Initial Thoughts:

“Managing money wisely today leads to financial freedom tomorrow.”

For Gen Z, mastering personal finance can be both exciting and overwhelming. Between juggling student loans, finding extra income through side hustles, and managing online work, it’s easy to feel lost.

The demands of modern life call for smarter tools that simplify financial planning and help build long-term wealth.

Thankfully, technology steps in to bridge the gap, offering money management apps tailored to fit your lifestyle.

These apps are designed to help you track expenses, create budgets, and invest wisely, making financial freedom a reachable goal.

At RealRichMoves, we’re committed to empowering you with the right tools to take charge of your finances and maximize your potential.

Now, let’s explore the top 10 money management apps Gen Z loves and discover how they can make managing your money both fun and effective! 🚀

Why Money Management Apps Are Essential for Gen Z

Saving Time and Effort

In today’s fast-paced world, managing finances can feel overwhelming. Money management apps simplify this process by automating tasks like budgeting, tracking expenses, and building savings.

For example, apps like YNAB (You Need a Budget) allow you to craft financial plans tailored to your lifestyle, saving you hours of manual work while keeping you organized.

Addressing Gen Z’s Financial Challenges

Gen Z navigates a unique set of financial hurdles, such as tackling student loan debt, balancing education with part-time jobs, and thriving in the gig economy.

Money management apps step in as personalized financial companions, offering tailored features for loan repayment strategies, budget optimization, and even generating extra income streams.

Achieving Financial Freedom with Technology

Building wealth early is critical, and technology makes this goal achievable.

Apps like Acorns and Robinhood empower you to start investing with small amounts while providing user-friendly interfaces that gamify the process.

This approach keeps financial planning engaging and helps you move steadily toward financial freedom.

👉 Ready to level up your money game? Let’s dive into the top apps that can transform your financial journey while perfectly fitting your Gen Z lifestyle. 🚀

Top 10 Money Management Apps Gen Z Loves

1. Mint: Your All-in-One Financial Companion

Mint stands out as a powerhouse for those looking to streamline their financial lives.

This app offers a suite of tools to help you manage your money effortlessly, making it a favorite among Gen Z.

Key Features to Love:

Mint provides real-time expense tracking, monitors your credit score, and sends timely bill reminders to keep your finances in check.

Mint consolidates all your accounts—bank, credit, and investments—into one intuitive dashboard, giving you a complete financial overview.

Why It’s Perfect for Gen Z:

Whether you’re a student balancing tuition, loans, and part-time jobs, or a young professional navigating your first salary, Mint simplifies financial management.

Its user-friendly interface and customizable budgets make it accessible for beginners and financial experts alike.

Pro Tips for Using Mint Effectively:

- Set Custom Budgets: Tailor budgets for categories like dining out or shopping to track spending habits.

- Enable Alerts: Get notified when you’re nearing spending limits or when bills are due.

- Analyze Spending Trends: Use Mint’s detailed insights to identify areas where you can save more.

👉 Ready to master budgeting and saving? Mint has your back, making financial planning as simple as a swipe. Start your journey to financial freedom today! 🚀

2. YNAB (You Need a Budget): Master Your Money, One Dollar at a Time

YNAB (You Need a Budget) revolutionizes the way you manage your finances by encouraging proactive money habits.

This app isn’t just about tracking—it’s about giving every dollar a job, ensuring your financial goals are always within reach.

Key Features to Elevate Your Budgeting Game:

- Zero-Based Budgeting: Assign every dollar to a specific purpose, ensuring your income aligns perfectly with your goals.

- Detailed Financial Reports: Gain insights into spending trends and track progress with precision.

- Goal Tracking: Set and achieve savings milestones, whether it’s paying off a loan or saving for your next big trip.

Why Gen Z Can’t Get Enough of YNAB:

For a generation juggling side hustles, student loans, and a dynamic lifestyle, YNAB offers clarity and control.

By teaching you to plan ahead and allocate resources wisely, it helps you build a strong financial foundation that grows with you.

Tips to Maximize YNAB’s Benefits:

- Embrace Flexibility: Adjust your budget in real-time as your expenses or income change.

- Link Accounts: Automate data syncing for seamless tracking of income, savings, and expenses.

- Take Advantage of Tutorials: YNAB offers free workshops to help you master the art of budgeting.

