Getting Started:

“A goal without a plan is just a wish.”

In an era defined by economic shifts and digital innovation, setting actionable financial goals has become a cornerstone of achieving both stability and freedom. For Gen Z, this is especially vital. With their unique blend of entrepreneurial spirit and adaptability, this generation is redefining how wealth building aligns with their lifestyle. From saving for education to launching side hustles or tackling student loans, financial goals offer the clarity and focus needed to turn aspirations into achievements.

At RealRichMoves, we’re here to empower you with strategies and tools to chart a path toward financial success. Whether you’re kick starting your journey with small savings or planning for long-term financial freedom, our insights are tailored to guide your unique approach. Let’s explore how setting financial goals can motivate and inspire you to own your future.

The Importance of Setting Financial Goals

Why Financial Goals Matter

Financial goals are more than just numbers—they’re a roadmap to achieving your dreams and aspirations. Here’s why setting them is crucial:

- Provide Clarity and Direction: Without goals, managing money can feel aimless. Clear financial goals transform vague ambitions into actionable plans, helping you navigate saving, spending, and investing decisions with confidence. Whether you’re building an emergency fund or planning a lifestyle upgrade, goals bring structure and purpose to your financial journey.

- Motivation to Take Action: Financial goals act as a personal benchmark, pushing you to allocate your resources intentionally and wisely. They provide a sense of accomplishment as you hit milestones, fueling the momentum to keep going.

- Wealth Building Made Strategic: Goals allow you to focus on the big picture. A strategic plan tailored to your unique situation accelerates financial freedom, ensuring stability and long-term wealth.

Key Statistics:

The numbers don’t lie:

- 75% of Gen Z believes financial planning is critical to their success.

- However, only 30% have actionable financial plans in place.

This stark gap highlights the need for structured goal-setting to help this generation build a financially secure and fulfilling future. With the right approach, Gen Z can turn these statistics into a roadmap for growth and stability.

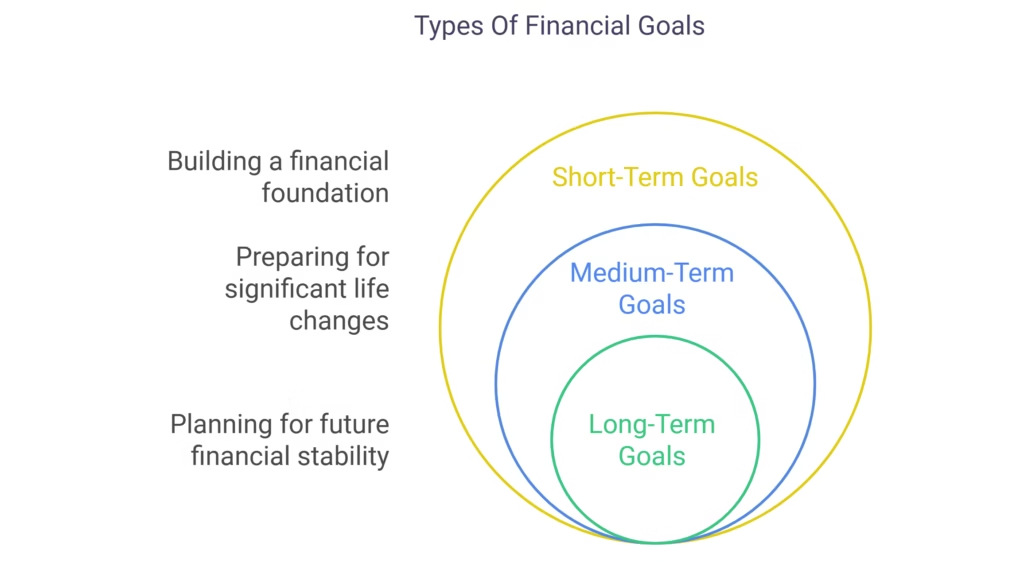

Types of Financial Goals

Short-Term Goals (Up to 1 Year)

Short-term financial goals are quick wins that set the foundation for long-term success. These goals typically focus on immediate needs and smaller financial milestones.

Examples:

- Building an emergency fund covering three months of expenses to safeguard against unexpected challenges.

- Saving for a short trip, new tech gadget, or a wardrobe refresh.

- Paying off small debts, such as credit card balances or payday loans.

Tips to Achieve Them:

- Leverage budgeting apps like Mint or YNAB to monitor progress and stay organized.

