How To Save Mon

Introduction

Saving money as a Gen Z student in 2025 might feel like a challenge, but with the right strategies, it’s entirely possible to thrive financially.

Life as a student comes with its unique blend of excitement and financial challenges. Between managing tuition, juggling part-time jobs, and trying to keep up with a vibrant social life, saving money might feel like an uphill battle. But it doesn’t have to be! With some smart strategies tailored to your Gen Z lifestyle, you can save money and take control of your finances, even on a tight budget.

At RealRichMoves, we believe that achieving financial stability starts with making small, intentional choices. From mastering budgeting to exploring innovative ways to save, this guide will provide practical, actionable tips to help you build a saving habit, manage your budget, and make financially sound decisions—all while enjoying your college or university years.

“Let’s dive in and explore how small changes today can create big wins for your financial future!“

Why Saving Money Is Crucial For Financial Planning

For Gen Z, saving money is more than just a necessity—it’s a stepping stone to financial independence and success. Living in a world marked by student debt, uncertain job markets, and rapidly changing economies, the ability to save empowers you to navigate these challenges confidently.

Here’s a deeper look into why prioritizing savings is essential for both your present and future:

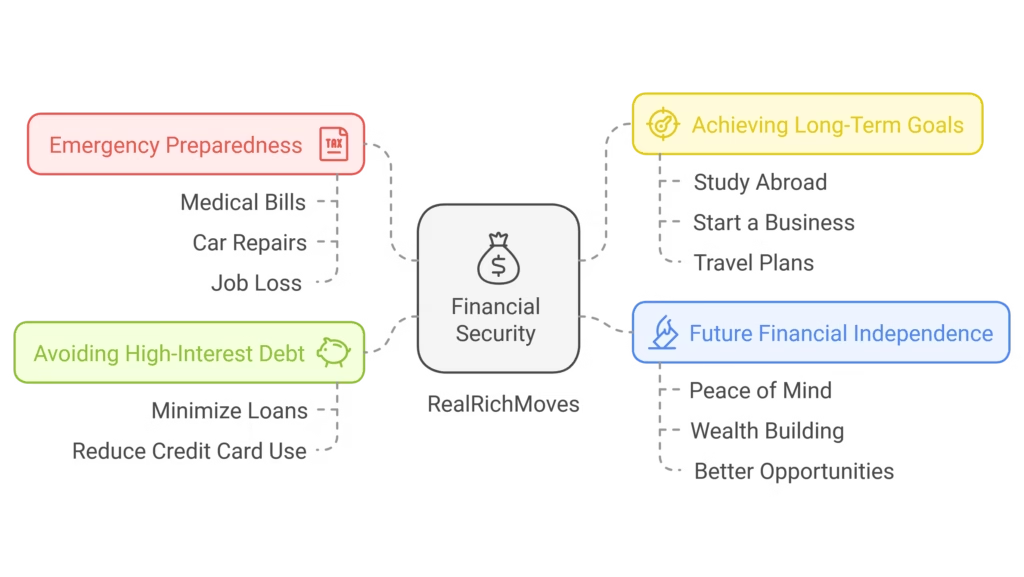

The Importance Of Financial Security

- Prepare for Emergencies: Life is full of unexpected twists—an urgent medical expense, a car breaking down, or a sudden need to relocate. A savings cushion provides a safety net, sparing you from the stress of scrambling for high-interest loans or relying on credit cards. Experts suggest aiming for at least three to six months’ worth of living expenses in an emergency fund.

- Avoid High-Interest Debt: Without savings, financial emergencies often push people to rely on high-interest options like payday loans or credit card advances. Building a reserve helps you break free from this cycle, saving you hundreds, if not thousands, in interest payments.

- Achieve Long-Term Goals: Whether it’s studying abroad, launching a side hustle, or embarking on that dream backpacking trip through Europe, long-term goals often require financial planning. Savings act as the bridge between dreaming and doing, enabling you to pursue your passions without hesitation.

Benefits For Future Financial Independence

- Freedom from Financial Stress: Imagine waking up without the anxiety of unpaid bills or overdue rents. Saving gives you that freedom, ensuring that you’re financially prepared for the month ahead and beyond. This peace of mind can also improve your overall well-being, allowing you to focus on your studies, career, or hobbies.