👉 Ready to take control of your finances and build wealth? With YNAB, every dollar works harder for you. Start creating the financial future you deserve today! 💪

3. Acorns: Invest Smarter, One Cent at a Time

Acorns transforms investing into a hassle-free and automated experience, making it an ideal choice for beginners who want to build wealth with minimal effort.

This app’s approach of turning spare change into investment capital empowers Gen Z to start their financial journey without needing a large upfront commitment.

Key Features That Make Acorns a Must-Have:

- Micro-Investing: Automatically round up your everyday purchases and invest the difference.

- Automatic Portfolio Management: Enjoy expertly designed, diversified portfolios tailored to your risk tolerance.

- Recurring Investments: Set up regular contributions to grow your investment steadily over time.

Why Gen Z Is Hooked on Acorns:

Acorns resonates with Gen Z’s fast-paced lifestyle by simplifying the investment process. Whether you’re a student, freelancer, or balancing multiple side hustles, Acorns fits seamlessly into your routine, helping you grow wealth effortlessly.

Pro Tips for Getting the Most Out of Acorns:

- Enable Round-Ups: Link your debit or credit card to start investing automatically with every purchase.

- Explore Found Money: Earn additional investments through cashback from participating brands.

- Start Small and Scale Up: Begin with micro-investments and gradually increase contributions as your income grows.

👉 Looking for an effortless way to turn your spare change into financial freedom? Acorns makes investing simple and achievable for everyone. Start building your future wealth today! 🌱

4. PocketGuard: Your Daily Expense Guardian

PocketGuard is a budgeting app that lives up to its name, keeping a watchful eye on your spending to ensure you stay financially on track.

Its innovative “In My Pocket” feature empowers users to know exactly how much they can safely spend, making it an essential tool for Gen Z balancing bills, savings goals, and lifestyle expenses.

Key Features That Make PocketGuard a Game-Changer:

- “In My Pocket” Analysis: Instantly calculates your spendable income after accounting for bills, savings, and goals.

- Spending Insights: Break down your expenses to identify overspending areas and opportunities to save.

- Bill Negotiation Assistance: Helps lower recurring costs like utilities or subscriptions.

Why Gen Z Swears by PocketGuard:

Gen Z’s busy lifestyles demand quick and efficient tools, and PocketGuard delivers. It’s especially loved by students and young professionals managing part-time jobs, student loans, and daily expenses. With PocketGuard, you don’t just track your money—you control it.

Pro Tips to Get the Most from PocketGuard:

- Link Your Accounts: Connect all your financial accounts to get a comprehensive view of your money.

- Set Spending Limits: Use the app’s budget features to establish boundaries for discretionary spending.

- Optimize Savings Goals: Allocate funds for emergency savings or short-term goals like travel or gadgets.

👉 Want to stay on top of your daily finances without stress? PocketGuard is the simple, effective tool to help you budget smarter and spend wisely. Take charge of your money today! 💰

5. Robinhood: Investing Made Easy and Exciting

Robinhood revolutionizes investing by making it accessible to everyone, especially Gen Z.

With its sleek design and commission-free trading, this app removes barriers to entry and gamifies the investment process, turning wealth-building into an engaging experience.

Key Features That Set Robinhood Apart:

- Commission-Free Trading: Buy and sell stocks, ETFs, and cryptocurrencies without extra fees.

- Fractional Shares: Invest as little as $1 in high-value stocks, making it ideal for beginners.

- User-Friendly Interface: Simple navigation and educational resources help users understand the market.

- Instant Deposits: Start trading immediately with fast transfers from your linked account.

Why Gen Z Can’t Get Enough of Robinhood:

Robinhood’s gamified approach appeals to Gen Z’s tech-savvy nature. It empowers aspiring investors, side hustlers, and those new to finance to grow their wealth with confidence.

The ability to invest in cryptocurrency aligns with Gen Z’s forward-thinking mindset and interest in digital assets.

Pro Tips to Maximize Your Robinhood Experience:

- Start Small: Use fractional shares to explore the market without overcommitting.

- Educate Yourself: Leverage Robinhood’s built-in resources and news updates to make informed decisions.

- Diversify Your Portfolio: Spread your investments across stocks, ETFs, and crypto to minimize risks.

👉 Looking to turn your side hustle income into a wealth-building opportunity? Robinhood makes investing simple, fun, and rewarding. Start trading and build your financial future today! 📈

6. Honeydue: Simplifying Shared Finances

Honeydue redefines money management for couples and roommates, making financial collaboration seamless and stress-free.

This app focuses on shared accountability, ensuring everyone stays on the same page when managing expenses and bills.

