Getting Started:

“Fear is the biggest obstacle to success; the only way to overcome it is to take that first step.”

timeless quote resonates deeply, especially when it comes to investing—a key pillar of financial freedom and long-term wealth building. For Gen Z, who are reshaping traditional finance with fresh ideas and modern approaches, the fear of investing can feel like an insurmountable barrier.

The hesitation often arises from misconceptions, a lack of financial education, or uncertainty about where to begin. But here’s the good news: overcoming this fear is entirely achievable with the right guidance and strategies. At RealRichMoves, we’re here to empower you with actionable insights and proven techniques to ease your investing anxieties.

From balancing debt management with smart saving strategies to utilizing side hustles for extra income, this guide will take you step-by-step toward confident financial planning. With the right mindset and tools, you can transform fear into courage and inaction into success, setting the stage for a secure and fulfilling financial future.

Understanding the Fear of Investing

Why Gen Z Hesitates to Invest

Gen Z has a unique perspective on money and lifestyle, but when it comes to investing, hesitation often arises due to several key factors:

- Lack of Financial Literacy: Traditional education systems rarely prioritize teaching essential skills like saving, budgeting, or investing. This gap leaves many young adults feeling unprepared to venture into the world of finance.

- Information Overload: From stocks and ETFs to crypto and bonds, the sheer variety of investment options can feel overwhelming. This flood of choices often leads to indecision or avoidance altogether.

- Fear of Loss: Tales of market crashes or failed investments amplify anxieties. Many avoid investing altogether to steer clear of potential losses, missing out on opportunities for wealth building.

The Psychological Barriers

The fear of investing isn’t just practical; it’s deeply psychological, influenced by common mental roadblocks:

- Fear of Failure: The idea of making mistakes and losing money can feel catastrophic, especially for those just starting out. But with sound financial planning and realistic goals, these fears can be managed effectively.

- Analysis Paralysis: In the age of endless online resources, having too much information without clear guidance can lead to inaction. This often leaves aspiring investors stuck at the starting line.

Debunking Common Myths

Fear is often fueled by myths that paint investing as inaccessible or overly risky. Let’s break these down:

- Myth 1: Investing is only for the rich.

- Reality: Today’s tools and platforms, like Robinhood and Acorns, allow anyone to begin investing with as little as $5. Wealth building starts small.

- Myth 2: It’s too risky.

- Reality: Risk can be minimized through diversification and smart strategies. Investing isn’t about gambling; it’s about planning.

- Myth 3: You need to understand everything about finance to start.

- Reality: Even a basic understanding, combined with a willingness to learn, is enough to begin your journey toward financial freedom.

By addressing these fears and myths head-on, you can shift your mindset and start viewing investing as an opportunity rather than a threat. With the right strategies and mindset, Gen Z can overcome these hurdles and embrace investing as a vital tool for achieving financial independence.

Building a Foundation for Financial Success

To embark on a successful investing journey, laying a solid financial foundation is essential. This involves mastering the basics of saving, budgeting, debt management, and leveraging side hustles to create a stable platform for growth.

Start with Saving and Budgeting

Saving and budgeting are the cornerstones of financial planning. Without these habits, investing can feel daunting and unsustainable. Here’s how to start:

- Create a Safety Net: Establish an emergency fund that covers 3-6 months of living expenses. This fund acts as a buffer against unexpected events, ensuring you’re not forced to dip into investments prematurely.

- Track Your Spending: Leverage budgeting tools like Mint and YNAB to monitor income and expenses, helping you stay in control of your finances.

- Adopt the 50/30/20 Rule: Simplify budgeting by categorizing your income:

- 50% for needs: Rent, utilities, groceries, and other essentials.

- 30% for wants: Entertainment, hobbies, dining out.

- 20% for savings and investments: Use this portion to grow your financial portfolio over time.

Debt Management: A Prerequisite for Investing

Debt can be a significant barrier to investing, but with the right strategies, you can manage it effectively while building wealth.

- Prioritize High-Interest Loans: Focus on paying off high-interest debt, like credit card balances, as these can erode your financial progress over time.

- Balance Student Loans and Investing: For low-interest student loans, make minimum payments while allocating funds toward investments. This approach allows you to grow your wealth without being burdened by excessive loan repayments.

