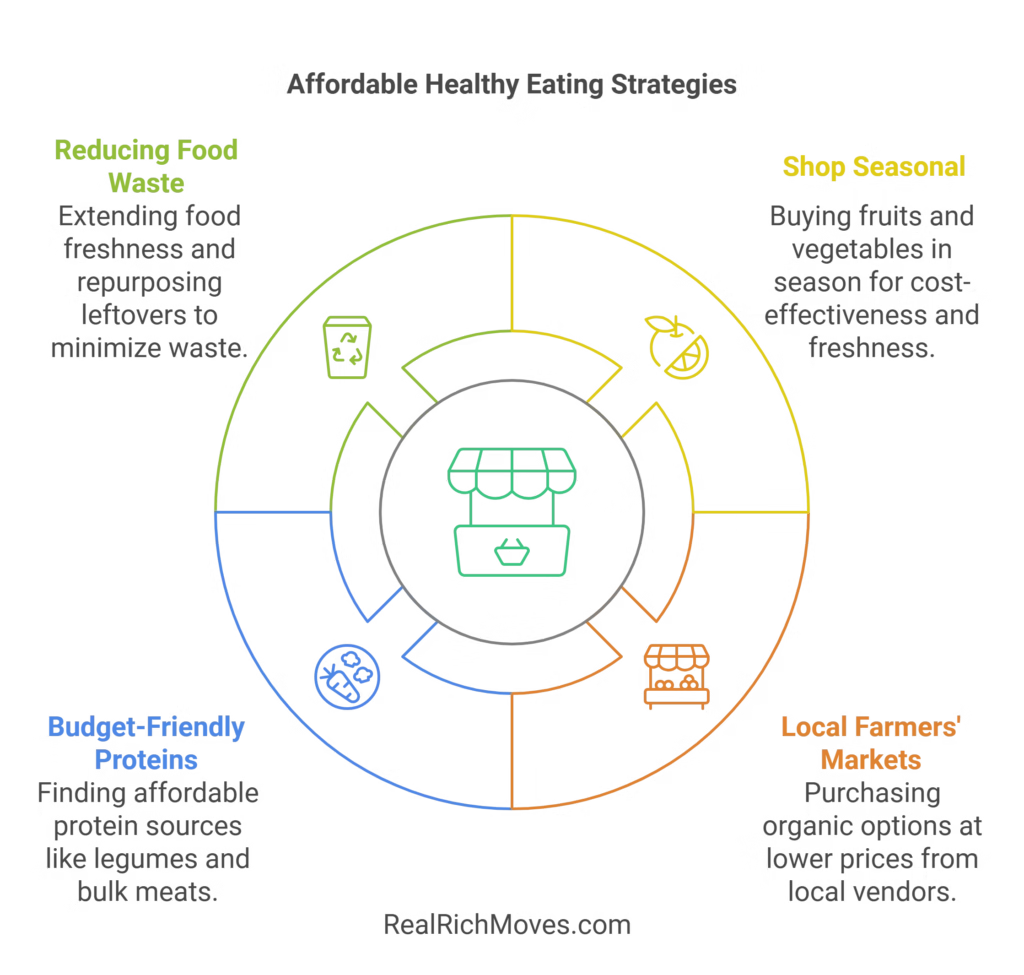

- Embrace Seasonal Shopping

- Why Seasonal? Seasonal fruits and vegetables are not only fresher but significantly cheaper due to abundant supply.

- Examples: Stock up on oranges in winter and berries in summer for affordable nutrition.

- Explore Local Farmers’ Markets

- Organic on a Budget: Farmers’ markets often offer organic produce at prices lower than those in supermarkets.

- Build connections with local vendors to discover weekly deals or discounts on bulk purchases.

Budget-Friendly Proteins – Nourishment Without Overspending

- Affordable Alternatives

- Include plant-based proteins like lentils, beans, and eggs in your meals—they’re inexpensive yet packed with essential nutrients.

- Experiment with creative recipes like lentil curries, bean salads, or egg frittatas.

- Smart Meat Purchases

- Buy meats in bulk during sales and freeze portions for later use.

- Opt for less expensive cuts (e.g., chicken thighs, pork shoulder) that are flavorful and versatile.

Reducing Food Waste – Maximizing Every Bite

- Extend Freshness with Proper Storage

- Use airtight containers or produce bags to maintain the quality of fruits and vegetables.

- Store leafy greens with paper towels to absorb excess moisture and keep them crisp.

- Get Creative with Leftovers

- Transform leftovers into new dishes:

- Soups: Blend vegetables and meats into hearty broths.