Key Features That Make Honeydue Stand Out:

- Shared Budgeting: Create joint budgets for rent, groceries, and other shared expenses.

- Expense Tracking: Monitor spending habits with categorized transactions visible to all parties.

- Bill Splitting: Easily divide bills and send reminders for payments to avoid conflicts.

- Customizable Settings: Decide what to share—full transparency or selected details.

Why Gen Z Loves Honeydue:

With the rise of shared living arrangements, Honeydue aligns with Gen Z’s collaborative and tech-savvy lifestyle. The app is a lifesaver for roommates splitting rent or couples managing joint finances, fostering trust and open communication about money.

Pro Tips to Make the Most of Honeydue:

Set Clear Goals Together: Use Honeydue to create financial plans that support mutual goals, like saving for a vacation or paying off a shared loan.

Leverage Notifications: Stay on track with bill reminders to avoid missed payments.

Review Spending Trends: Analyze where your money goes and find ways to save more as a team.

👉 Whether you’re sharing a Netflix subscription or saving for a big goal, Honeydue ensures smooth financial collaboration. Start using it today to simplify shared finances and strengthen your partnerships! 💑

7. Goodbudget: A Modern Take on Traditional Budgeting

Goodbudget brings the time-tested envelope budgeting system into the digital age, offering a straightforward and effective way to manage money.

This app is perfect for those who prefer a hands-on approach to budgeting but still want the convenience of technology.

Key Features That Define Goodbudget:

- Envelope Budgeting System: Allocate money into virtual envelopes for categories like groceries, rent, or entertainment.

- Expense Tracking: Monitor your spending to ensure you stay within your budgeted amounts.

- Goal Setting: Save for specific goals by designating envelopes for future purchases or expenses.

- Cross-Device Sync: Share your budget with family or partners across multiple devices.

Why Gen Z Loves Goodbudget:

Gen Z values simplicity, and Goodbudget’s clean, user-friendly interface makes budgeting less intimidating. It appeals to those seeking clarity and control over their finances, whether they’re managing part-time job income or balancing student loans.

Pro Tips for Getting the Most Out of Goodbudget:

- Categorize Thoughtfully: Ensure each expense has a home by creating tailored envelopes that reflect your lifestyle.

- Reassess Regularly: Adjust envelope allocations as your income or spending habits change.

- Use Envelopes for Big Goals: Create specific envelopes for long-term goals, such as a vacation fund or emergency savings.

👉 Goodbudget combines the best of old-school budgeting with modern convenience. Start using it today and take control of your finances one envelope at a time! ✉️

8. Personal Capital: Your Wealth-Building Powerhouse

Personal Capital is the ultimate tool for Gen Z individuals ready to take their financial planning to the next level.

Combining robust investment analysis with intuitive tracking features, this app is designed for wealth building and achieving long-term financial independence.

Key Features That Set Personal Capital Apart:

- Investment Analysis: Gain insights into your portfolio performance, asset allocation, and potential growth opportunities.

- Retirement Planning Tools: Plan for your future with customizable retirement calculators and goal-setting options.

- Net Worth Tracking: View all your accounts in one place to monitor and grow your overall financial standing.

- Cash Flow Monitoring: Track income and expenses effortlessly to stay on top of your budget.

Why Gen Z Loves Personal Capital:

Gen Z appreciates the app’s ability to provide a comprehensive snapshot of their financial health.

Personal Capital’s particularly useful for those eager to build wealth early through investing and retirement planning, offering a clear path to financial independence.

Pro Tips for Maximizing Personal Capital:

- Link All Accounts: Integrate your checking, savings, and investment accounts for a holistic view of your finances.

- Set Retirement Goals Early: Use the retirement planner to establish realistic savings targets based on your lifestyle.

- Leverage Financial Insights: Use the app’s fee analyzer to identify hidden fees and save more money over time.

👉 Personal Capital is your go-to app for building wealth and securing a financially free future. Start today, and take one step closer to your financial goals! 💰

9. Venmo: Simplifying Payments with a Social Twist

Venmo redefines how Gen Z handles transactions, combining practicality with a touch of fun.

Whether you’re splitting the bill at dinner or repaying a friend for concert tickets, this app ensures seamless peer-to-peer payments with an engaging social aspect.

Key Features That Make Venmo a Hit:

- Peer-to-Peer Payments: Transfer money instantly to friends or family without hassle.