- Automate savings by setting up recurring transfers to a dedicated account.

Medium-Term Goals (1-5 Years)

Medium-term goals bridge the gap between short-term achievements and long-term ambitions. These goals often require careful planning and discipline.

Examples:

- Saving for significant milestones, such as a car purchase or college tuition.

- Launching an online side hustle or building a small business to diversify income streams.

- Investing in professional certifications or educational courses to enhance career prospects.

Strategies:

- Explore additional income sources like freelance jobs, online marketplaces, or selling digital products.

- Dedicate a fixed percentage of your monthly income to these goals, ensuring consistent progress.

Long-Term Goals (5+ Years)

Long-term financial goals are about securing your future and achieving financial freedom. These require patience, commitment, and strategic planning.

Examples:

- Planning for retirement by investing in low-cost index funds or employer-sponsored 401(k) plans.

- Saving for a down payment to purchase your first home.

- Building passive income sources, such as rental properties or dividend-yielding investments, to support long-term financial independence.

Execution Plan:

- Increase retirement contributions annually, especially when you receive salary raises or bonuses.

- Maintain consistency in investments, even during periods of market volatility, to take advantage of compound growth.

By categorizing your financial goals into short, medium, and long-term objectives, you can prioritize effectively and stay motivated as you progress through your financial journey.

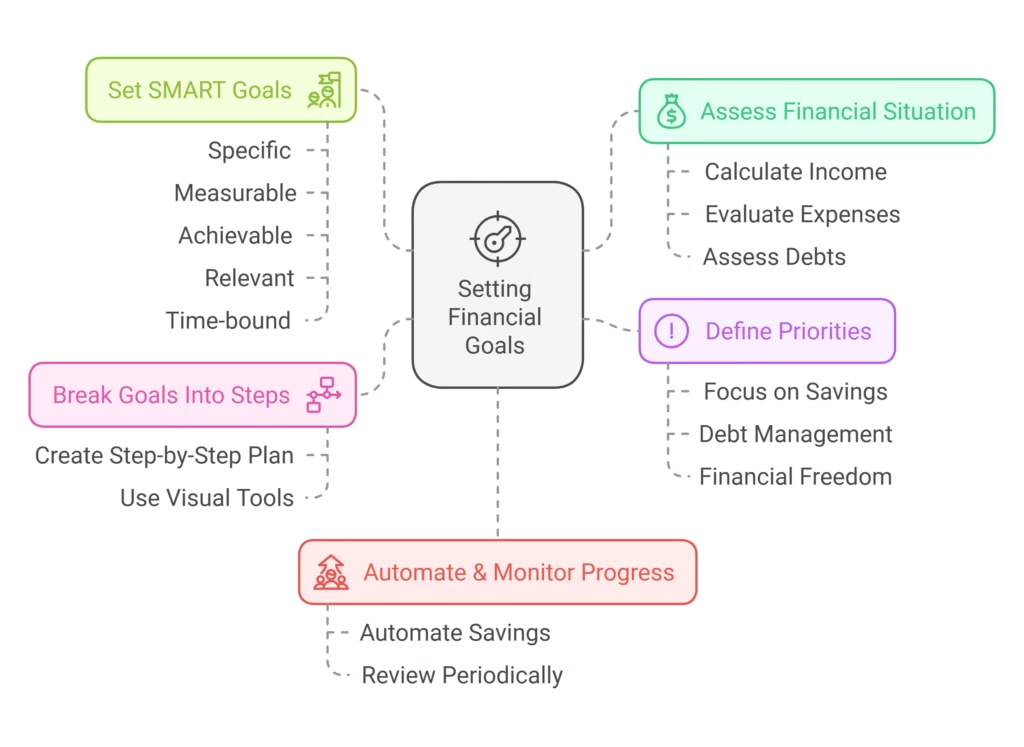

How to Set Financial Goals That Motivate You

Step 1: Assess Your Current Financial Situation

Before setting financial goals, it’s crucial to understand where you currently stand. This step lays the foundation for effective planning.

- Analyze Your Finances: Review your income, expenses, savings, and debt to get a complete picture of your financial health.

- Tools: Utilize budgeting apps like Mint or simple spreadsheets to organize and visualize your finances.

Tip: Categorize your expenses into essentials, discretionary spending, and savings to identify areas for adjustment.

Step 2: Define Your Priorities

Your financial goals should reflect what matters most to you. Aligning goals with your values ensures they remain motivating and relevant.

