First Steps: How to Build Wealth in Your 20s

“The earlier you start, the further you’ll go.”

Your 20s are the golden years for building wealth, yet they can feel overwhelming. Between managing student loans, juggling part-time jobs, and pursuing side hustles, balancing it all might seem unattainable.

However, this decade is your perfect window of opportunity to establish a strong financial foundation.

By adopting smart saving strategies, leveraging budgeting tools, and creating effective debt management plans, you can start crafting a future of financial freedom.

This is also the time to explore additional income streams, like side hustles or online work, to supercharge your wealth-building efforts.

At RealRichMoves, we understand the unique challenges faced by Gen Z and are committed to helping you transform financial goals into achievable milestones.

This guide, “How to Build Wealth in Your 20s,” will provide you with practical insights tailored to your lifestyle, ensuring that you not only save for the future but also enjoy the journey along the way.

Key Takeaways:

- Understand why starting early gives you a significant edge in wealth building.

- Learn how tools like budgeting apps and saving hacks can streamline your financial management.

- Discover the balance between achieving financial goals and maintaining your desired lifestyle.

Pro Tip:

“Small, consistent steps—like automating savings or investing modest amounts—can have a monumental impact when compounded over time.“

Now, let’s explore actionable steps to help you achieve financial independence in your 20s!

Why Building Wealth in Your 20s is Crucial

The Power of Starting Early

Starting your wealth-building journey in your 20s isn’t just a good idea—it’s transformative. Thanks to the magic of compound interest, the earlier you begin, the more your money can grow.

For example, investing as little as $100 per month at a 7% annual return can snowball into over $120,000 by age 50. Waiting until your 30s to start could mean missing out on tens of thousands of dollars.

Beyond just numbers, starting young builds a foundation of good financial habits that set you up for a lifetime of success.

Key Insights:

- Early investments multiply over time, creating long-term financial security.

- Habits like automated savings and incremental investing ensure consistency without extra effort.

Freedom Through Financial Planning

Financial planning in your 20s is the gateway to freedom—freedom to make choices that align with your values and dreams. Whether it’s paying off a loan, launching a side hustle, or planning for education, having a financial safety net allows you to take bold steps without fear.

By setting the groundwork early, you can embrace opportunities without the burden of financial stress, giving you the flexibility to build the lifestyle you desire.

Key Benefits:

- Gain the freedom to pursue passions and career changes without financial constraints.

- Avoid falling into debt traps by planning for major expenses, from education to life goals.

RealRichMoves Tip:

“Think of your 20s as the starting line for wealth-building. Every small step—be it saving, budgeting, or investing—pushes you closer to financial freedom.”

Let’s dive deeper into the actionable strategies that can set you on the path to lasting wealth.