The Role of Side Hustles

A side hustle isn’t just about earning extra income—it’s a tool for accelerating financial goals. Here’s how to make the most of your efforts:

- Freelancing Platforms: Use Fiverr or Upwork to monetize your skills, whether in writing, graphic design, or coding. This additional income can supplement your savings and investment goals.

- Online Sales: Tap into platforms like Etsy or eBay to sell handmade items, thrifted finds, or even digital products. These small ventures can provide the capital needed for your initial investments.

By mastering these foundational skills—saving, budgeting, managing debt, and creating extra income streams—you’ll be well-prepared to enter the world of investing. These habits not only provide stability but also set you on the path to achieving long-term financial success.

Overcoming the Fear of Investing

Overcoming the fear of investing starts with breaking down the process into manageable steps and arming yourself with knowledge and tools. By starting small, educating yourself, and gaining hands-on experience, you can transform fear into confidence.

Start Small with Low-Risk Options

Taking your first step into investing doesn’t mean diving headfirst into high-risk ventures. Here are beginner-friendly, low-risk options:

- Index Funds and ETFs: These investment options spread your money across various assets, reducing risk while providing consistent returns. They’re a favorite choice for beginners aiming to build wealth steadily.

- Micro-Investing Platforms: Platforms like Acorns and Stash make investing accessible by rounding up your everyday purchases and investing the spare change.

- Robo-Advisors: Services like Wealthfront and Betterment create personalized investment plans based on your risk tolerance and financial goals, taking the guesswork out of investing.

Educate Yourself

Knowledge is a powerful antidote to fear. Equip yourself with resources to understand the basics and beyond:

- Books to Read:

- The Simple Path to Wealth by JL Collins: A straightforward guide to financial independence.

- I Will Teach You to Be Rich by Ramit Sethi: A relatable approach to personal finance for young adults.

- Podcasts and Blogs: Tune in to finance creators like Graham Stephan or platforms like NerdWallet for insights tailored to Gen Z’s financial aspirations.

- Interactive Tools: Use investment calculators or stock market simulators to practice decision-making in a risk-free environment. These tools help demystify complex concepts.

Learn by Doing

Experience is the best teacher when it comes to investing. Start small and build confidence through action:

- Start with Virtual Portfolios: Many investment platforms offer demo accounts, allowing you to simulate trades and understand market dynamics without financial risk.

- Invest Small Amounts: Even modest contributions, such as $10 weekly, can accumulate significantly over time. This approach builds a habit of investing while limiting risk exposure.

By embracing these steps, you’ll gain both the knowledge and confidence needed to navigate the world of investing. Remember, starting small and consistently taking action is the key to overcoming fear and achieving long-term financial freedom.

