Getting Started:

Breaking Free From the Debt Cycle

“Debt is a thief of future wealth; budget wisely today for freedom tomorrow.”

For Gen Z, managing finances can feel like a balancing act between chasing dreams and managing reality. Credit card debt is often a significant hurdle, with its high-interest rates and persistent monthly payments.

Yet, with the right tools and mindset, breaking free from the debt cycle is not just a possibility—it’s a plan waiting to be executed.

At RealRichMoves, we understand that financial independence isn’t just about numbers; it’s about freedom, security, and building the future you deserve.

This guide offers tailored strategies for overcoming credit card debt while embracing a lifestyle that reflects your values and goals.

Whether you’re struggling with multiple balances or just starting your debt-free journey, this roadmap will empower you to reclaim control of your finances.

Let’s dive into the actionable steps that will help you transform your financial challenges into opportunities for lasting wealth and freedom.

Step 1: Understanding Credit Card Debt

The Basics of Credit Card Debt

Credit card debt is the amount owed to credit card companies after making purchases or cash withdrawals using credit.

What makes it particularly challenging is the high-interest rate that accumulates if balances are not paid in full each month.

This can lead to a cycle of debt, especially if minimum payments are the only ones being made.

Credit cards are not inherently bad. When used responsibly, they can help build credit and earn rewards.

However, misuse can lead to financial stress, making it critical to understand how debt works and the importance of budgeting and debt management.

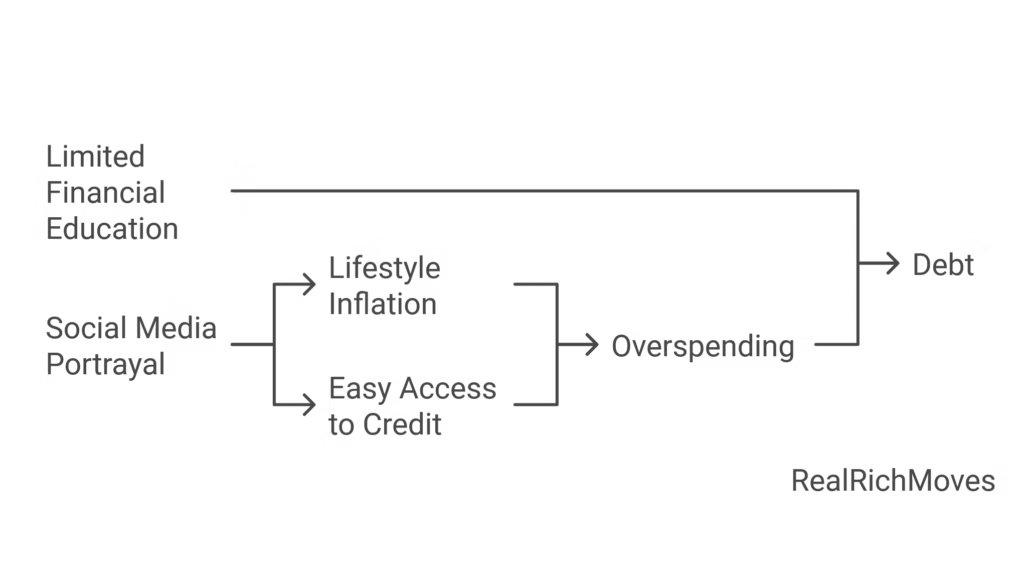

Why Gen Z Is Struggling With Debt

- Lifestyle Inflation: Social media amplifies the desire to keep up with luxurious lifestyles, leading to overspending.

- Easy Access to Credit: Credit card companies frequently target Gen Z with appealing offers, making it easy to fall into the debt trap.

- Limited Financial Education: Many young adults lack foundational knowledge in saving, budgeting, and financial planning, leaving them vulnerable to debt.

The Hidden Cost of Credit Card Debt

The effects of credit card debt extend beyond monetary losses:

- Financial Impact: High-interest payments erode potential savings and delay investment opportunities.