- Early Wealth Building: Starting small is the key to long-term wealth. By saving early, you allow your money to grow through compound interest or investments. For example, setting aside just $50 per month in an index fund during college can result in significant wealth by the time you’re 40.

- Better Opportunities: Savings provide you with the flexibility to seize opportunities when they arise. Whether it’s taking on an unpaid internship at a prestigious firm, enrolling in a certification course, or relocating for your dream job, financial preparation ensures you won’t miss out on life-changing moments.

Practical Examples and Insights

- Case Study: Imagine two students, Alex and Jordan. Alex saves $20 weekly, and Jordan spends every penny. When their car unexpectedly breaks down, Alex uses their savings to cover repairs, avoiding high-interest loans. Jordan, however, racks up debt on a credit card. This difference underscores how saving provides stability in unexpected situations.

- Financial Tip: Use a high-yield savings account for your emergency fund. It keeps your money accessible while earning more interest than a regular account.

“Every dollar you save today builds a stronger foundation for tomorrow. Embrace the power of saving—it’s not just a habit, but a game-changer for your financial journey.“

Proven Strategies To Save Money On A Tight Student Budget

Navigating the financial maze of student life requires effective strategies that balance saving with your lifestyle needs. While your income may be limited, consistent small steps can lead to significant financial achievements. Here’s how you can get started:

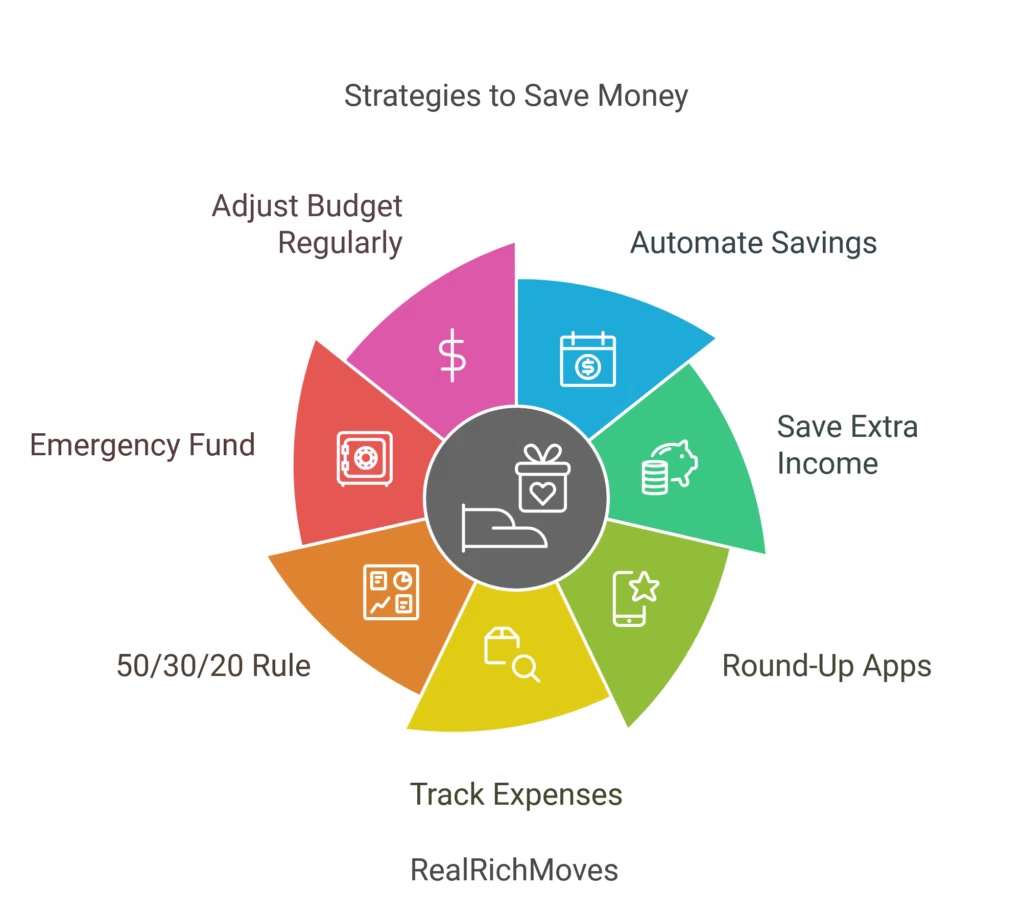

Start Small And Be Consistent

- Automate Your Savings: Automating your savings eliminates the temptation to spend money impulsively. Set up a weekly or monthly transfer to your savings account, even if it’s as small as $10. Over time, these small contributions accumulate into a substantial safety net.

