Introduction

“A budget isn’t about restrictions; it’s about creating freedom.“

For Gen Z, managing money often feels like walking a tightrope between the pressures of financial responsibility and the pursuit of a vibrant, fulfilling life.

From navigating student loans to funding side hustles or saving for future goals, the challenges are real—but so are the opportunities.

At RealRichMoves, we believe budgeting is more than cutting corners; it’s about creating a clear roadmap to achieve your dreams without compromising your lifestyle.

Budgeting allows you to align your finances with your aspirations, whether it’s taking that dream trip, building an emergency fund, or starting your journey to wealth building.

With the right strategies, you can take control of your money, feel confident in your decisions, and create a financial future that matches your ambition.

Let’s dive into how you can master the art of budgeting in 2025 and turn financial challenges into stepping stones for success.

Let’s get started.

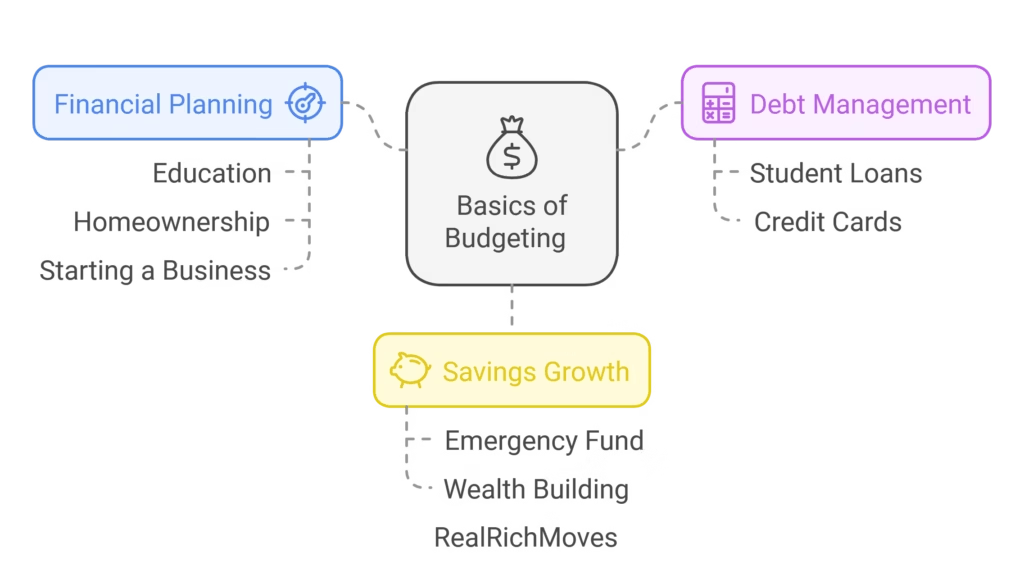

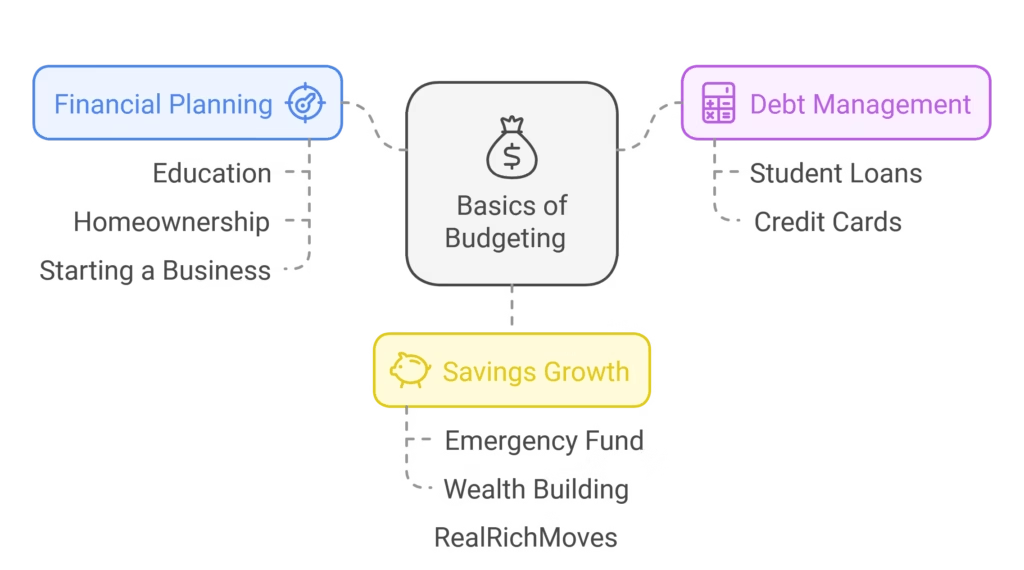

Step 1: Understanding the Basics of Budgeting

What Is a Budget?

