Introduction: Mastering the Art of Student Loans

“Education is an investment, but understanding student loans ensures it doesn’t become a financial burden.”

Student loans are often the gateway to achieving career goals for many Gen Zers. However, without a clear plan, they can also become a financial hurdle.

This guide will decode the complex world of student loans, empowering you to borrow wisely, repay effectively, and avoid debt traps.

The Basics of Student Loans

What Are Student Loans and Why Do They Matter?

Student loans are financial tools designed to cover education-related expenses like tuition, housing, books, and even daily living costs.

They matter because they open doors to educational opportunities that might be out of reach otherwise.

However, their significance goes beyond mere access—understanding how they work ensures you can manage them effectively and avoid falling into the trap of long-term debt.

Think of student loans as a bridge to your dreams, but without proper planning, that bridge could lead to shaky financial ground.

The Two Main Types of Student Loans

Navigating the world of student loans starts with understanding their types—federal and private. Each serves a purpose but comes with distinct features, benefits, and responsibilities.

Federal Student Loans

Federal loans, backed by the U.S. Department of Education, are the most common starting point due to their borrower-friendly terms. They include:

- Subsidized Loans: Tailored for undergraduates with financial need, these loans are interest-free while you’re in school or during deferment periods.

Example: If you borrow $10,000, your balance won’t grow while you’re studying. - Unsubsidized Loans: Available to both undergraduate and graduate students, these loans accrue interest immediately after disbursement.

Tip: Regularly pay off the interest during school to reduce your total cost over time. - PLUS Loans: Designed for parents or graduate students to cover additional education costs, these loans have higher borrowing limits but also higher interest rates.

Pro Insight: Ensure you can manage repayment before taking out PLUS loans, as they lack some flexibility offered by other federal loans.

Private Student Loans

Private loans are provided by banks, credit unions, or online lenders and cater to students who need funds beyond federal loan limits. Key points include:

- Higher Interest Rates: Often variable, making your payments less predictable.

- Fewer Repayment Options: May lack benefits like income-driven repayment plans.

- Cosigner Requirements: Typically require a parent or guardian with good credit.

Pro Tip: Use private loans as a last resort and compare lenders to find the best terms.

Understanding the basics of student loans sets the foundation for informed borrowing. Up next, let’s explore how the Student Loan Process Works.