- Bill Splitting Made Easy: Divide expenses among roommates or group outings in just a few taps.

- Bill Splitting Made Easy: Divide expenses among roommates or group outings in just a few taps.

- Venmo Debit Card: Use your Venmo balance directly for everyday purchases.

Why Gen Z Loves Venmo:

Venmo turns mundane financial transactions into a social experience. Its fun, relatable interface resonates with Gen Z’s lifestyle, making it more than just a payment tool—it’s a way to stay connected.

Pro Tips for Making the Most of Venmo:

- Use the Social Feed Thoughtfully: Customize privacy settings for transactions while sharing fun moments with trusted contacts.

- Leverage Instant Transfers: Need quick cash? Instantly transfer your balance to your bank account for a small fee.

- Activate Security Features: Enable two-factor authentication for added security on your transactions.

👉 Venmo simplifies how you handle money while keeping the process light-hearted and engaging. Start using it today to make payments quick, easy, and fun! 🎉

10. Digit: Automate Your Savings, Simplify Your Life

Digit is a game-changer for Gen Z, offering a seamless way to save and budget without the stress of manual calculations.

It takes the guesswork out of financial planning, perfect for those with packed schedules or minimal budgeting experience.

Key Features That Make Digit a Must-Have:

- Automated Savings: Digit analyzes your spending habits and automatically sets aside small amounts of money you won’t miss.

- Personalized Budgeting Suggestions: Get tailored advice to help you stay on track with your financial goals.

- Goal-Based Savings: Set up specific goals, like a vacation fund or emergency savings, and watch your progress grow effortlessly.

- Overdraft Protection: The app monitors your account balance to prevent overdrafts while saving.

Why Gen Z Loves Digit:

Digit caters to Gen Z’s fast-paced lifestyle by doing the heavy lifting for them. Its “save-while-you-sleep” approach aligns perfectly with the generation’s tech-savvy and hands-off financial habits.

Pro Tips to Maximize Your Digit Experience:

- Set Clear Savings Goals: Whether it’s for a side hustle investment, a student loan repayment, or a dream trip, define your targets for better motivation.

- Regularly Review Your Savings: Keep track of how Digit adjusts to your financial flow and tweak your settings as needed.

- Leverage Notifications: Stay informed about your savings and account balance with real-time updates.

👉 Digit makes saving simple and stress-free, allowing you to focus on living your best life while your money grows in the background. Let Digit help you build wealth effortlessly! 🌟

Each app offers unique features tailored to your needs. Pick one that aligns with your goals and start your wealth-building journey today.

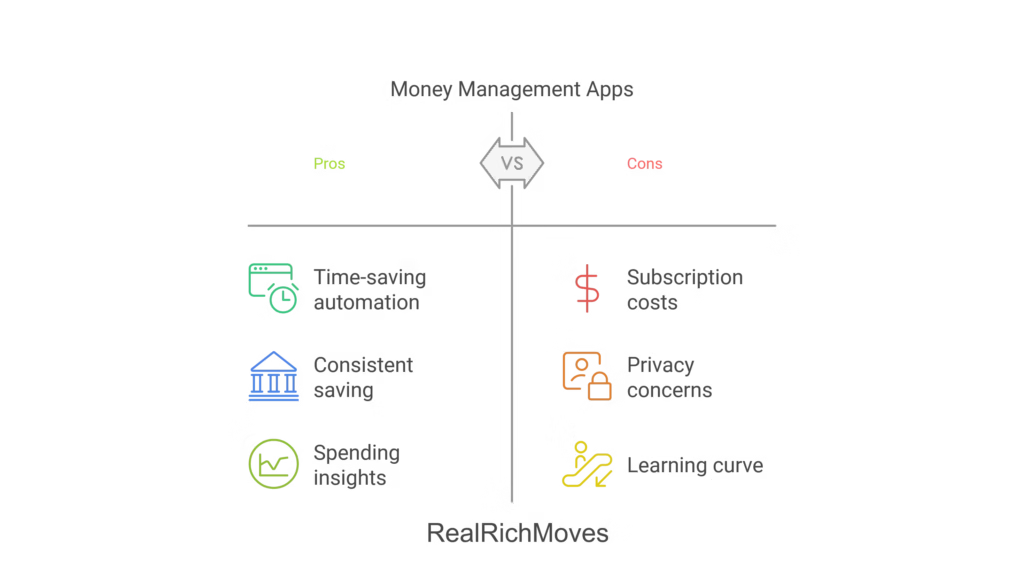

Pros and Cons of Money Management Apps

Benefits of Using Apps for Saving and Budgeting

Money management apps are game-changers, especially for Gen Z, as they offer several advantages:

Automation Saves Time and Reduces Errors: These apps take the hassle out of tracking expenses, setting budgets, and monitoring savings by automating the process.