Saving: The First Step to Financial Stability

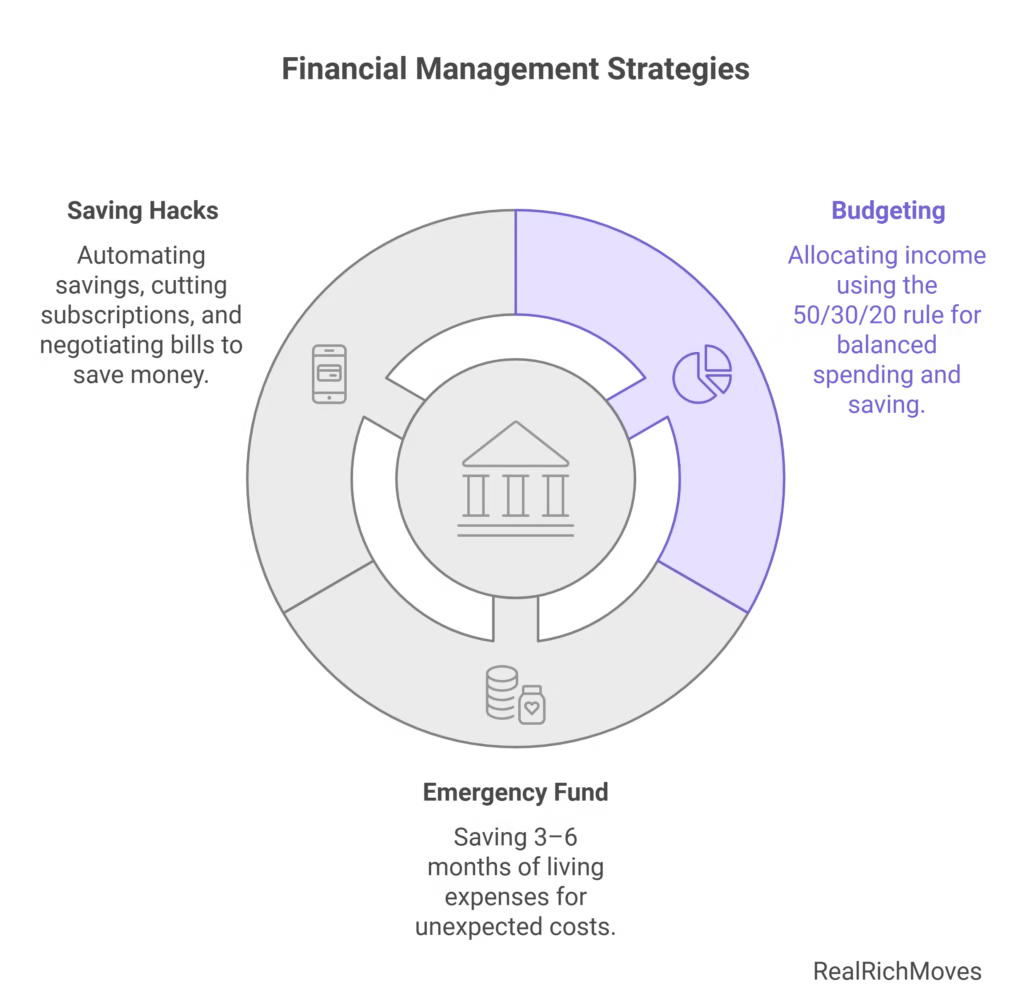

Mastering Budgeting Early

Budgeting isn’t just about cutting back—it’s about giving every dollar a purpose. Embracing the 50/30/20 rule simplifies your approach to money management:

- 50% for Needs: Cover essentials like rent, groceries, and transportation.

- 30% for Wants: Allocate funds for entertainment, travel, and hobbies.

- 20% for Savings and Debt Repayment: Prioritize financial goals and secure your future.

Tools like YNAB (You Need a Budget) and Mint streamline expense tracking and highlight opportunities to optimize spending. By mastering budgeting early, you create a strong financial foundation that supports your goals.

💡 Quick Tip:

“Periodically review your budget to adjust for life changes like new jobs or unexpected expenses.“

Building an Emergency Fund

An emergency fund is your financial safety net. Life happens—medical emergencies, car repairs, or sudden job losses can disrupt your plans. Aim to save 3–6 months’ worth of living expenses to cushion against these setbacks.

Starting small makes the goal manageable. For example, saving just $25 weekly adds up to over $1,300 in a year—enough to cover many unforeseen expenses.

Key Steps to Build Your Fund:

- Open a dedicated high-yield savings account for emergencies.

- Automate transfers to consistently grow your fund.

- Use windfalls like bonuses or tax refunds to boost savings.

Practical Saving Hacks

Small, actionable changes can make a big difference. Consider these hacks to save without sacrificing your lifestyle:

- Automate Savings: Apps like Acorns round up your purchases and stash the spare change into savings.

- Cancel Unused Subscriptions: Audit memberships for services you rarely use, like streaming platforms or gym memberships

- Negotiate Bills: Reach out to providers to lower rates on internet, insurance, or phone plans.

These strategies not only help you save more but also free up money for debt management, investing, or side hustles.

💡 RealRichMoves Tip:

“Start where you are, use what you have, do what you can.“

Saving, no matter how small, is a step toward financial freedom.

Up next, let’s explore how to tackle debt effectively and unlock your path to wealth-building in your 20s!