- Stir-Fries: Toss remaining ingredients with spices for a quick meal.

- Wraps: Repurpose proteins and veggies into flavorful wraps or sandwiches.

- Transform leftovers into new dishes:

Key Takeaway:

Prioritizing quality over quantity doesn’t mean overspending. By shopping smartly for seasonal produce, affordable proteins, and minimizing waste, you can enjoy healthier, tastier meals while staying within your budgeting goals. These strategies also free up funds for financial planning, like starting a side hustle or saving for long-term wealth building.

Common Grocery Shopping Mistakes to Avoid

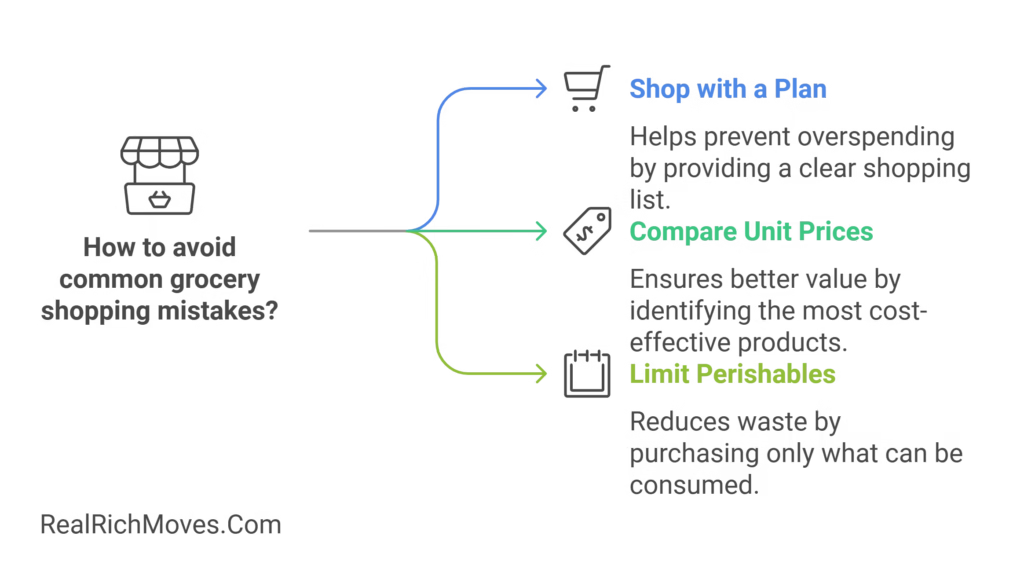

Shopping Without a Plan – The Cost of Impulse Buying

- Why It’s a Problem

- Wandering through aisles without a list often leads to unnecessary purchases, inflating your grocery bill.

- How to Avoid It

- Create a Detailed List: Write down exactly what you need based on a weekly meal plan.

- Stick to Your Budget: Use apps like Mint or PocketGuard to set a spending limit.

Ignoring Unit Prices – Missing Out on Value

- The Hidden Cost

- Focusing only on the product’s sticker price can be misleading. A larger or bulk item might seem cheaper but costs more per unit.

- How to Maximize Savings

- Compare Unit Prices: Check the cost per ounce, pound, or liter displayed on the shelf tags.

- Compare Unit Prices: Check the cost per ounce, pound, or liter displayed on the shelf tags.

Overbuying Perishables – A Recipe for Waste

- Why It Happens

- Bulk discounts or ambitious meal planning can lead to purchasing more fresh produce than you can use.

- How to Prevent It

- Know Your Consumption Rate: Estimate how much fresh produce you’ll realistically consume in a week.

- Shop More Frequently: Opt for smaller, regular trips instead of a single large haul.

- Preserve Extras: Freeze surplus fruits, vegetables, or herbs to extend their shelf life.

Key Takeaway:

Avoiding these common mistakes can significantly enhance your grocery shopping efficiency. By planning ahead, comparing unit prices, and controlling perishables, you’ll not only save money but also align with broader financial planning goals, like reducing debt or investing in a side hustle for extra income.

Side Hustles That Can Help You Save on Groceries

Food-Related Side Hustles – Turn Passion Into Profit

- Meal-Prep Services – Helping Others, Boosting Income

- Why It Works: Many busy professionals and families lack the time to cook and are willing to pay for prepped meals.

- How to Start: Offer customized meal plans catering to dietary needs (e.g., keto, vegan). Use social platforms like Instagram or local community groups to market your services.

- Financial Impact: Extra income from meal-prep services can significantly offset your grocery expenses.