Encourages Consistent Saving Habits: With features like round-ups and automated transfers, they help you save effortlessly.

Provides Spending Insights: Detailed reports and analytics give you a clear picture of your financial habits, making it easier to craft effective financial plans.

Potential Limitations

While money management apps are handy, they’re not without their challenges:

Subscription Costs Can Add Up: Many apps require monthly or annual fees, which can strain tight budgets if not accounted for.

Privacy Concerns: Sharing sensitive financial information on these platforms can pose risks, especially if the app’s security measures are inadequate.

Learning Curve: Some apps, particularly those with advanced features, may feel overwhelming at first, requiring time to understand and use effectively.

👉 Balancing these pros and cons will help you choose the app that best aligns with your financial goals and lifestyle. Ready to explore the options? Let’s dive into the next section for app recommendations tailored to Gen Z needs! 🌟

FAQs – About Money Management Apps

👉 Still curious? Try out different apps, explore their features, and find the one that aligns with your financial goals. The journey to financial freedom starts here! ✨

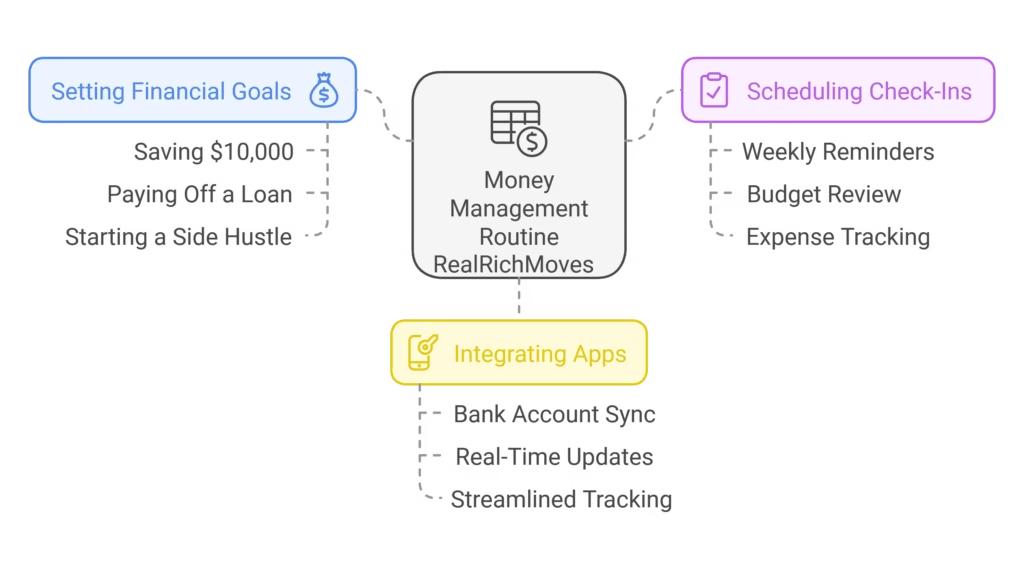

Creating a Money Management Routine with Apps

Start with a Goal

Every successful financial plan begins with clear goals. Whether it’s saving $10,000, paying off a student loan, or building an online side hustle, having a defined target gives you direction. Use apps like YNAB to create a customized plan that aligns with your ambitions and lifestyle.

Schedule Regular Check-Ins

Consistency is the backbone of effective money management. Schedule weekly or bi-weekly check-ins to review your budget, monitor spending patterns, and adjust your financial strategy.

Apps like Mint send reminders and provide detailed financial insights to keep you on track. These sessions help you stay accountable and adapt to any changes in income or expenses.

Integrate Apps Seamlessly into Daily Life

To make financial management effortless, sync your apps with your bank account and credit cards. This provides real-time updates on transactions and ensures you’re always aware of your financial standing.

Apps like PocketGuard can help you see how much you can safely spend daily while keeping your savings intact.