Tackling Debt Management in Your 20s

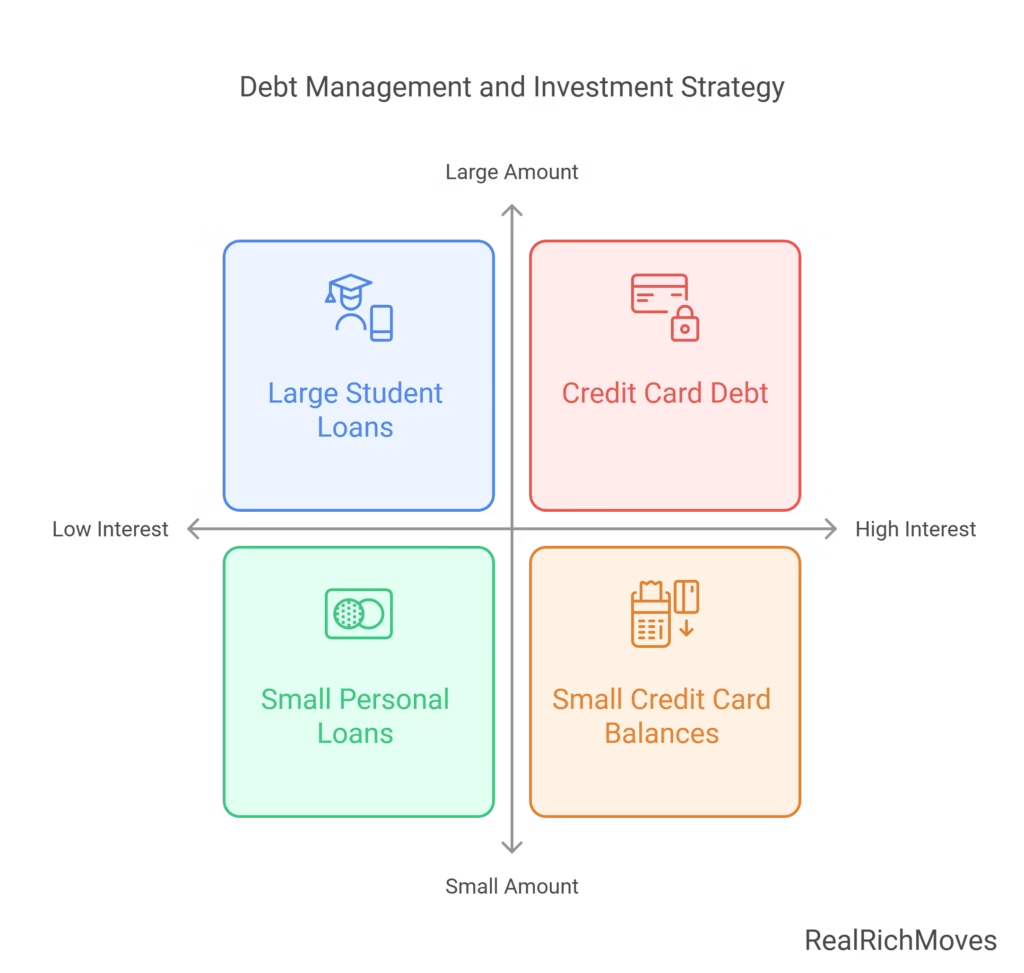

Prioritizing High-Interest Debts

High-interest debts, like credit card balances, can act as financial roadblocks, draining resources you could otherwise invest or save. Tackling these debts strategically is essential for financial stability and wealth-building in 20s.

Effective Debt-Repayment Strategies:

- Avalanche Method: Focus on debts with the highest interest rates first, saving you money in the long run.

- Example: If your credit card interest rate is 20% and your personal loan is 10%, prioritize the credit card.

- Snowball Method: Start by paying off the smallest debts first to gain quick psychological wins and build momentum.

- Example: Paying off a $500 balance before tackling larger debts boosts confidence.

💡 Pro Tip:

“Use tools like Tally to consolidate and manage your debts efficiently.”

Balancing Student Loans and Investing

For Gen Z, student loans are often unavoidable, but managing them wisely can pave the way to financial freedom. Here’s how to strike the right balance between repaying loans and investing:

- Understand Your Loan Terms: Identify which loans have low-interest rates (e.g., 4–6%) versus high-interest rates.

- Minimum Payments: Pay at least the required minimums to avoid penalties and keep your credit score intact.

- Direct Extra Funds to Growth: Instead of aggressively paying off low-interest student loans, consider allocating extra funds to investments with higher potential returns, like stocks or ETFs.

Example Scenario:

- Loan interest rate: 5%

- Investment return: 8%

- Result: You gain a 3% net growth by investing while paying the minimum on your loans.

💡 RealRichMoves Tip:

“Don’t let student loans hold you back—make them a part of your strategy, not your identity.“

Leveraging Debt-Management Tools

Simplify the repayment process with these resources:

- Debt Snowball Calculator: Helps you map out your repayment journey.

- Apps like YNAB: Track spending and allocate funds toward debt repayment.

- Loan Refinancing: Explore refinancing options for lower interest rates through providers like SoFi or Earnest.

