Getting Started:

Emergency Funds: Building Your Safety Net for Financial Freedom

“Preparation is the foundation of financial freedom.”

personal finance in today’s fast-paced, tech-driven world means juggling expenses, student loans, and side hustles while striving for independence.

Establishing an emergency fund is an essential first step toward achieving financial security and building wealth.

In this guide, we’ll break down the what, why, and how of emergency funds, ensuring you have the tools and knowledge to create a robust financial safety net.

What Is an Emergency Fund? Why It’s Essential for Gen Z

Breaking Down the Basics of Emergency Funds

An emergency fund is more than a safety net of funds; it’s your readily available savings for those unplanned, unavoidable expenses life throws your way.

Think sudden medical bills, unexpected car repairs, or even a surprise job loss. Instead of using credit cards or loans, your emergency fund is the stress-free way to manage crises without upsetting your financial plans.

- Purpose: Designed to handle unplanned expenses while keeping your financial goals intact.

- Key Benefit: Saves you from debt cycles that result from emergencies by protecting your wallet and your mind.

The Gen Z Perspective on Financial Freedom

For Gen Z, the concept of financial freedom goes beyond covering bills—it’s about living life on your terms and seizing opportunities.

However, many in this generation find saving challenging due to mounting student loan payments, rising living costs, and the allure of a consumption-driven lifestyle.

Building an emergency fund offers a pathway to financial stability, allowing you to embrace independence and adaptability without sacrificing your future.

By prioritizing an emergency fund, Gen Zers can align their values with practical steps toward financial security and peace of mind.

Next, let’s explore how much you should save and the best strategies to build a robust emergency fund that works for your lifestyle.

How Much Should You Save in an Emergency Fund?

Rule of Thumb for Emergency Fund Savings

The classic guideline for emergency fund savings is straightforward: aim for three to six months’ worth of essential living expenses.

This financial cushion ensures that you can weather unexpected situations like a job loss, medical emergency, or car breakdown without sinking into debt.

Here’s an example breakdown:

- Rent/Mortgage: $1,200/month

- Groceries: $300/month

- Utilities and Transportation: $500/month

- Total Goal: $6,000–$12,000

This range provides a secure foundation to navigate life’s uncertainties with confidence and control.

Tailored Savings for Gen Z

For Gen Z, juggling student loans, multiple jobs, or side hustles, the idea of saving several months’ worth of expenses might feel overwhelming.

Start small and realistic—building even a $1,000 starter emergency fund can make a big difference.

Consider these factors to personalize your savings goal:

- Lifestyle and Income: Account for your cost of living and earning potential.

- Financial Obligations: Factor in education loans, recurring bills, or dependent care.

- Extra Income Sources: Use earnings from side hustles or online work to boost savings.

Emergency Fund Savings Calculator

Leverage budgeting apps like Mint, YNAB, or Personal Capital to estimate your ideal emergency fund amount.

These tools let you input monthly expenses, prioritize categories, and track your progress with ease.

By automating savings goals, you can steadily work toward a robust financial safety net without overthinking the process.

Now that you’ve determined how much to save, let’s explore where to keep your emergency fund for easy access and maximum security.

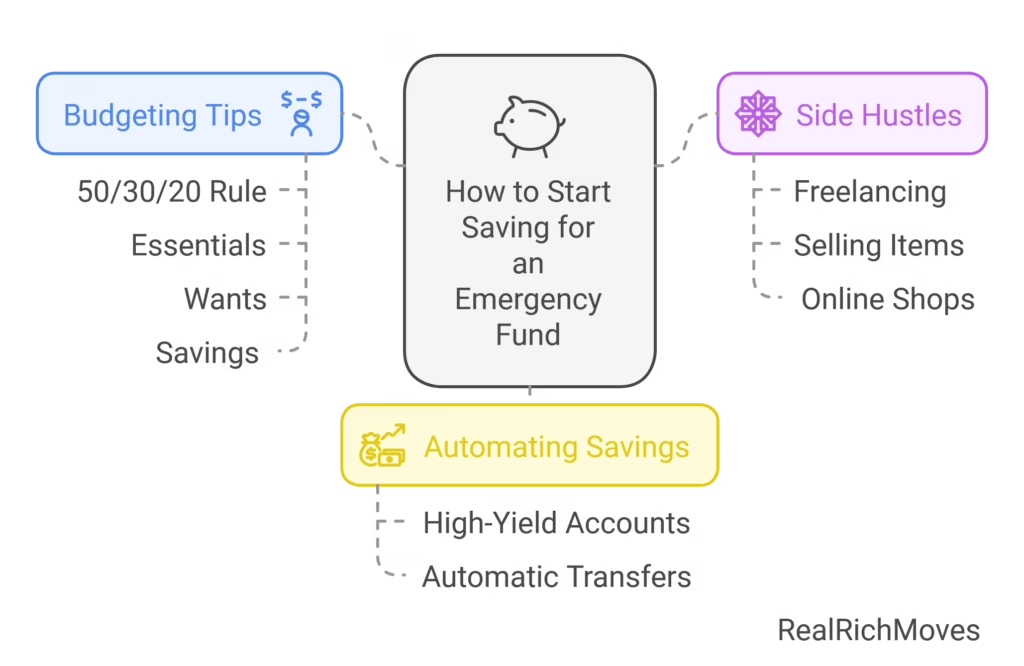

How to Start Saving for an Emergency Fund

Budgeting Tips for Gen Z

Budgeting doesn’t need to be overwhelming—keeping it simple can lead to big results. A tried-and-true method is the 50/30/20 rule:

- 50% Essentials: Cover necessities like rent, groceries, and transportation.