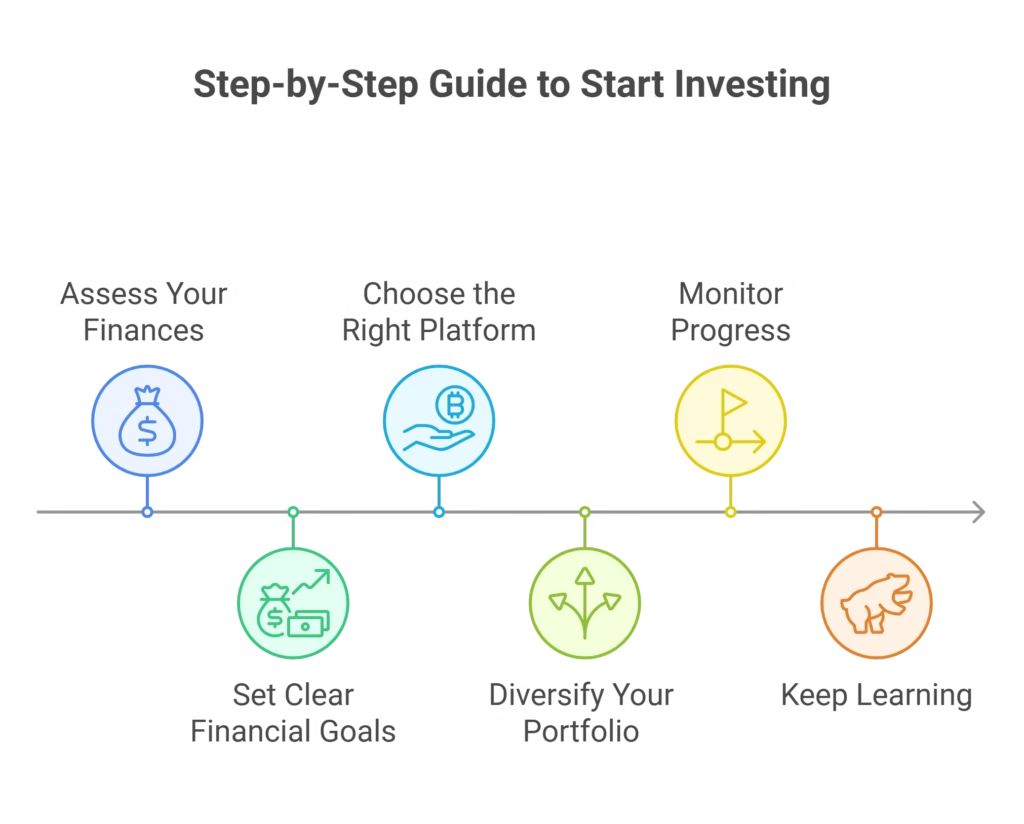

Step-by-Step Guide to Start Investing

Embarking on your investment journey may seem daunting, but following a structured approach simplifies the process. This step-by-step guide provides a clear roadmap to help Gen Z beginners build their investing confidence while focusing on financial freedom.

Assess Your Finances

Before diving into investing, gain a comprehensive understanding of your current financial situation:

- Evaluate Your Income and Expenses: Track monthly cash flow to identify how much you can allocate for investments.

- Build a Safety Net: Ensure you have an emergency fund covering 3-6 months of essential expenses to avoid tapping into your investments during unforeseen circumstances.

Set Clear Financial Goals

Having specific objectives helps guide your investment decisions and keeps you motivated:

- Define Your Goals: Examples include saving $5,000 for education, building a $50,000 retirement fund, or creating passive income streams.

- Use SMART Criteria: Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-Bound for better clarity and focus.

Choose the Right Platform

Selecting the right platform can make your investment journey smoother:

- Beginner-Friendly Platforms: Start with user-friendly apps like Robinhood or Acorns, which allow small initial investments and simplified interfaces.

- Consider Features: Look for platforms offering educational resources, automated investing options, and low fees.

Diversify Your Portfolio

A diversified portfolio reduces risk and maximizes potential returns:

- Low-Risk Options: Invest in index funds and ETFs to achieve steady growth with minimal volatility.

- Moderate to High-Risk Options: Gradually explore individual stocks, REITs (Real Estate Investment Trusts), or cryptocurrency based on your risk tolerance.

- Balancing Strategy: Allocate funds across asset classes to create a balanced portfolio aligned with your financial goals.

Monitor Progress

Regularly tracking your investments ensures you stay on course:

- Set a Monthly Review Schedule: Evaluate your portfolio’s performance monthly to understand trends and make adjustments.

- Avoid Impulsive Changes: Resist the urge to react to short-term market fluctuations. Patience is crucial for long-term gains.

Keep Learning

Continuous learning is vital to growing your investment knowledge and confidence:

- Follow Financial Blogs and Podcasts: Stay updated with creators like NerdWallet or The College Investor for relatable advice.

- Expand Your Reading List: Books like Rich Dad Poor Dad by Robert Kiyosaki and The Little Book of Common Sense Investing by John C. Bogle offer timeless insights.

- Engage in Online Communities: Participate in forums or social media groups to share experiences and learn from other investors.

By following these steps, you can build a strong foundation for investing and progress towards your financial planning and wealth-building goals. Remember, consistency and informed decisions are the keys to achieving financial success.