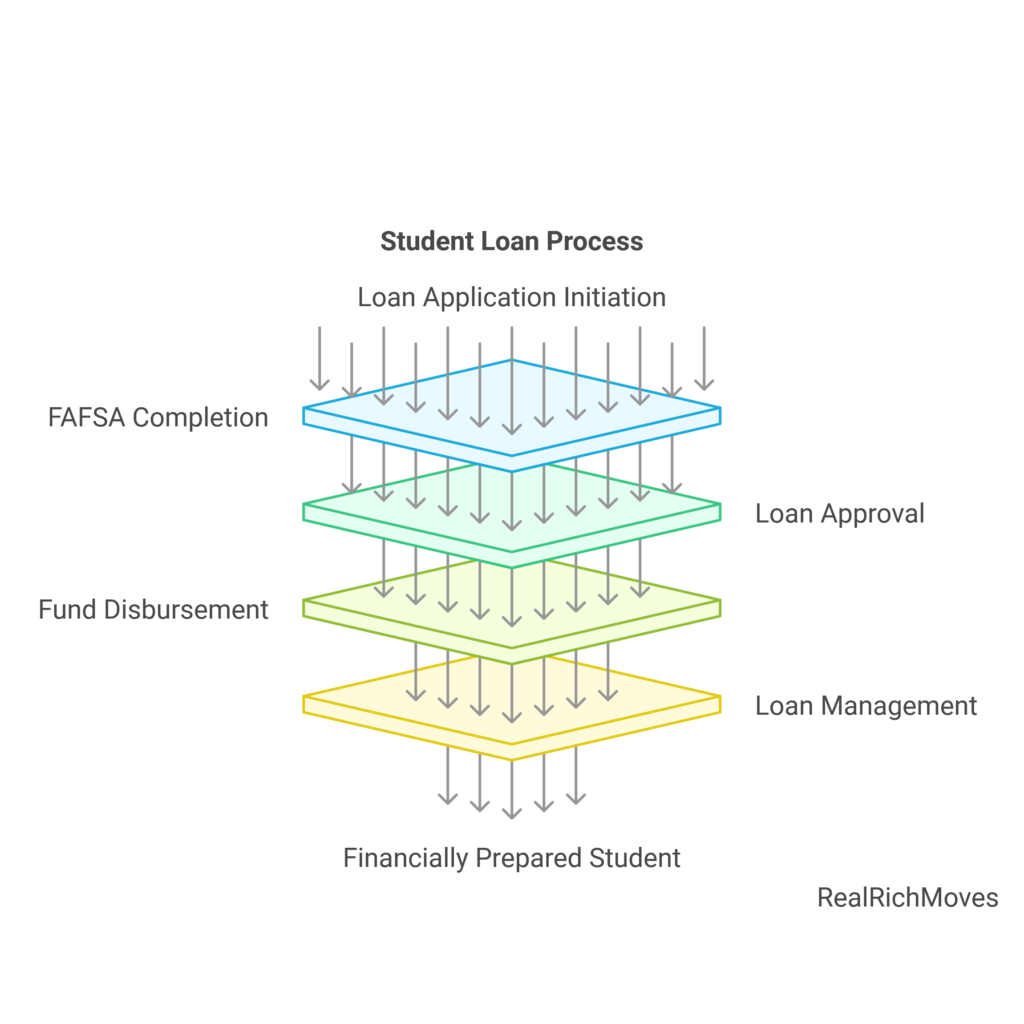

How the Student Loan Process Works – Step By Step

Step 1: Research and Apply

The journey to securing student loans starts with informed decisions. Here’s how to take the first step:

- Complete the FAFSA (Free Application for Federal Student Aid): This form determines your eligibility for federal loans, grants, and work-study programs. Pro Tip: Submit it as early as possible to maximize your chances of receiving aid.

- Explore Private Loan Options: If federal aid falls short, consider private loans as a supplement. Compare lenders based on interest rates, repayment terms, and borrower benefits to ensure you get the best deal.

Key Insight: Federal loans should always be your first choice due to their lower rates and flexible repayment options.

Step 2: Approval and Disbursement

Once you’ve applied, the next step is approval and accessing your funds:

- Federal Loan Approval: These loans are typically approved based on financial need rather than credit history, making them accessible for most students.

- Private Loan Approval: Requires a credit check and often a cosigner, especially for young adults with limited credit history.

Pro Tip: Choose a cosigner with strong credit to secure better interest rates.

After approval, the loan amount is sent directly to your school to cover tuition, fees, and other costs. Any leftover funds are disbursed to you for housing, books, or personal expenses.

Example: If your tuition is $8,000 and you borrow $10,000, you’ll receive $2,000 for additional needs.

Step 3: Managing Loans While in School

Effective loan management begins while you’re still studying:

- Borrow Smartly: Take only what you need to avoid unnecessary debt accumulation.

Tip: Create a budget to estimate your actual expenses before deciding how much to borrow. - Repay Interest on Unsubsidized Loans: Even small, regular payments toward accruing interest can significantly reduce your total debt after graduation.

Example: Paying $25 monthly on a $10,000 loan can save you hundreds in interest over time.

Understanding the loan process is key to borrowing wisely, but the real challenge lies in understanding Interest rates and loan terms —let’s break it down in the next section.