By mastering debt management, you free up financial resources to fuel your savings, investments, and side hustles—laying the groundwork for long-term financial success.

Up next: Explore the importance of investing early and how it accelerates wealth-building in your 20s!

Investing: Building Wealth for the Future

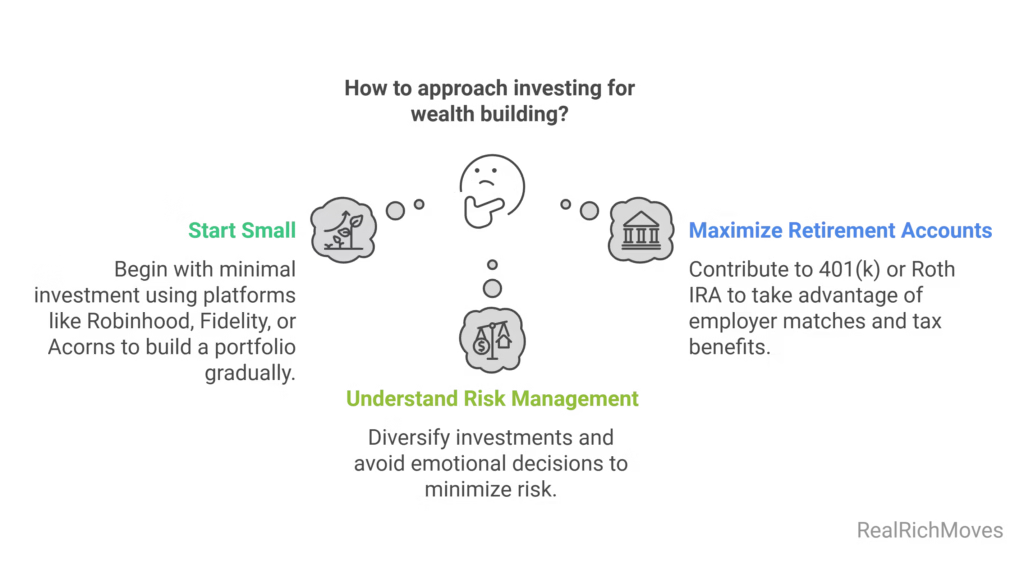

Start Small, Think Big

Investing is one of the most effective ways to grow wealth, even if you’re starting with limited funds. Thanks to modern technology, it’s easier than ever to get started, no matter your budget.

Key Steps to Begin:

- Use Beginner-Friendly Platforms: Apps like Robinhood, Fidelity, and Acorns allow you to start investing with as little as $5. These platforms offer educational resources to help you make informed decisions. Example: Acorns rounds up your daily purchases to invest spare change automatically.

- Focus on Diversification: Minimize risk by investing in a mix of asset types, such as index funds and ETFs (Exchange-Traded Funds). Why ETFs? They spread risk across multiple stocks, making them a safer choice for beginners.

💡 Pro Tip:

“Small, consistent investments today lead to big rewards tomorrow.“

Maximizing Retirement Accounts

Retirement might feel distant, but investing in retirement accounts early can exponentially grow your savings thanks to compound interest.

Best Practices for Retirement Savings:

- 401(k) Contributions: If your employer offers a match, contribute enough to take full advantage—this is essentially free money! Example: For every $1 you contribute, your employer might add $0.50, effectively boosting your investment by 50%.

- Roth IRA Benefits: Contribute to a Roth IRA for tax-free withdrawals in retirement.

💡 RealRichMoves Tip:

“Think of retirement accounts as your future self’s paycheck.”

Understanding Risk Management

Investing involves risk, but managing it wisely ensures long-term success.

Strategies for Risk Control:

- Diversify Your Portfolio: Invest across different asset classes like stocks, bonds, and mutual funds to reduce the impact of market volatility. Example: A balanced portfolio might include 60% stocks, 30% bonds, and 10% real estate funds.

- Avoid Emotional Investing: Market dips are normal—avoid selling in panic or buying on hype. Stick to your plan and think long-term.

Time in the market beats timing the market.

Investing Resources to Explore

- Educational Tools: Learn investing basics through websites like Investopedia or Coursera courses.

- Advanced Apps: Use tools like M1 Finance for automated investing or Betterment for financial planning.

- Books to Read: Titles like The Intelligent Investor by Benjamin Graham offer timeless investment wisdom.

Investing in your 20s isn’t just about wealth-building; it’s about creating financial freedom and unlocking opportunities for your future self. Take small steps today, stay consistent, and watch your investments grow over time.