A budget is more than just a list of numbers—it’s a tool that empowers you to take charge of your financial journey.

Think of it as your personal money map, guiding how you allocate, save, and invest your income.

It’s not just about cutting back; it’s about making intentional choices that bring you closer to your life goals. Whether it’s tackling student loans, building an emergency fund, or laying the foundation for future investments, a budget sets the stage for achieving financial stability and growth.

Why Is Budgeting Essential for Gen Z?

Budgeting isn’t just practical—it’s a game-changer for navigating today’s fast-paced world. Here’s why it matters:

- Financial Planning for the Future: From buying a home to starting a business, budgeting helps you prepare for big goals.

- Debt Management: It’s easier to manage student loans and avoid unnecessary credit card debt with a clear plan.

- Building Wealth: Saving and investing start with a solid budget.

Understanding the basics is your first step to unlocking the financial freedom you deserve. Let’s continue to break it down and make budgeting work for you!

Step 2: Setting Financial Goals

Setting clear financial goals is the compass that directs your budgeting efforts. Whether you’re saving for something immediate or planning for the future, defining your objectives is crucial to creating a budget that truly works.

The Importance of Goals in Budgeting

Your financial goals shape your budget. Start by categorizing them into short-term and long-term objectives.

Short-Term Goals

Short-term goals are all about immediate wins and building momentum. These goals typically span a few months to a year and include:

- Saving for Special Purchases: Allocate funds for experiences like a vacation, buying the latest tech, or paying off a minor loan.

- Building an Emergency Fund: Aim to save at least $500–$1,000 to cover unexpected expenses like car repairs or medical bills. Having this buffer is essential for financial peace of mind.

Long-Term Goals

Long-term goals focus on securing your future and achieving major life milestones. These goals may take years to accomplish but are pivotal for lasting financial success:

- Achieving Financial Freedom: Start investing early to grow your wealth and eventually enjoy the flexibility of financial independence.

- Planning for Milestones: Set aside funds for significant achievements, such as purchasing a home, starting a business, or preparing for retirement.

By aligning your budget with these goals, you’ll create a financial roadmap that keeps you motivated and on track. Let’s dive deeper into how tracking your income and expenses supports these aspirations!

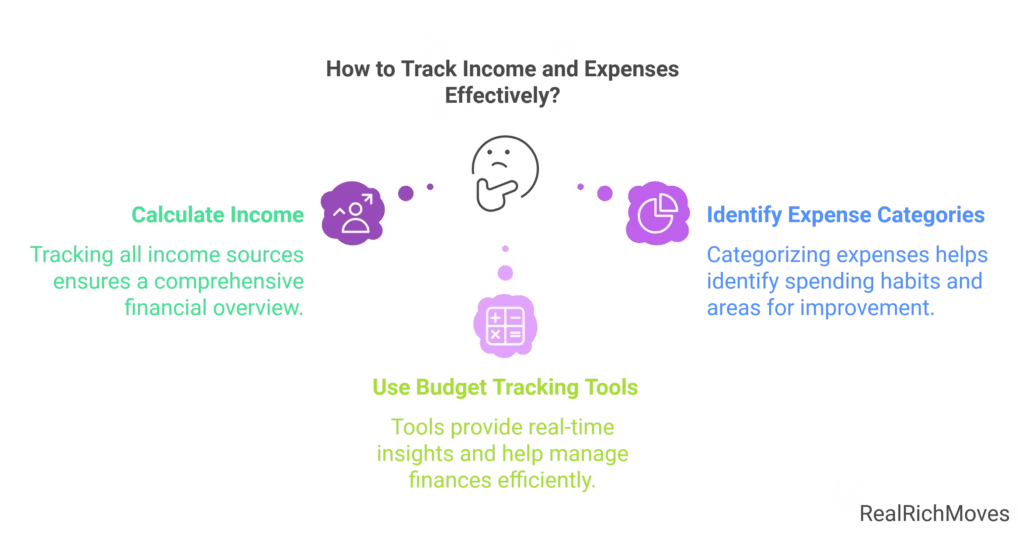

Step 3: Tracking Your Income and Expenses

Understanding where your money comes from and where it goes is the foundation of effective budgeting. Tracking income and expenses ensures you have a clear picture of your financial situation, helping you allocate resources wisely and achieve your goals.

Calculate Your Income

Accurately calculating your income is the first step to creating a budget that works. Understanding where your money comes from helps you plan your expenses and savings effectively. Here’s how to track all your income sources:

Primary Job or Part-Time Gigs

- Monthly Paychecks: If you have a steady job, note your after-tax income (net income). This is the money available for budgeting.