- Credit Score Damage: Poor credit management can hurt your credit score, making it harder to secure loans or favorable terms for major purchases.

- Emotional Toll: Debt-related stress and anxiety can affect mental health and overall well-being.

By understanding the dynamics of credit card debt, you can begin to dismantle its hold and take steps toward financial stability.

Transitioning from awareness to action sets the stage for effective debt management and long-term success.

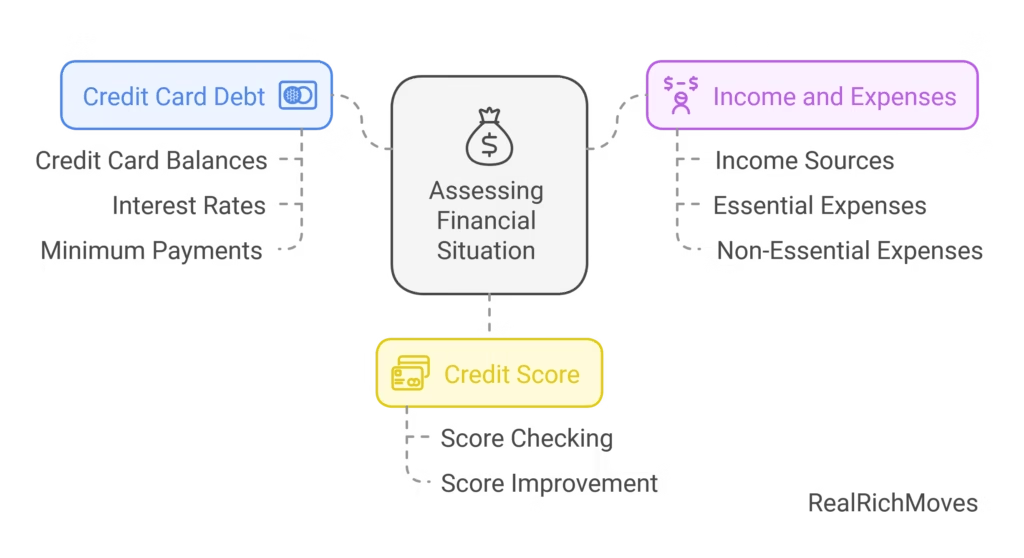

Step 2: Assessing Your Financial Situation

Take Stock of Your Debt

To effectively manage credit card debt, start by understanding your financial position. Create a detailed list that includes:

- All your credit card balances.

- Their respective interest rates.

- Minimum payment requirements.

This process not only offers a comprehensive view of your debt but also helps prioritize which debts to tackle first based on interest rates and payment terms.

Evaluate Your Income and Expenses

A clear picture of your cash flow is essential for debt repayment. Begin by tracking all sources of income, such as full-time jobs, side hustles, and freelance gigs. Next, categorize your expenses into:

- Essentials: Rent, utilities, groceries.

- Non-essentials: Dining out, subscriptions, entertainment.

This breakdown highlights areas where you can reduce spending and allocate additional funds to paying off debt.

Know Your Credit Score

Your credit score influences interest rates and loan approvals. Use free tools like Credit Karma or your bank’s app to check your score.

Improving your credit score by paying off debts on time and maintaining low balances is crucial for long-term financial freedom.

Understanding your financial situation lays the groundwork for a focused and effective debt repayment strategy. By taking stock, tracking income and expenses, and monitoring your credit score, you empower yourself to make informed decisions that align with your financial goals.