Up next: Discover how side hustles can further accelerate your journey to wealth!

Building Multiple Streams of Income to Build Wealth

Side Hustles for Extra Income

Creating multiple income streams is essential for financial stability and wealth-building in your 20s. A side hustle not only brings in extra income but also diversifies your earning potential.

Popular Side Hustles for Gen Z:

- Freelancing Services: Offer your skills on platforms like Fiverr, Upwork, or Toptal. Popular services include:

- Graphic design.

- Content writing.

- Website development.

- Example: Earn $100–$500 per project by designing logos or creating websites for small businesses

- Online Work Opportunities:

- Open an Etsy shop to sell handmade or digital products, such as custom stickers or templates.

- Manage social media accounts for local businesses. Many small businesses pay $200–$500 monthly for content creation.

- Create and sell eBooks, online courses, or printables.

💡 RealRichMoves Tip:

“A side hustle is more than extra cash—it’s your gateway to financial freedom and skill growth.”

Monetizing Hobbies

Turning hobbies into income streams is a rewarding way to boost your finances while doing something you love.

Ideas for Monetizing Your Passions:

- Blogging or Vlogging:

- Start a blog on topics you’re passionate about, like travel, cooking, or fitness.

- Monetize through ads, affiliate marketing, or sponsored posts.

- Example: A food blog with 50,000 monthly visitors can earn $500–$1,000 from ad revenue alone.

- Teaching Skills Online:

- Offer virtual classes on platforms like Teachable or Skillshare. Topics could include playing an instrument, mastering photography, or coding basics.

- Potential Earnings: Instructors on Skillshare earn an average of $200 monthly.

- Selling Digital Products:

- Create and sell downloadable guides, workout plans, or resume templates.

- Example: Selling a $10 template to 100 customers brings in $1,000.

💡 Pro Tip:

“Hobbies that pay are hobbies that stay.”

The Benefits of Diversified Income Streams

- Increased Savings: Use your side hustle earnings to build an emergency fund or invest in long-term financial goals.

- Enhanced Career Growth: Many side hustles can develop skills that boost your primary career.

- Financial Security: Multiple income streams reduce reliance on a single paycheck.

Resources for Starting a Side Hustle to Build Wealth

- Freelancing Platforms: Fiverr, Upwork, and Toptal.

- E-Commerce Tools: Etsy, Shopify, or WooCommerce.

- Content Creation Help: Canva for design or OBS Studio for video recording.

Building multiple streams of income is one of the smartest ways to achieve financial freedom in your 20s. Whether freelancing, teaching online, or monetizing hobbies, every effort contributes to wealth-building and personal growth in your 20s. Start small, stay consistent, and explore what works best for your goals.

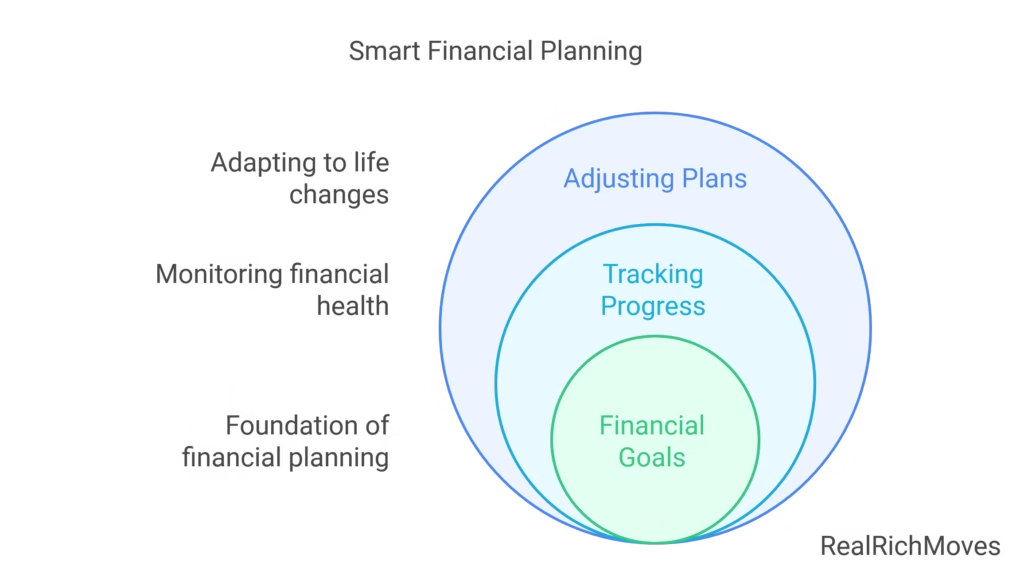

Smart Financial Planning to Build Wealth in Your 20s

Setting Clear Financial Goals

Creating a financial roadmap in your 20s sets the stage for long-term success. By defining actionable goals, you can align your budgeting, saving, and investing strategies effectively.