- Part-Time Earnings: Include earnings from part-time roles, internships, or seasonal work.

Side Hustles and Freelance Work

- Irregular Income: Track freelance projects, gig work, or commission-based jobs. Keep a record of fluctuating payments to determine an average monthly income.

- After-Deductions: Ensure you account for taxes and platform fees when calculating income from gigs like rideshare driving or content creation.

Extra Income from Online Platforms

- Selling Products or Services: Include profits from selling handmade goods, digital products, or vintage finds on platforms like Etsy or eBay.

- Online Freelancing: Don’t forget payments from platforms like Upwork, Fiverr, or freelance writing sites.

Tracking all income streams gives you a clear financial picture and ensures that every dollar you earn is accounted for. With this foundation, you’re ready to dive deeper into managing your expenses and building your budget!

Identifying Key Expense Categories

Categorizing expenses helps you understand your spending habits and identify areas for improvement:

- Essentials: These are non-negotiable costs, including rent, utilities, groceries, and transportation.

- Discretionary: Spending on wants like dining out, entertainment, shopping, and subscriptions.

- Savings: Money allocated for emergency funds, retirement accounts, or investments that secure your financial future.

Using Daily Budget Tracking Tools

Keeping a close eye on your daily spending is crucial for mastering your finances. With technology at your fingertips, tracking your daily budget has never been easier. These tools not only help you stay accountable but also provide insights into your spending habits, allowing you to make smarter financial decisions.

Benefits of Daily Budget Tracking Tools

- Real-Time Insights: See exactly where your money is going throughout the day.

- Customization: Categorize expenses according to your lifestyle and priorities.

- Alerts and Notifications: Stay within budget with timely reminders about your spending limits.

Popular Daily Budget Tracking Tools

Here are some highly recommended budget tracking tools designed to fit various needs and preferences:

- PocketGuard: Perfect for Gen Z, this app shows how much disposable income you have after accounting for bills, goals, and necessities.

- Goodbudget: A digital envelope budgeting system that lets you allocate funds to specific categories. Great for visualizing spending.

- Spendee: A user-friendly app that connects to your bank accounts and provides an overview of your finances with colorful charts and graphs.

- Fudget: Ideal for simplicity, this app focuses on listing expenses and income without overwhelming features.

- EveryDollar: A zero-based budgeting app that’s simple and effective for daily tracking.

How to Maximize These Tools

- Set Up Automatic Imports: Link your bank account for effortless tracking.

- Schedule Daily Reviews: Spend 5–10 minutes at the end of the day reviewing your expenses.

- Align with Your Budget: Adjust your spending categories in the app to match the budget you’ve planned.

By consistently tracking these elements, you’ll gain better control over your finances and make informed decisions. With this clarity, you’re ready to select a budgeting method that aligns perfectly with your lifestyle!

Step 4: Choosing the Right Budgeting Method

Selecting the right budgeting method is key to managing your money effectively. Different methods cater to unique financial situations and goals, ensuring there’s a fit for everyone. Let’s explore three proven approaches:

The 50/30/20 Rule

This straightforward method divides your income into three distinct categories:

- 50% for Needs: Rent, groceries, bills.

- 30% for Wants: Streaming services, eating out, travel.

- 20% for Savings and Debt: Building your emergency fund and paying off loans.

The 50/30/20 rule is ideal for students or young professionals looking for a balanced, easy-to-follow framework.

Zero-Based Budgeting

In this method, every dollar of your income is assigned a purpose:

- After categorizing your needs, wants, and savings, ensure that all income is accounted for, leaving a “zero balance.”

- It’s perfect for freelancers or gig workers with variable income, helping them prioritize spending and savings efficiently.

The Envelope System

This hands-on technique involves allocating money into physical or digital “envelopes” for each spending category:

- Once the envelope is empty, spending in that category stops.

- It’s an excellent tool for controlling overspending and sticking to your budget.

Choosing the right method depends on your income type, lifestyle, and financial goals. Experiment and adapt until you find the one that fits seamlessly into your routine. From here, leveraging technology can make sticking to your chosen method even easier!

Step 5: Using Technology to Simplify Budgeting

In the digital age, technology can be your ultimate ally in managing your finances. With user-friendly apps and customizable tools, budgeting has never been more accessible or efficient.

Best Budgeting Apps for Gen Z

- Mint: Automatically tracks your spending, categorizes expenses, and helps you set and monitor financial goals.

- YNAB (You Need a Budget): Empowers you to allocate every dollar intentionally, providing detailed insights and guidance.

- EveryDollar: Designed for beginners, it streamlines the zero-based budgeting method with an intuitive interface.