- 30% Wants: Spend on entertainment, dining out, and subscriptions—but stay mindful.

- 20% Savings: Dedicate this portion to your emergency fund.

Pro Tip: Use budgeting apps like Mint or YNAB to track your expenses and pinpoint where you can cut back. These tools offer real-time insights that make financial planning a breeze.

Side Hustles and Extra Income Sources

For Gen Z, side hustles are the ultimate game-changer when it comes to saving faster. Thanks to technology, there’s no shortage of opportunities to boost your income:

- Freelancing: Platforms like Fiverr, Upwork, and Toptal let you monetize skills like writing, graphic design, or coding.

- Selling Unused Items: Turn clutter into cash using Depop, Facebook Marketplace, or eBay.

- E-commerce: Launch an online store with Etsy to sell handmade goods or digital products.

- Gig Economy Work: Drive for rideshare services, deliver food, or take up pet-sitting gigs to earn extra cash on flexible terms.

Automating Your Savings

Automation is a stress-free way to ensure consistent contributions to your emergency fund. Set up automatic transfers from your checking account to a high-yield savings account.

This approach removes the temptation to spend and helps your fund grow steadily. Here are a few excellent options:

- Ally Bank: Offers competitive rates and no maintenance fees.

- Marcus by Goldman Sachs: Known for high yields and user-friendly tools.

- Capital One 360: Combines accessibility with solid interest rates.

With these strategies in place, you’re well on your way to creating a reliable safety net.

Next, let’s explore the best ways to keep your emergency fund secure and accessible.

Where to Keep Your Emergency Fund

Savings Accounts vs. Other Options

Choosing the right place for your emergency fund is essential—it should be accessible yet not so easy to spend impulsively. Here are the top options to consider:

- High-Yield Savings Accounts: These accounts offer liquidity while earning you a competitive interest rate. Popular choices include Ally Bank, Marcus by Goldman Sachs, and Discover Bank.

- Money Market Accounts: Similar to high-yield savings, these accounts often come with check-writing features, making them slightly more flexible.

- Certificates of Deposit (CDs): A CD can be a good option if you’re confident you won’t need the funds immediately. It offers higher interest rates but locks in your money for a set period.

Mistakes to Avoid When Storing Emergency Funds

While saving is crucial, where you keep your emergency fund can make or break its effectiveness. Avoid these common missteps:

- Investing the Fund: The stock market may seem enticing, but its volatility makes it unsuitable for emergency funds. Your safety net should be free from risks.

- Mixing Funds: Combining your emergency savings with vacation, shopping, or other savings goals can blur lines and lead to overspending. Keeping accounts separate ensures clarity and purpose.

By placing your emergency fund in the right account and avoiding these pitfalls, you’re ensuring your financial safety net is both secure and accessible when you need it.

Now let’s dive into how to maintain and grow this critical resource.

Maintaining Your Emergency Fund Over Time

Adjusting Savings Goals with Life Changes

Your financial needs evolve over time, so your emergency fund should adapt too. Here’s how to stay on track:

- Your financial needs evolve over time, so your emergency fund should adapt too. Here’s how to stay on track:

- Employment Shifts: Moving from part-time jobs to full-time employment may change your financial obligations and allow you to save more.

- Life Milestones: Starting a family, pursuing further education, or taking on new loans requires a reassessment of your safety net.

Regularly reviewing and adjusting your emergency fund ensures it aligns with your current lifestyle and obligations.

Replenishing Your Emergency Fund

Once you dip into your emergency fund, it’s crucial to rebuild it promptly. Use these strategies to restore your savings:

- Allocate windfalls like tax refunds, bonuses, or monetary gifts.

- Channel extra income from side hustles, freelancing, or selling unused items directly into your fund.

- Adjust your budget temporarily to divert more money toward replenishment until your target is met.

By keeping your emergency fund up to date and fully replenished, you’re fortifying your path to financial freedom, no matter what life throws your way.

Next, let’s talk about common challenges Gen Z facing in saving money

Common Challenges Gen Z Faces in Saving

Balancing Debt Management with Emergency Savings

For many in Gen Z, juggling debt repayment and saving for emergencies can feel overwhelming. A strategic approach can help:

- Prioritize High-Interest Debt: Tackle debts with interest rates above 10% first, as they drain your finances quickly.