Key Steps to Setting Financial Goals:

- Be Specific:

- Clearly outline what you want to achieve. For example:

- Save $10,000 for a home down payment within five years.

- Pay off a $20,000 student loan within seven years.

- Clearly outline what you want to achieve. For example:

- Break It Down:

- Divide large goals into smaller, manageable milestones.

- Example: Saving $10,000 for a down payment translates to saving $167 monthly over five years.

- Divide large goals into smaller, manageable milestones.

- Make It Time-Bound:

- Assign realistic deadlines to each goal to stay motivated.

- Example: “Build a $5,000 emergency fund within 18 months.”

- Assign realistic deadlines to each goal to stay motivated.

💡 RealRichMoves Tip:

“Goals are dreams with deadlines. Start small and scale up as you achieve success.”

Tracking and Adjusting Plans

Your 20s are a time of growth and change. Regularly revisiting your financial goals ensures they stay relevant to your evolving lifestyle, income, and priorities.

Tools for Tracking Financial Progress:

- Apps for Goal Management: Mint, YNAB (You Need a Budget), or Personal Capital to monitor expenses and savings.

- Spreadsheets: Use Google Sheets or Excel for a custom financial tracker tailored to your needs.

How to Adjust Financial Plans:

- Reassess Annually:

- Evaluate progress toward your goals at least once a year. Are you ahead, behind, or on track?

- Example: If you received a raise or started a side hustle, increase your savings rate.

- Adapt to Life Changes:

- Major events like starting a new job, moving, or pursuing education may require plan adjustments.

- Example: Use bonuses or windfalls to accelerate debt payments or savings.

- Stay Flexible Yet Focused:

- Life can be unpredictable; it’s okay to adjust deadlines while maintaining overall direction.

Benefits of Financial Planning to Build Wealth in Your 20s

- Early Start Advantage: Compound growth amplifies your efforts over time, whether in savings or investments.

- Financial Freedom: Well-defined plans reduce stress and provide clarity about achieving wealth-building goals.

- Adaptability: A structured plan offers flexibility to seize opportunities, such as pursuing education or launching a side hustle.

Actionable Steps to Kickstart Planning Today

- Write down one short-term, one medium-term, and one long-term goal.

- Choose a budgeting tool and set up goal trackers within the app.

- Commit to reviewing your progress monthly to stay aligned with your objectives.

💡 RealRichMoves Insight:

“Your 20s are the decade of decisions—make choices today that your future self will thank you for.”

With smart financial planning, you can turn your 20s into a decade of growth and empowerment, setting the stage for financial independence and wealth-building success.