- Save Your Extra Income: Unexpected windfalls like tax refunds, bonuses, or birthday gifts are opportunities to supercharge your savings. Instead of spending them, deposit these funds into a dedicated savings or high-yield account.

- Round-Up Apps: Apps like Acorns make saving effortless by rounding up your purchases to the nearest dollar and investing the spare change. For instance, if you spend $3.50 on coffee, the app rounds it up to $4, investing the extra $0.50. Over time, these micro-savings contribute to your financial growth.

Key Insight: “Consistency is more important than the amount saved. Regular contributions, no matter how small, build discipline and create momentum in your saving journey.“

Smart Budgeting Tips For Students

Budgeting is the cornerstone of effective financial management. By understanding where your money goes, you can make informed decisions and avoid unnecessary expenses.

- Track Every Expense: Use apps like Mint or YNAB to monitor your spending habits. Knowing how much you spend on coffee, groceries, or entertainment helps you identify areas for improvement.

- Use the 50/30/20 Rule: This budgeting framework divides your income into three categories:

- 50% for necessities like rent and food.

- 30% for discretionary spending like entertainment or shopping.

- 20% for savings or debt repayment. (Adjust these percentages to suit your financial priorities.)

- Create an Emergency Fund: Having at least $500 set aside for unexpected expenses like medical bills or car repairs can save you from relying on credit cards or loans.

- Adjust Regularly: Life changes quickly—your budget should too. Set a reminder to review your finances monthly, adjusting your spending plan based on new income, expenses, or goals.

Practical Example: Imagine you’re earning $500 a month from a part-time job. Following the 50/30/20 rule, you could allocate $250 to essentials, $150 to wants, and $100 to savings. This ensures your financial priorities are balanced.

Actionable Insights to Maximize Savings

Pro Tip: Pair your budget with cashback or coupon apps like Rakuten or Honey to reduce everyday expenses.

Motivational Strategy: Set a short-term saving goal, like $100 for a weekend getaway. Achieving smaller milestones keeps you motivated for bigger financial objectives.

Saving on a tight student budget isn’t about deprivation—it’s about making strategic choices. Start with small, consistent actions today to unlock financial freedom tomorrow.

Everyday Ways To Save Money Without Compromising Lifestyle

Saving money doesn’t mean sacrificing the joys of student life. With the right strategies, you can enjoy a fulfilling lifestyle while keeping your finances in check. Here are some practical ways to cut costs without compromising on quality or convenience:

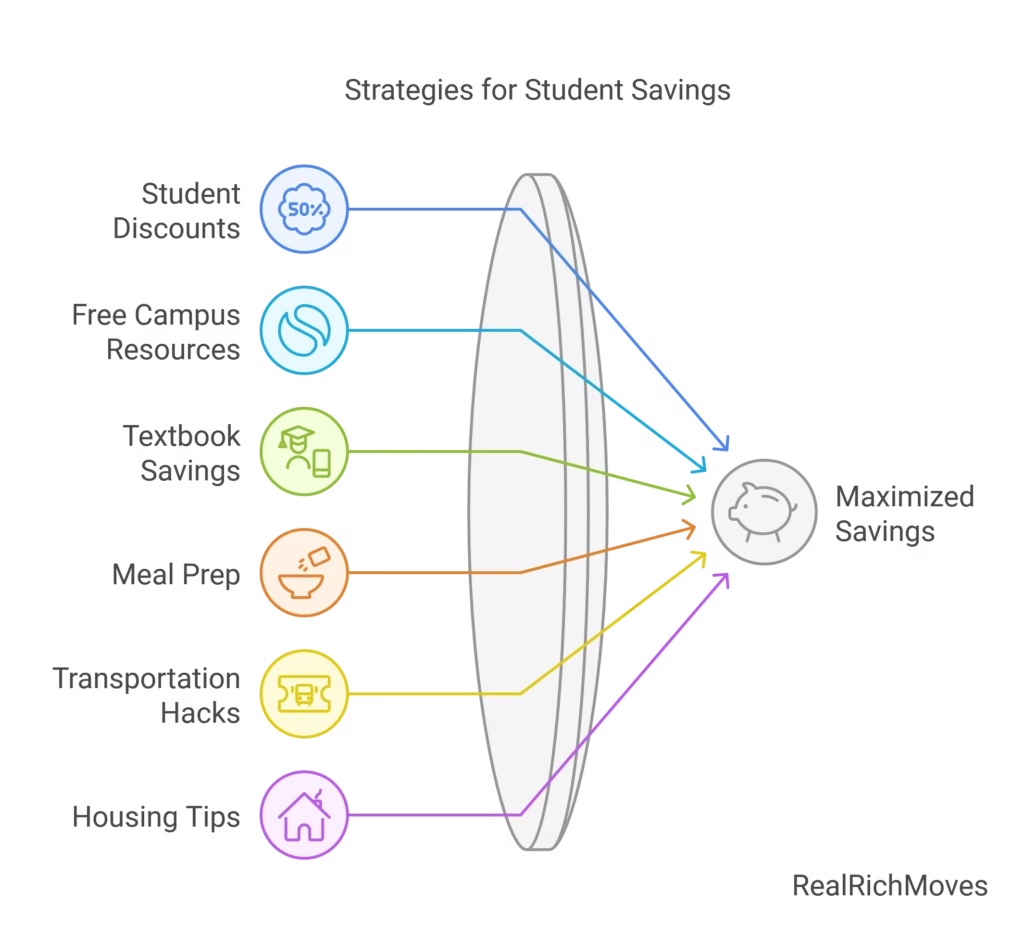

Maximize Student Discounts And Free Perks

As a student, you have access to a treasure trove of discounts and free resources. Leveraging these can significantly reduce your expenses:

- Discounts on Subscriptions: Platforms like Spotify, Hulu, and Amazon Prime offer exclusive student pricing. By switching to these discounted plans, you enjoy premium services at a fraction of the cost. Combine these discounts with family or shared accounts to save even more.

- Free Campus Resources: Take full advantage of the free facilities available on your campus, such as libraries for textbooks and study materials, gyms for fitness, and career centers for job opportunities and resume building. These resources can save you hundreds of dollars annually.

- Textbook Savings: New textbooks can be expensive. Instead, buy used copies, rent from platforms like Chegg, or explore free online resources and open educational platforms. You can also check if your campus library offers textbooks for short-term borrowing.

Pro Tip: Always carry your student ID—many local businesses, stores, and restaurants offer student discounts that aren’t widely advertised.

Cut Costs On Essentials

Small tweaks to your daily routine can lead to significant savings without making your life feel restrictive:

- Meal Prep: Cooking at home is not only healthier but also far cheaper than dining out. Dedicate a few hours each week to meal prep. Make larger portions of dishes like pasta, stir-fries, or soups that can be easily reheated. Limit eating out to special occasions or as a reward for achieving your goals.

- Transportation Hacks: Save on transportation costs by choosing economical options:

- Walk or bike whenever possible—it’s free and great for your health.

- Use public transportation with student passes for discounted fares.

- Carpool with friends or use ride sharing services during group outings to split costs.

- Housing Tips: Housing is often one of the biggest expenses. Reduce costs by:

- Opting for shared housing or on-campus dorms.

- Negotiating your rent, especially if you’re renewing a lease or paying upfront for several months.

- Exploring subletting options during summer breaks to avoid paying for unused accommodation.

Real-Life Example: A student who walks to classes, meal preps for the week, and uses campus resources for gym access could save over $200 per month compared to those who drive, eat out frequently, and pay for external services.

Actionable Insights to Maintain Balance

Keep the Fun Alive: Plan budget-friendly activities like movie nights at home, potluck dinners, or free events on campus to socialize without overspending.