- Focus on What Matters: Decide whether saving, reducing debt, or investing takes precedence based on your current needs.

- Lifestyle Alignment: Whether it’s saving for travel, education, or a major purchase, ensure your goals support your desired lifestyle.

Example: If education is a priority, allocate a higher portion of your income to a savings fund for tuition.

Step 3: Set SMART Goals

SMART goals provide structure, making it easier to stay focused and measure progress.

- Specific: Clearly define the goal (e.g., save $10,000 for a down payment).

- Measurable: Break the goal into measurable milestones to track progress effectively.

- Achievable: Ensure the goal is realistic based on your income and resources.

- Relevant: Align goals with your long-term aspirations and lifestyle.

- Time-Bound: Establish a clear deadline to create urgency and maintain momentum.

Quick Example: Instead of saying, “I want to save money,” specify, “I want to save $5,000 for an emergency fund within 12 months.”

Step 4: Break Goals Into Manageable Steps

Large goals can feel overwhelming, so divide them into smaller, actionable steps.

- Micro-Plans: For instance, break a $5,000 savings goal into monthly targets of $416.66 or weekly targets of $104.16.

- Visual Aids: Use tools like goal charts, trackers, or digital apps to visually monitor progress and stay motivated.

Tip: Celebrate milestones, such as reaching 25% or 50% of your target, to maintain enthusiasm.

Step 5: Automate and Monitor Progress

Automation simplifies the process of achieving financial goals by reducing reliance on willpower.

- Automation: Set up recurring transfers to savings accounts or investment platforms to ensure consistent contributions.

- Periodic Reviews: Reassess your financial plan quarterly to accommodate changes in income, expenses, or priorities.

Pro Tip: Use notifications from budgeting apps to remind you of upcoming milestones and keep you accountable.

By following these steps, you can create financial goals that not only inspire but also equip you with the clarity and tools to achieve them efficiently.

Overcoming Challenges in Achieving Financial Goals

Common Obstacles

Achieving financial goals can be daunting, especially when faced with hurdles that derail progress. Recognizing these challenges is the first step toward overcoming them.

Lack of Discipline:

Many struggle to adhere to budgets or resist unnecessary spending temptations.

Example: Overspending on dining out or impulsive online purchases can eat into savings.

Unplanned Expenses:

Unexpected emergencies, such as car repairs or medical bills, can deplete funds earmarked for financial goals.

Fact: Nearly 40% of people face financial setbacks due to unanticipated expenses.

Procrastination:

Delaying savings contributions or investment decisions can slow progress and lead to missed opportunities.

Solutions

By adopting proactive strategies, these obstacles can be managed effectively, ensuring steady progress toward your goals.

- Build an Emergency Fund: Create a safety net to cover unforeseen costs, ensuring your primary goals remain unaffected. Tip: Aim for at least 3-6 months’ worth of living expenses in a separate, accessible account.

- Reward Milestones: Celebrate achievements, such as reaching 25% or 50% of your savings goal, to keep motivation high. Example: Treat yourself to a small reward, like a movie night or dinner, after hitting a significant milestone.

- Stay Accountable: Share your goals with trusted friends or family members who can provide encouragement and hold you accountable. Pro Tip: Consider joining financial planning groups or communities for support and inspiration.

- Use Automation to Stay Consistent: Set up automatic transfers to savings accounts or investments to bypass the temptation to spend.

- Track Progress Regularly: Review your goals and adjust strategies as needed to accommodate changes in your financial situation. Motivational Insight: Challenges are inevitable, but overcoming them strengthens your financial discipline and brings you closer to long-term stability. Motivational Insight: Challenges are inevitable, but overcoming them strengthens your financial discipline and brings you closer to long-term stability.

Tools and Resources for Financial Planning

Budgeting Apps

Effective budgeting is the cornerstone of financial planning. The right app can simplify tracking expenses and managing your income.

- Mint: Provides an all-in-one financial overview. Tracks spending, categorizes expenses, and sets budget goals. Key Feature: Free to use with alerts for bills and overspending.

- YNAB (You Need A Budget): Focuses on proactive budgeting by assigning every dollar a purpose. Ideal for those looking to break the paycheck-to-paycheck cycle. Pro Tip: Use YNAB’s tutorials to master advanced budgeting techniques.

Investment Platforms

Start building wealth with user-friendly platforms designed for beginners and experienced investors alike.