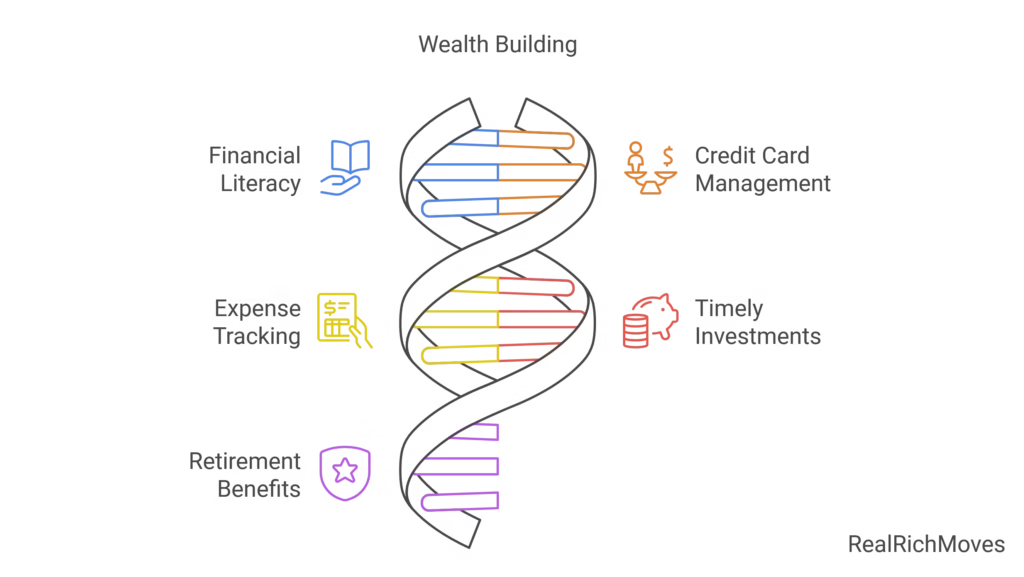

Common Mistakes to Avoid While Building Wealth in 20s

Building wealth in your 20s is a journey filled with opportunities—and potential pitfalls. Recognizing and avoiding common mistakes can save you time, money, and unnecessary stress.

Ignoring Financial Literacy

- Why It Matters: Without a solid understanding of personal finance, it’s easy to make costly mistakes like overspending or missing out on investment opportunities.

- How to Avoid It:

- Dedicate time to learning about topics like saving, budgeting, investing, and debt management.

- Explore resources such as financial blogs, podcasts, or courses on platforms like Coursera and YouTube.

💡 RealRichMoves Tip:

“Knowledge is the foundation of wealth. Invest in your financial education—it pays the best interest.”

Overusing Credit Cards for Lifestyle Expenses

- Why It Matters: Credit card debt, especially with high interest rates, can quickly snowball and derail your wealth-building efforts.

- How to Avoid It:

- Use credit cards for planned, budgeted expenses and pay off the balance in full each month.

- Stick to a debit card or cash for discretionary spending to avoid impulsive purchases.

💡 Pro Tip:

“Take advantage of credit card rewards programs, but don’t let them tempt you into overspending.”

Failing to Track Monthly Expenses

- Why It Matters: Without tracking your spending, you may underestimate how much you’re spending on non-essential items, hindering savings and investment goals.

- How to Avoid It:

- Use budgeting apps like Mint or YNAB to monitor your cash flow.

- Regularly review your expenses to identify areas where you can cut back.

Delaying Investments Due to Fear of Risk

- Why It Matters: Waiting too long to invest means missing out on the compounding growth potential that early investing provides.

- How to Avoid It:

- Start small with low-risk investments like index funds or ETFs.

- Educate yourself about risk management and long-term investment strategies.

💡 RealRichMoves Insight:

“The best time to start investing was yesterday. The second-best time is today.”

Neglecting Employer-Provided Retirement Benefits

- Why It Matters: Skipping out on employer-matching contributions is like leaving free money on the table.

- How to Avoid It:

- Contribute enough to your 401(k) to maximize your employer’s match.

- If your employer offers other benefits like stock purchase plans, take advantage of them to grow your wealth.

How to Stay on Track

- Set Financial Alerts: Use apps to send reminders for bill payments or low account balances.

- Create Accountability: Share your goals with a trusted friend or mentor who can keep you on track.

- Evaluate Quarterly: Check your progress every three months and make adjustments as needed.

💡 RealRichMoves Advice:

“Mistakes are part of learning. The key is to recognize them early and take corrective action.”

By avoiding these common missteps, you’ll pave the way for a smoother, more successful journey toward wealth-building in Your 20s and financial independence.

FAQs – How to Build Wealth in Your 20s

When starting your wealth-building journey in 20s, it’s natural to have questions. Here’s a deeper dive into some common queries to guide you on the right path.

By addressing these frequently asked questions, you’ll gain clarity and confidence to make smarter financial decisions, ensuring a strong start to your wealth-building journey in your 20s.

How to Stay Motivated on Your Wealth-Building Journey in 20s

Building wealth is a long-term journey, and staying motivated is key to sustaining progress. These practical tips will help you maintain focus and enthusiasm as you work toward financial success.

Celebrate Small Wins

Every milestone, big or small, deserves recognition. Reaching your first $1,000 in savings, paying off a credit card, or successfully sticking to your budget for a month are achievements worth celebrating.

💡 Actionable Tip: Treat yourself in a budget-friendly way—like a homemade coffee date or a streaming movie night—to honor your progress without derailing your financial goals.

💬 Motivational Quote: “Success is the sum of small efforts repeated day in and day out.”

Join Supportive Communities

Surround yourself with individuals who share similar goals to exchange ideas, inspiration, and advice. Platforms like Reddit’s r/personalfinance, Twitter finance threads, or even local meetups can provide valuable insights and keep you motivated.