Smart Splurging: Set aside a small fund for occasional treats or experiences, so you don’t feel deprived.

“Living within your means doesn’t have to mean living without fun. With these everyday strategies, you can save smartly while still enjoying your student lifestyle to the fullest.“

Earning Extra Income To Boost Savings

Building savings on a tight budget often requires more than cutting expenses—it’s about increasing your income, too. As a student, you have access to flexible opportunities that fit into your schedule while providing a financial boost. Here’s how to make it happen:

Explore Flexible Side Hustles

Side hustles are an excellent way to earn extra money without interfering with your academic commitments. They offer flexibility, allowing you to work during free hours and scale your efforts based on your financial needs:

- Freelancing: Use platforms like Upwork, Fiverr, or Freelancer to offer skills such as graphic design, writing, video editing, or web development. Set your rates competitively and gradually increase them as you gain experience and positive reviews.

- Online Surveys: Participate in survey sites like Swagbucks, Survey Junkie, or Toluna to earn small amounts of cash or gift cards. While not a primary source of income, these can provide a quick financial boost during breaks or downtime.

- Social Media Management: Help small businesses create and manage their social media profiles by curating content, engaging with followers, and running ad campaigns. Many businesses prefer hiring students due to their affordability and familiarity with platforms like Instagram and TikTok.

Pro Tip: Leverage your unique skills or hobbies—whether it’s photography, crafting, or coding—to find niche opportunities and stand out in competitive markets.

Tap Into Campus Opportunities

Your university is a hub of resources, often offering part-time roles that align with your student schedule:

- Work-Study Programs: Many universities provide on-campus jobs through federal work-study programs, offering roles in libraries, administrative offices, or student centers. These jobs are designed with students in mind, making them flexible and accommodating during exams or busy semesters.

- Tutoring: If you excel in a particular subject, become a tutor. Offer your services to peers, younger students, or through university tutoring centers. Online platforms like Chegg Tutors and TutorMe also connect you with students worldwide, expanding your reach.

- Event Staff: Work at campus events, sports games, or conferences as an usher, ticket handler, or logistics assistant. These roles not only pay but also allow you to network and engage in campus life.

Real-Life Example: A student who freelances part-time as a writer, works 10 hours weekly in a campus job, and tutors in their subject expertise could easily earn an extra $500–$800 per month.

Actionable Insights to Maximize Earnings

- Combine Opportunities: Use a mix of online side hustles and campus roles to diversify your income streams.

- Set a Goal: Allocate your earnings strategically—dedicate a percentage to savings, a percentage to essentials, and a portion for discretionary spending.

- Track Your Hours: Ensure you don’t overextend yourself and maintain a balance between academics, work, and personal time.

“By exploring flexible income streams and leveraging campus resources, you can earn extra cash while still prioritizing your education. Every dollar earned brings you one step closer to financial freedom!“

Smart Saving Hacks Every Student Should Know: FAQs

Navigating finances as a student can be tricky, but these common questions and answers will help guide you toward smarter money management.

Have more questions about saving as a student? Start experimenting with these strategies, and remember: small changes today can lead to big financial wins tomorrow!

Summary

Saving money as a Gen Z student may seem challenging, but it’s far from impossible with the right strategies and determination.

The key lies in adopting a proactive approach to managing your finances. From creating a realistic budget to exploring creative ways to cut costs, every small action helps build a solid foundation for your financial future.

Key Takeaways:

- Budget Wisely: Allocate your income using practical frameworks like the 50/30/20 rule to balance needs, wants, and savings.

- Maximize Opportunities: Leverage student discounts, free campus resources, and cost-saving hacks to stretch your dollars.

- Supplement Your Income: Explore flexible side hustles or campus opportunities to boost your earnings and grow your savings.

- Adopt Long-Term Thinking: Saving isn’t just about the present—it sets the stage for financial independence and future success.

Remember, saving money isn’t about deprivation—it’s about making smarter, value-driven choices that align with your goals and lifestyle. Start small, stay consistent, and watch as those tiny habits grow into significant wins over time.

“Your journey to financial freedom begins today—make it count!“