Custom Spreadsheets for Detailed Planning

For those who prefer a more hands-on approach, spreadsheets offer unparalleled flexibility:

- Tools like Google Sheets and Excel enable you to design personalized budgeting templates tailored to your needs.

- Track income, categorize expenses, and adjust allocations in real-time for a dynamic financial plan.

With the right tech tools, you can automate tedious tasks, gain deeper insights into your spending habits, and make informed financial decisions.

Let’s move forward by focusing on consistency to ensure your budget remains effective and sustainable!

Step 6: Staying Consistent and Accountable

Creating a budget is only half the battle; sticking to it is where the real progress happens. Consistency ensures that your financial plan evolves with your goals and lifestyle.

Reviewing Your Budget Regularly

Your budget should be a living document, not a static plan:

- Monthly Adjustments: Reassess your income and expenses at the end of each month to accommodate changes, such as unexpected expenses or new income streams.

- Flexibility is Key: Life happens—your budget should adapt to ensure you stay on track without feeling constrained.

Accountability Strategies

Stay motivated by involving others in your financial journey:

- Share Your Goals: Let trusted friends or family know about your financial objectives for encouragement and support.

- Join Finance Communities: Online groups, forums, and social platforms offer advice, success stories, and accountability to keep you inspired.

Staying Motivated

Celebrate small wins, like reaching your monthly savings goal or paying off a chunk of debt.

“Consistency is the bridge between financial plans and success.”

By regularly reviewing and staying accountable, you ensure your budget grows with you, propelling you closer to your financial freedom.

Let’s solidify this momentum by understanding why saving plays a pivotal role in Gen Z’s financial journey!

Step 7: Importance of Savings for Gen Z

Savings are more than just money in the bank—they are your financial safety net and stepping stone toward a secure future. For Gen Z, prioritizing savings can unlock opportunities and minimize financial risks.

Why Saving Matters

Life is unpredictable, and emergencies can strike when you least expect them:

- Financial Cushion: Savings protect you from financial stress during situations like medical emergencies, job loss, or sudden expenses.

- Avoiding Debt: With a dedicated emergency fund, you can handle urgent costs without resorting to credit cards or loans.

Investing Opportunities

Savings open the door to wealth-building possibilities:

- Starting Investments: Begin investing in low-risk options like index funds, ETFs, or retirement accounts once your emergency fund is established.

- Capital for Opportunities: Having savings allows you to take calculated risks, such as starting a side hustle or pursuing personal development courses.

Debt Avoidance

A solid savings plan helps keep you out of the debt cycle:

- Minimized Borrowing: Savings reduce reliance on high-interest credit cards or payday loans.

- Financial Independence: The more you save, the less you’ll need to rely on others or external financing for your goals.

Tips for Saving More

Savings open the door to wealth-building possibilities:

- Cook at home instead of dining out.

- Sell unused items online for extra income.

- Limit discretionary spending without sacrificing your lifestyle.

Savings are your financial foundation, helping you navigate life’s uncertainties while empowering you to grow wealth and avoid unnecessary debt.

Step 8: Overcoming Budgeting Challenges

What If You Overspend?

Don’t panic! Adjust your next month’s budget to cover the difference, and identify areas where you can cut back.

Managing Irregular Income

For freelancers or gig workers, average your income over several months and prioritize saving during high-earning periods.

“Daily budgeting isn’t just about controlling expenses; it’s about taking charge of your financial future. With the right tools, you can simplify the process and make progress toward your wealth-building goals one day at a time.”

Ready to answer your most pressing budgeting questions? Let’s dive into the FAQs!

FAQs – About Budgeting for Gen Z

Budgeting might feel daunting at first, but with the right strategies and mindset, it becomes your strongest tool for financial empowerment. Let’s tackle some common questions Gen Z faces while mastering the art of budgeting:

Empower yourself with these budgeting answers, and take control of your financial future one informed decision at a time.

Summary

Budgeting is more than just a financial tool—it’s a lifestyle choice that empowers you to take control of your money and shape your future. For Gen Z, navigating the complexities of student loans, side hustles, and ever-evolving career paths requires a budgeting approach that’s both practical and flexible.

With strategies like tracking expenses, adopting modern budgeting methods, and leveraging technology, you can align your financial habits with your personal goals.

At RealRichMoves, we believe that budgeting in 2025 is about building habits that lead to financial freedom, wealth building, and long-term stability.

Start today and embrace a life where your money works as hard as you do!

“Budgeting isn’t about restrictions; it’s about building a financial plan that empowers you to live your best life today while securing your future.”

Remember, every small step toward financial discipline is a giant leap toward achieving your dreams. Start now, stay consistent, and watch how your money begins to work for you. Your financial freedom journey starts here with RealRichMoves!