💡 RealRichMoves Insight: Engaging with others on the same path helps normalize challenges and reinforces your commitment to long-term goals.

Keep Your “Why” in Mind

Revisit your reasons for building wealth. Whether it’s achieving financial freedom, paying off student loans, or securing a comfortable future, staying connected to your purpose keeps you motivated.

💡 Mindset Exercise: Write your financial goals and the reasons behind them on a vision board or in a journal for daily inspiration.

Set Short- and Long-Term Goals

- Break your ultimate wealth-building objective into smaller, actionable goals. For example:

- Short-Term: Save $500 this month by cutting back on dining out.

- Long-Term: Pay off $10,000 in student loans within three years.

💡 Pro Tip: Track your progress using budgeting apps like Mint or Personal Capital for real-time motivation.

Reward Yourself Responsibly

Build rewards into your financial plan to keep things fun and engaging. For instance, once you’ve saved 10% of your annual income, plan a low-cost getaway or invest in something you’ve wanted.

💡 Actionable Idea: Use rewards as milestones to reinforce positive financial behaviors.

Learn and Grow Continuously

Stay informed about personal finance through blogs, podcasts, or books. The more you learn, the more empowered and motivated you’ll feel to take control of your financial journey.

💬 Motivational Quote: “The more you know, the more you grow.”

Surround Yourself with Positive Influences

Avoid negative financial habits or discouraging conversations. Instead, follow inspiring creators on social media and listen to uplifting financial success stories.

💡 RealRichMoves Tip: Curate your social media feed with content from financial educators to keep learning while scrolling.

Reflect on Progress Regularly

ake time each month to review your progress, celebrate achievements, and refine your strategies. Knowing how far you’ve come can rekindle your motivation.

💡 Insight: Create a “Financial Wins” list to look back on during tough moments.

Embrace Setbacks as Lessons

Challenges are part of any journey. Whether it’s an unexpected expense or missing a savings goal, use setbacks as opportunities to learn and improve your financial habits.

💡 Pro Tip: Reassess your budget and adjust your plan to prevent similar setbacks in the future.

Stay Inspired by Your Future Vision

Picture yourself living the life you’re working toward—whether it’s traveling the world, owning a dream home, or retiring early. Keeping this vision vivid in your mind fuels your determination.

💬 RealRichMoves Reminder: “Every step forward is progress toward the life you deserve.”

By incorporating these strategies into your routine, you’ll not only stay motivated but also enjoy the process of building wealth. With consistent effort and the right mindset, financial freedom is well within reach.

In a Nutshell:

The Road to Financial Freedom Starts in Your 20s

“The Road to Financial Freedom Starts in Your 20s“

Your 20s are the ideal time to lay the foundation for a lifetime of financial success. By embracing a proactive approach to saving, budgeting, debt management, and investing, you can take charge of your financial future. Here’s how every step matters:

Saving and Budgeting as Cornerstones

Implementing a solid budgeting plan helps allocate your income wisely, ensuring that every dollar serves a purpose. From building an emergency fund to planning for big goals, the habits you form now will empower you to face life’s challenges confidently.

Smart Investing for Long-Term Growth

Start small but think big. Investing even modest amounts early allows compound interest to work its magic. Platforms like Robinhood and Fidelity make it easier than ever to get started, while retirement accounts like 401(k)s ensure your future is secure.

Side Hustles: Boosting Income Streams

Whether through freelancing, online work, or monetizing hobbies, side hustles provide the extra financial cushion needed to accelerate your goals. These additional income streams enhance your lifestyle while paving the way for greater opportunities.

The Role of Financial Literacy

Staying informed is a game-changer. By educating yourself and making informed decisions, you not only build wealth but also safeguard it.

💬 RealRichMoves Tip: Never underestimate the power of continuous learning and community support to stay motivated and inspired.

Your Journey to Build Wealth in Your 20s Starts Today

At RealRichMoves, we believe that financial freedom isn’t just a dream—it’s a destination within your reach. By committing to actionable strategies today, you’re investing in a brighter, more secure future.

💡 Final Thought: “The best investment you can make is in yourself.”

Keep growing, keep learning, and remember—small steps today lead to giant leaps tomorrow.

So there you have it—How to Build Wealth in Your 20s. Craving more insights? Head over to my other blog post on Smart Investment Ideas!