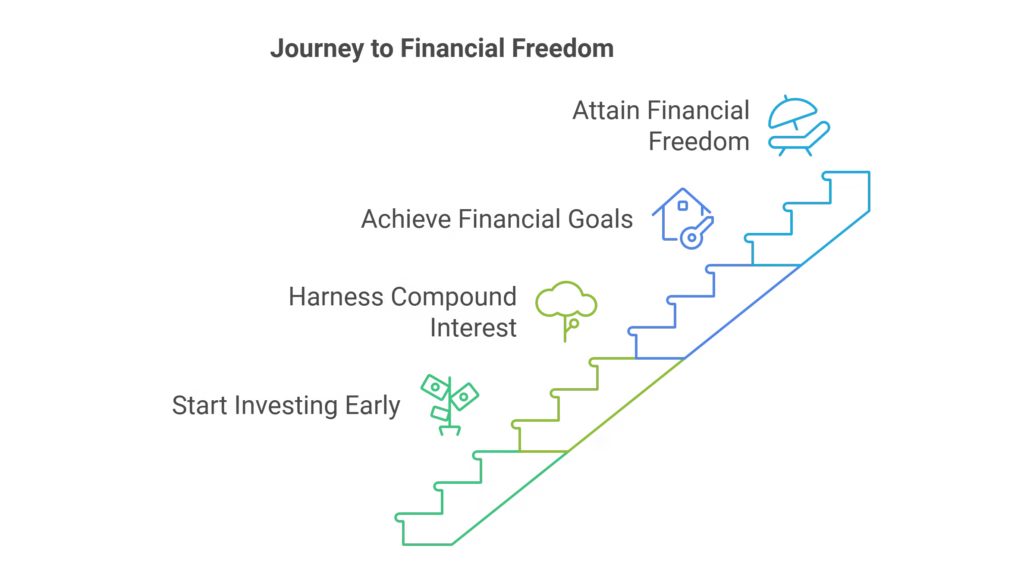

Benefits of Investing Early for Gen Z

Investing at an early age offers unparalleled advantages, especially for Gen Z. By taking proactive steps now, you can leverage time and technology to secure your financial future while aligning with your lifestyle aspirations.

The Power of Compound Interest

One of the greatest benefits of early investing is the ability to harness compound interest, often referred to as the “eighth wonder of the world.”

- Exponential Growth: Starting young means your investments have more years to grow, as returns are reinvested to generate even greater earnings.

- Illustrative Example: Consider this scenario:

- Investing just $100 monthly at an average annual return of 7% could grow to over $120,000 in 30 years.

- If you delay investing by 10 years, that same monthly contribution would only reach around $57,000, emphasizing the value of starting early.

- Takeaway: The earlier you start, the less you need to invest to achieve significant long-term gains.

Achieving Financial Freedom

Investing early isn’t just about building wealth—it’s a pathway to a life of greater financial independence and freedom.

- Faster Goal Achievement: By combining investments with saving and budgeting strategies, you can realize long-term goals like:

- Buying your first home.

- Retiring early to enjoy the lifestyle you envision.

- Flexibility Through Passive Income:

- Investments in dividend-paying stocks, REITs (Real Estate Investment Trusts), or peer-to-peer lending platforms can create streams of passive income.

- This extra income provides freedom to pursue side hustles, travel, or other lifestyle passions without financial stress.

By starting your investing journey today, you’re not just preparing for the future—you’re actively shaping it. As Gen Z embraces financial literacy and wealth-building tools, early investments will serve as the cornerstone for achieving dreams and ensuring long-term stability.

Common Investment Mistakes to Avoid

While investing is a powerful tool for financial growth, avoiding common pitfalls is just as important as choosing the right assets. Learning from these mistakes will help you build a more resilient and profitable investment strategy.

Acting on Emotions

Emotional decisions often lead to financial setbacks.

- Panic Selling: Market dips can be unnerving, but selling during downturns locks in losses instead of allowing for recovery. Pro Tip: Adopt a long-term mindset and remember that market fluctuations are normal. Historically, markets tend to recover and grow over time.

- Chasing Trends: Jumping into “hot” investments like meme stocks or cryptocurrencies without proper research can result in significant losses. Example: Many investors who bought high during hype cycles ended up selling at a loss when prices fell.

Ignoring Diversification

The adage “Don’t put all your eggs in one basket” applies strongly to investing.

- Risk Concentration: Investing all your money in one stock, sector, or asset class exposes you to unnecessary risk.