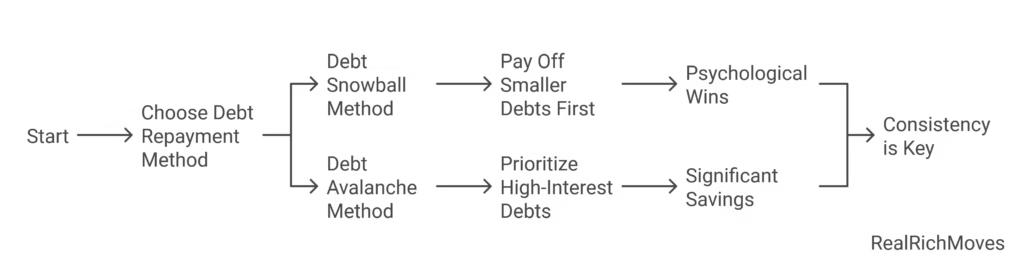

Step 3: Choosing the Right Debt Repayment Strategy

Debt Snowball vs. Debt Avalanche

Both methods are effective; choosing the right one depends on your personality and financial situation.

Debt Snowball Method:

- Pay off smaller debts first while making minimum payments on others.

- Provides psychological wins, motivating you to keep going.

Debt Avalanche Method:

- Prioritize high-interest debts for significant savings in the long run.

- Ideal for those focused on reducing the total cost of debt.

Which Method Is Right for You?

- Choose the Debt Snowball Method if you thrive on quick wins and need motivation to maintain momentum.

- Opt for the Debt Avalanche Method if your goal is to save the most money by tackling high-interest debts first.

Regardless of your choice, consistency and dedication are non-negotiable. Both methods are effective as long as you stick to the plan.

Selecting a debt repayment strategy tailored to your financial needs and personality is a game-changer.

By choosing the snowball or avalanche method, you can systematically reduce your debt while building confidence and achieving financial freedom.

Step 4: Boosting Your Income to Pay Off Debt Faster

Side Hustles and Extra Income Ideas

Finding creative ways to earn more is an excellent strategy for tackling debt quickly. Consider these ideas:

- Freelancing: Platforms like Upwork and Fiverr are perfect for offering skills like writing, design, or coding.

- Rideshare Services: Companies like Uber or Lyft offer flexible opportunities to earn extra cash.

- Dropshipping: Start an online business with minimal upfront costs, leveraging e-commerce platforms like Shopify.

Gen Z’s tech-savvy nature makes online work a powerful avenue to explore for increasing income streams.

Selling Unused Items

Turn clutter into cash by selling items you no longer need:

- Use eBay, Facebook Marketplace, or Depop to market and sell unused clothing, gadgets, or furniture.

- Decluttering not only contributes to your debt repayment but also creates a more organized and stress-free living space.

Leveraging Your Skills for Income Growth

Your unique talents can open doors to additional income:

- Creative Skills: Offer graphic design, photography, or videography services.

- Educational Expertise: Tutor students or create online courses for platforms like Udemy.

- Local Tasks: Use TaskRabbit to find opportunities for handyman work, moving assistance, or event setup.

Monetizing your hobbies and skills is a fulfilling way to supplement your primary income and pay off debt faster.

Boosting your income is all about leveraging opportunities that align with your strengths and interests.

By diversifying your income streams, you can tackle debt repayment with confidence and reach financial freedom more efficiently.

Step 5: Negotiating and Consolidating Your Debt

Talk to Your Credit Card Companies

Don’t hesitate to reach out to your credit card issuers to explore negotiation options. Credit card companies are often willing to adjust terms to ensure repayment. Here’s what to request:

- Lower Interest Rates: Reducing your interest rate can save you significant money over time.

- Waived Late Fees: Ask for fees to be removed, especially if you’ve generally maintained good payment history.

- Customized Payment Plans: Discuss a payment plan that aligns with your financial situation, helping you stay on track without defaulting.

A single call can lead to adjustments that ease your debt burden and accelerate repayment.

Consider Balance Transfers or Debt Consolidation Loans

Simplify your debt with these options:

- Balance Transfers: Move high-interest balances to a card with a lower interest rate. Many cards offer 0% introductory APRs, making them ideal for short-term debt reduction.

- Debt Consolidation Loans: Combine multiple debts into one manageable loan with a lower interest rate. This approach not only reduces monthly payments but also streamlines your finances.