- Acorns: Automates investing by rounding up spare change from purchases. Perfect for passive, hands-off investing. Example: Spend $3.75 on coffee, and Acorns invests $0.25 in your portfolio.

- Robinhood: Offers commission-free stock, ETF, and cryptocurrency trades. Tip: Leverage Robinhood’s research tools to make informed decisions. Tip: Leverage Robinhood’s research tools to make informed decisions.

Tracking Tools

Visualizing your financial progress keeps you motivated and on track.

- Spreadsheets: Customizable for tracking income, expenses, and goal milestones. Example: Create a monthly tracker with categories for savings, investments, and discretionary spending.

- Goal-Setting Apps: Apps like PocketGuard or EveryDollar help prioritize financial objectives. Pro Tip: Use progress bars and alerts to stay motivated as you inch closer to your goals.

Actionable Insight: The right tools not only simplify your financial journey but also empower you to make informed decisions and maintain momentum.

FAQs – About Setting Financial Goals

Practical Financial Goals You Can Set Today

Saving

- Emergency Fund: Aim to save 3-6 months’ worth of expenses for unexpected situations.

- Targeted Savings: Set aside money for specific purchases, like a new laptop, vacation, or educational course.

Tip: Use high-yield savings accounts to grow your savings faster.

Budgeting

- Adopt the 50/30/20 Rule: 50% for necessities (rent, utilities, food). 30% for discretionary spending (entertainment, dining out). 20% for savings and investments.

- Cut Non-Essential Expenses: Cancel unused subscriptions. Avoid impulse purchases by sticking to a list when shopping.

Example: Skipping a daily $5 coffee can save $150 per month.

Debt Management

- Prioritize High-Interest Debts: Focus on paying off credit cards or payday loans first. Use the avalanche or snowball method to streamline repayments.

- Consider Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate to simplify payments.

Pro Tip: Negotiate with lenders for better terms or interest rates.

Investing

- Start Small: Begin investing with as little as $5 using micro-investment platforms like Acorns or Robinhood.

- Diversify: Explore stocks, ETFs, or mutual funds to reduce risk and build long-term wealth.

Insight: Even investing $50 per month can grow significantly over time due to compound interest.

Side Hustles

- Freelancing: Use platforms like Fiverr or Upwork to monetize skills like writing, graphic design, or coding.

- Selling Products: Create a stream of income by selling handmade crafts, thrifted items, or digital products online.

Example: Turning a $20 thrift find into a $60 sale can add up quickly with consistency.

Top Tips for Staying Motivated

- Create a Vision Board: Visualize your goals with images of desired achievements, such as your dream home, car, or travel destinations. Place your vision board where you’ll see it daily to keep your goals top of mind. Example: Use digital tools like Pinterest or a physical corkboard to compile your visual inspirations.

- Track Progress Weekly: Utilize apps like Mint or budgeting tools to monitor your financial milestones. Break goals into smaller, trackable steps and update your progress regularly. Tip: Seeing tangible progress can fuel your determination to stay on track.

- Celebrate Small Wins: Reward yourself for achieving mini-goals, like saving your first $500 or paying off a credit card. Keep rewards budget-friendly, such as a nice meal or a new book. Insight: Positive reinforcement boosts motivation and makes the journey enjoyable.

- Join Communities: Engage with groups or forums focused on financial planning to share ideas and stay inspired. Participate in social media challenges or join local meetups for accountability and encouragement. Pro Tip: Learning from others’ experiences can help you overcome obstacles more effectively.

- Set Reminders: Use digital tools like Google Calendar or task management apps to stay aware of deadlines and check-ins. Schedule monthly reviews to reflect on achievements and adjust your strategies. Example: Set alerts for savings transfers or goal milestones to avoid procrastination.

Summary

Achieve the Lifestyle You Desire

Setting financial goals is a transformative step in aligning your finances with the life you envision. Whether focusing on short-term savings or long-term wealth building, each goal acts as a milestone on your path to financial freedom.

Turn Dreams Into Reality

As the saying goes, “A goal without a plan is just a wish.” By crafting actionable plans and leveraging tools like RealRichMoves, you can turn aspirations into achievements.

Key Takeaway: Financial goals aren’t just about numbers—they’re about creating the future you deserve.

Your Financial Freedom Journey Starts Today

Embrace the process, utilize available resources, and take intentional steps toward building a secure, prosperous future.