- Solution: Diversify across stocks, bonds, index funds, and even alternative investments like REITs or ETFs.

- Balanced Approach: Allocate investments based on your risk tolerance, combining safer options like bonds with growth-oriented stocks.

- Global Reach: Diversifying geographically reduces risks tied to a single country’s economy or market.

Overlooking Fees

Fees may seem minor, but they can have a significant impact on long-term returns.

- Expense Ratios: High fees on mutual funds or ETFs can erode your earnings.

- Example: A 1% fee on a $100,000 portfolio can cost you $10,000 over a decade.

- Solution: Opt for low-cost index funds with minimal fees.

- Hidden Costs: Be aware of transaction costs, account maintenance fees, or advisory fees.

Pro Tip: Use commission-free trading platforms like Robinhood or Fidelity to minimize unnecessary expenses.

By understanding and avoiding these common mistakes, you can create a sustainable investment plan that aligns with your financial goals and minimizes unnecessary risks.

FAQs About Overcoming Fear of Investing

Here are answers to common concerns Gen Z investors face when beginning their journey into the world of finance. By addressing these questions, you can approach investing with greater confidence and clarity.

This FAQ section highlights practical strategies to overcome fears and make investing accessible for Gen Z beginners. By combining knowledge with action, you can confidently embark on a path to financial independence.

Tools and Resources for Gen Z Investors

To make the investing journey smoother and more effective, having the right tools and resources at your disposal is crucial. Here are some of the best options tailored for Gen Z, blending technology, education, and community.

Budgeting Apps

- Mint: Tracks your spending, categorizes expenses, and provides insights into your financial habits.

- YNAB (You Need A Budget): Encourages proactive budgeting by assigning every dollar a job. Ideal for those new to financial planning.

- PocketGuard: Helps you understand how much you can safely spend while ensuring you meet savings goals.

Investment Platforms

- Acorns: Perfect for beginners, this app rounds up spare change from purchases and invests it automatically.

- Robinhood: Offers commission-free trading with an intuitive interface ideal for Gen Z investors exploring stocks and ETFs.

- Stash: Provides educational tools and guidance for investing in fractional shares with as little as $5.

- Fidelity: A full-service platform with robust options, including IRAs and zero-fee index funds for wealth building.

Books for Financial Literacy and Investing

- “Rich Dad Poor Dad” by Robert Kiyosaki: A timeless classic that challenges traditional beliefs about wealth and investing.

- “Broke Millennial” by Erin Lowry: A relatable guide covering financial basics, from budgeting to investing.

- “The Intelligent Investor” by Benjamin Graham: Offers timeless strategies for value investing and long-term success.

Communities for Shared Learning and Support

- Reddit’s r/personalfinance: A vibrant online hub where users share advice, experiences, and strategies for managing money and investing.

- Local Investment Clubs: Join groups in your area to learn from peers, share insights, and grow your network.

Additional Online Resources

- YouTube Channels: Follow creators like Graham Stephan and RealRichMoves for relatable, actionable investing advice.

- Financial Calculators: Use tools like Vanguard’s retirement planner or NerdWallet’s investment calculators to map out your goals.

- Podcasts: Tune into “The Minimalists” for frugal living tips or “Millennial Money” for actionable finance strategies.

By leveraging these tools and resources, you can simplify your financial planning process and gain the confidence needed to start investing. Whether it’s managing a budget, building a diversified portfolio, or learning from industry experts, these options ensure you’re equipped for success.

Closing Notes

“Fear is temporary; regret is forever.”

This powerful quote perfectly encapsulates the journey of overcoming the fear of investing. As a Gen Z investor, embracing the principles of saving, budgeting, debt management, and leveraging extra income from side hustles can unlock your potential for wealth building and financial freedom.

The process begins with small, actionable steps: creating a financial plan, setting clear goals, and exploring beginner-friendly platforms like Acorns and Robinhood. Consistency and education are your best allies in navigating the investment landscape. Remember, the earlier you start, the greater the rewards of compound interest and long-term growth.

At RealRichMoves, we’re dedicated to empowering you with the tools, strategies, and confidence needed to conquer your fears and achieve your financial dreams. Start small, stay the course, and always invest in yourself—because your financial freedom starts with the first step.