Make managing money as natural as scrolling through your favorite social media—turn it into a habit that sets you on the path to financial freedom. Let’s explore how these tools can transform your routine into a wealth-building machine! 🚀

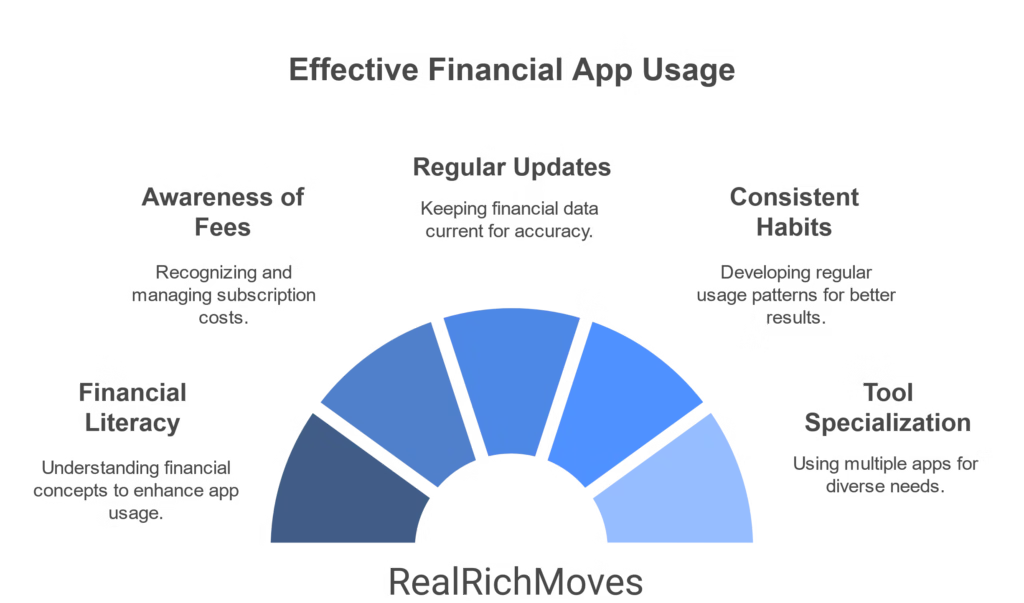

Common Mistakes to Avoid When Using Financial Apps

1. Ignoring Financial Literacy While Relying Solely on Apps

Apps are powerful tools, but they can’t replace financial knowledge.

Understanding concepts like budgeting, saving, and investing ensures you make informed decisions rather than blindly following app suggestions.

Pairing apps like YNAB with financial literacy resources can help you gain deeper control over your money.

2. Overlooking Subscription Fees That Eat Into Savings

Many premium financial apps come with subscription fees that can add up over time. While these apps often provide valuable features, ensure their benefits outweigh the costs.

Regularly evaluate your app subscriptions to avoid undermining your savings goals.

3. Failing to Regularly Update Income and Expenses in the App

Financial apps are only as effective as the data you input. Forgetting to update changes in income, expenses, or savings goals can lead to inaccurate insights.

Make it a habit to log every financial change promptly to get the most accurate analysis from your chosen app.

4. Using Apps Sporadically Instead of Developing Consistent Habits

Success comes from consistency. Sporadic usage of financial apps won’t help you achieve long-term goals.

Dedicate specific times each week to review your app, analyze your spending, and adjust your financial plans.

Apps like Mint and Acorns work best when used regularly.

5. Relying on One App for All Needs Instead of Combining Specialized Tools

No single app can meet all financial needs. For example, Robinhood is excellent for investing, while PocketGuard excels at tracking daily spending.

Combining specialized tools ensures you cover all aspects of your financial life effectively.

Steer clear of these common missteps and turn your financial apps into powerful allies on your journey to financial freedom. Let’s dive deeper into how you can maximize these tools for success! 🌟

Wrap-Up:

The Road to Financial Freedom Starts with Smart Tools

“Managing money wisely today leads to financial freedom tomorrow.”

Money management apps are more than just tools—they’re game-changers for mastering personal finance.

These platforms simplify tasks like budgeting, saving, and investing, helping you build better financial habits.

Whether it’s beginner-friendly apps like Mint or advanced solutions like Personal Capital, there’s something tailored to every need and lifestyle.

At RealRichMoves, we believe that financial independence isn’t a distant dream but a goal within reach for every Gen Z individual. By embracing these smart tools, you can manage student loans, grow wealth through investing, and create a sustainable financial plan.

Remember, the journey to financial freedom begins with small, consistent actions and the right resources.

Start exploring these apps today and make your financial goals a reality—because the best investment you can make is in yourself. Let’s move forward together! 🚀