- Food Blogging – Share, Influence, Earn

- Why It’s Lucrative: Food blogging allows you to monetize your grocery knowledge through ads, affiliate links, and sponsorships.

- Content Ideas: Post recipes that maximize savings without sacrificing quality. Create guides on grocery budgeting or meal planning.

- Income Potential: Partner with brands or use platforms like YouTube to diversify your revenue streams.

Cash-Back and Rewards Apps – Shop Smart, Save More

- Why Use These Apps?

- Apps like Ibotta, Fetch Rewards, and Rakuten offer cashback on everyday grocery purchases, effectively reducing your overall expenses.

- How to Maximize Benefits:

- Double Dip: Combine store discounts with cashback app rewards for greater savings.

- Redeem Points Strategically: Use accumulated points to buy gift cards for future groceries or other necessities.

- Pro Tip:

- Consistently use these apps to funnel small savings into a broader financial plan, such as paying off a loan, building savings, or supporting a side hustle for extra income.

Key Takeaway:

Leveraging food-related side hustles and smart shopping tools not only helps you save on groceries but also contributes to broader wealth-building goals. These efforts are a step closer to achieving financial freedom, proving that small actions can lead to significant gains.

FAQs About Saving Money on Groceries

Key Takeaway:

These FAQs provide actionable solutions tailored to different lifestyles, ensuring you can shop smarter and achieve broader financial planning goals. By integrating small savings strategies into your routine, you can contribute to long-term wealth-building while maintaining quality and nutrition.

Grocery-Saving Checklist

Before Shopping

- Plan Your Meals: Outline meals for the week using items already in your pantry and fridge to minimize unnecessary purchases.

- Inventory Check: Go through your kitchen to avoid buying duplicates.

- Set a Budget: Decide on a spending limit and use budgeting apps like Mint or PocketGuard to track it.

- Look for Coupons and Discounts: Check store flyers, digital apps like Flipp, or cashback platforms like Ibotta for the best deals.

- Choose the Right Time: Shop mid-week or early mornings for markdowns on perishables and less crowded aisles.

During Shopping

- Stick to Your List: Avoid impulse buys by focusing solely on your pre-made shopping list.

- Compare Unit Prices: Check the cost per ounce, pound, or liter to ensure you’re getting the best value.

- Shop Store Brands: Opt for generic brands that often provide the same quality at a fraction of the price.

- Buy Seasonal and Bulk Items: Seasonal produce and bulk staples like rice and beans are cheaper and last longer.

- Limit Convenience Foods: Pre-packaged meals or pre-cut produce are typically more expensive than whole ingredients.

After Shopping

- Proper Storage: Store produce in breathable bags or containers to extend its shelf life. Freeze items like bread, meats, or leftovers to prevent spoilage.

- Meal Prep Immediately: Portion and prep meals for the week to save time and reduce the temptation to eat out.

- Creative Leftovers: Turn yesterday’s dinner into new dishes like soups, stir-fries, or wraps to minimize waste.

- Track Your Usage: Keep a record of what gets used and what doesn’t to fine-tune your future shopping habits.

Pro Tip:

Review your checklist after each grocery trip to identify areas for improvement. This simple practice ensures you stay on track with your budgeting, debt management, and broader financial planning goals while still enjoying quality food.

Wrap-Up

Save Big While Eating Well

“Small changes can lead to big savings.” This timeless truth holds especially true when it comes to grocery budgeting—a critical component of financial freedom.

The Power of Grocery Budgeting

By implementing strategies such as meal planning, using coupons, and focusing on reducing food waste, you not only save money but also cultivate healthier eating habits. These small yet impactful changes free up resources for broader financial goals like investing, debt management, and saving for milestones.

Key Takeaways to Transform Your Shopping Habits

- Plan Ahead: Thoughtful meal planning and strategic shopping prevent unnecessary expenses.

- Maximize Discounts: Leveraging coupons and digital cashback apps ensures every dollar counts.

- Reduce Waste: Creative use of leftovers and proper storage prolongs the value of your groceries.

Invest in Your Future

Saving on groceries is more than just a cost-cutting exercise—it’s an investment in your future. The money saved can be directed toward side hustles, online work, or even a well-planned education journey. Start today and take control of your finances because, as the saying goes, “The best investment is in your future.”

By mastering these strategies, you’re not just saving on groceries; you’re creating opportunities for greater financial freedom and long-term success.

At RealRichMoves, we’re committed to equipping Gen Z with actionable advice to build a solid foundation for wealth-building and financial independence. Our guides are designed to help you optimize your spending while maintaining the quality of life you deserve.