Pro Tip:

“Always read the fine print for fees or conditions, ensuring the new terms genuinely benefit your repayment goals.”

Negotiating and consolidating your debt empowers you to take control of your finances with fewer obstacles. These strategies can reduce financial stress and allow you to focus on building a stable, debt-free future.

Step 6: Building Habits for Long-Term Financial Freedom

Avoiding the Debt Trap

Achieving debt freedom is an accomplishment, but staying out of debt requires a commitment to better financial habits. Here’s how to avoid falling back:

- Set Spending Limits: Define a monthly budget for discretionary spending and stick to it.

- Use Credit Cards Strategically: Limit credit card usage to essentials you can pay off immediately, like recurring bills.

- Track Progress: Regularly review your financial goals to stay motivated and on course.

Breaking the debt cycle is about more than paying off balances—it’s about building a lifestyle that prevents new debt from accumulating.

Automate Payments and Savings

Leverage technology to make financial discipline effortless:

- Automatic Payments: Set up auto-pay for credit card bills to avoid late fees and improve your credit score.

- Automated Savings: Direct a portion of each paycheck into a savings or investment account. This ensures consistent progress toward financial goals.

Apps like Mint, YNAB, or even your bank’s tools can streamline these processes, reducing the need for manual management.

Prioritize Saving and Investing

Debt freedom creates room for financial growth. Take the following steps:

- Emergency Fund: Build or expand your emergency savings to cover at least 3–6 months of essential expenses.

- Invest for the Future: Redirect the money once used for debt payments into investments that grow your wealth, like index funds, stocks, or retirement accounts.

Planning for both short-term stability and long-term wealth ensures that your financial independence lasts a lifetime.

Creating habits that align with your goals not only secures your current financial stability but also sets the stage for a prosperous future. Every small habit change today builds momentum toward lifelong financial freedom.

FAQs – About Credit Card Debt Management

These answers provide actionable insights to tackle credit card debt effectively while keeping long-term financial goals in focus. Remember, there’s no one-size-fits-all solution—find what works best for you and stay committed to your journey.

Importance of Budgeting for Debt Management

Why Budgeting Is Key to Paying Off Credit Card Debt

Budgeting is your financial roadmap, offering clarity and control over your money. Here’s how it helps:

- Track Spending and Savings: A budget highlights where your money is going, ensuring no dollar goes unaccounted for.

- Identify Unnecessary Expenses: By categorizing spending, it’s easier to spot and cut non-essential expenses like dining out or subscriptions, freeing up funds for debt repayment.

- Allocate Funds for Debt Repayment: Budgets enable intentional spending, ensuring a portion of your income is consistently directed toward paying off credit card balances.

- Reduce Financial Stress: Knowing you have a plan reduces the mental burden of debt and fosters a sense of control.

- Build Financial Discipline: Sticking to a budget cultivates habits that help you avoid future debt and achieve long-term financial goals.

When you budget effectively, you’re not just managing your finances—you’re setting the stage for a debt-free future and creating a strong foundation for financial success. Let’s explore the next steps to accelerate your journey to financial freedom!

Summery:

The Path to Financial Freedom

“The best way to predict your financial future is to create it today.”

Credit card debt may feel like a burden, but with determination and a clear plan, freedom is within reach. Paying off debt is not just about clearing balances; it’s about unlocking opportunities for financial growth and independence.

At RealRichMoves, we empower Gen Z to take control of their finances through actionable strategies:

- Budgeting: Align your spending with your goals and track every dollar effectively.

- Debt Management: Choose the repayment method that works best for you—whether it’s snowball or avalanche—and stay consistent.

- Saving and Investing: Build a safety net for emergencies and grow your wealth over time.

Consistency is the key to success. With every payment you make and habit you build, you’re not only erasing debt but also creating a future filled with possibilities. Together, we can turn financial freedom from a dream into a reality. Let’s start your journey to wealth-building today!