- Start Small: While repaying debt, build a mini emergency fund of $500–$1,000 to cover unexpected expenses without resorting to more credit.

This dual focus ensures progress on both fronts, keeping you financially secure while reducing long-term debt burdens.

Overcoming the “I’ll Start Later” Mentality

Procrastination is a common roadblock to saving, but small, consistent actions can help you overcome it:

- Set Weekly Goals: Even saving $10–$20 per week can build momentum and establish the habit.

- Picture Your Financial Freedom: Imagine the relief and independence that a fully funded emergency account offers, motivating you to start now.

By tackling these challenges head-on, you can lay the groundwork for a more stable financial future while staying aligned with your lifestyle and goals.

Let’s explore some FAQs to clear up common concerns about building and maintaining your emergency fund.

FAQs – About Emergency Funds for Gen Z

A well-stocked emergency fund is your financial safety net, offering peace of mind and flexibility to tackle life’s surprises without derailing your goals.

Let’s dive into the next step—deciding where to store your fund for maximum security and accessibility.

Emergency Funds vs. Other Financial Goals

Saving for Emergencies vs. Investing

Emergency funds and investments serve distinct purposes in your financial journey. An emergency fund acts as a safety net for unforeseen expenses like medical bills or sudden job loss, ensuring you don’t have to rely on high-interest loans or credit cards.

Investments, on the other hand, are for long-term wealth building, such as retirement or future education costs.

Key Differences:

- Accessibility: Emergency funds are liquid and easy to access, while investments are often tied up in assets that may take time to convert into cash.

- Risk Level: Emergency funds are secure, stored in low-risk accounts like high-yield savings, while investments involve market risks but offer higher potential returns.

Pro Tip: Always establish a fully-funded emergency fund before diving into investments like stocks or crypto. It provides the financial cushion you need to handle emergencies without disrupting your long-term financial goals.

Building Wealth Without Compromising Financial Security

Having an emergency fund lays the foundation for building wealth.

It gives you the confidence to pursue side hustles, career advancements, or even higher-risk investments. Knowing you have a safety net reduces financial anxiety and allows you to take calculated risks that could yield significant rewards.

For example:

- Launching a small online business or freelance career is less stressful when unexpected costs won’t derail your plans.

- Exploring investments in stocks or real estate becomes feasible without worrying about liquidity for emergencies.

Takeaway: Your emergency fund is a non-negotiable first step in financial planning. It sets the stage for sustainable wealth-building while maintaining your financial security.

Let’s explore how to strike the perfect balance between these goals!

Gen Z Success Stories: Inspiring Emergency Fund Journeys

Real-Life Examples of Emergency Fund Wins

Stories of success can be incredibly motivating, especially when they highlight how an emergency fund can transform financial challenges into manageable situations.

Here are some inspiring examples from Gen Z:

- Case 1: A Student’s Medical Emergency – A college student found themselves facing unexpected medical bills after a minor accident. Thanks to their $1,000 emergency fund, they avoided relying on high-interest credit cards. This experience reinforced their commitment to saving and maintaining financial independence.

- Case 2: A Side Hustler’s Backup Plan – When a side hustler lost a major gig, their emergency fund stepped in to cover rent and utilities. This cushion allowed them to focus on finding new opportunities without panic, proving the importance of planning for the unexpected in a gig economy.

- Case 3: A Freelancer’s Car Repair Dilemma – A freelance graphic designer faced an urgent car repair, essential for meeting client deadlines. Their emergency fund covered the costs, ensuring uninterrupted work and preserving their professional reputation.

Takeaway: These stories show that an emergency fund isn’t just a financial tool—it’s a lifeline. It empowers Gen Z to handle unexpected challenges while keeping their long-term goals intact. Ready to build your success story?

Let’s dive into actionable strategies!

Actionable Tips to Kickstart Your Emergency Fund Journey

Start Small, Stay Consistent

You don’t need to save thousands overnight. Begin with manageable amounts—just $5 a week can add up to $260 a year. What matters most is consistency.

Set a reminder or automate savings to ensure you’re contributing regularly without having to think about it. Over time, small efforts snowball into a solid safety net.

Find Motivation in Your Financial Freedom Goals

Picture the lifestyle you’re working toward: no debt weighing you down, no stress over unexpected expenses, and the freedom to pursue what truly matters.

Whether it’s funding a side hustle, traveling, or investing, let this vision inspire you to stick to your savings habit.

Takeaway: Each small step brings you closer to a life of financial security and peace of mind. Let’s turn those dreams into a reality, one savings deposit at a time!

Final Thoughts: Your Financial Safety Net for a Brighter Future

Building an emergency fund is a crucial step toward achieving financial freedom.

At RealRichMoves, we believe that every Gen Zer has the potential to take control of their finances, create a solid safety net, and pave the way for wealth-building.

Start today, stay consistent, and watch as your financial planning transforms your future into one of stability and success.