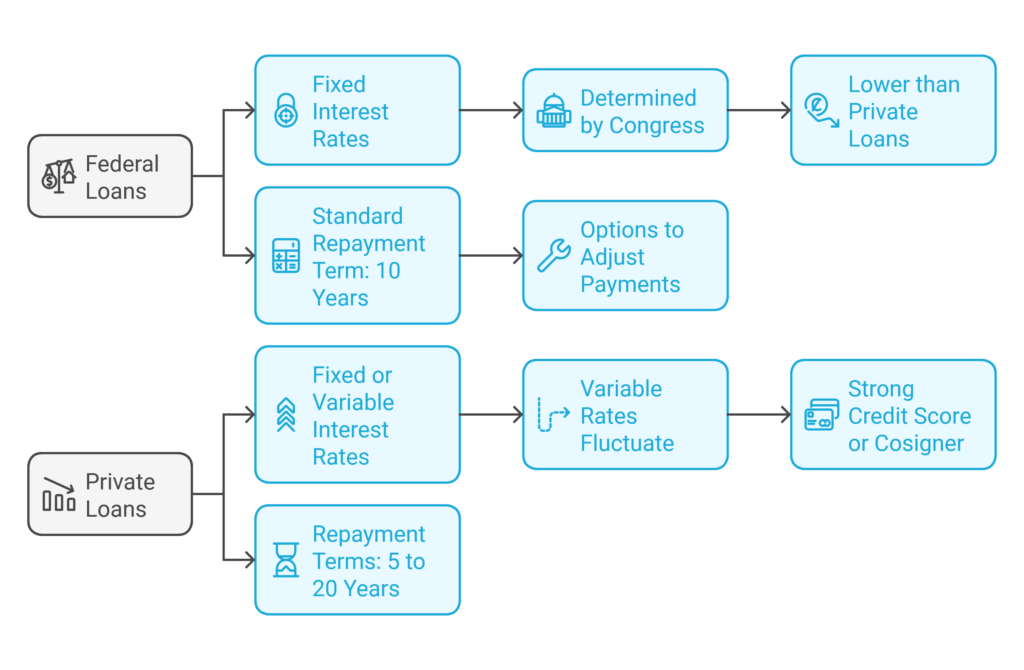

Interest Rates and Loan Terms Explained

Federal Loan Interest Rates

Federal loans offer a predictable and stable borrowing experience thanks to their fixed interest rates, which stay consistent throughout the life of the loan. Here’s what you should know:

- Determined Annually by Congress: Each year, federal loan rates are set based on market trends, ensuring accessibility for students.

- Typically Lower Than Private Loans: These rates make federal loans the first choice for most students.

Example: A federal subsidized loan may have an interest rate of 4.99%, significantly lower than private alternatives.

Key Takeaway: Fixed rates simplify budgeting and eliminate surprises in monthly payments.

Private Loan Interest Rates

Private loans, on the other hand, offer more variability but come with some caveats:

- Fixed Rates: These remain constant, providing stability similar to federal loans.

- Variable Rates: Fluctuate with market conditions, potentially starting lower than fixed rates but posing a risk of rising over time.

Example: A variable rate might start at 4% but climb to 7% or higher, increasing monthly payments unexpectedly.

To secure the best rates:

- Build a strong credit score.

- Consider applying with a cosigner who has excellent credit.

Loan Terms and Repayment Periods

Loan terms define how long you’ll be repaying your loan and directly impact your monthly payments:

- Federal Loans: Typically have a standard repayment term of 10 years. However, flexible options like income-driven repayment plans or extended terms up to 25 years are available.

Pro Tip: Opt for income-driven repayment plans if you anticipate lower earnings in the initial stages of your career. - Private Loans: Terms vary widely, usually ranging from 5 to 20 years. Shorter terms mean higher monthly payments but lower overall interest costs, while longer terms offer smaller payments with more interest over time.

Example: A 10-year loan term at 5% interest will have smaller overall costs than a 20-year term at the same rate.

Interest rates and loan terms are key to understanding your financial commitment, but managing repayment strategies is where the real financial planning begins—let’s explore this further!

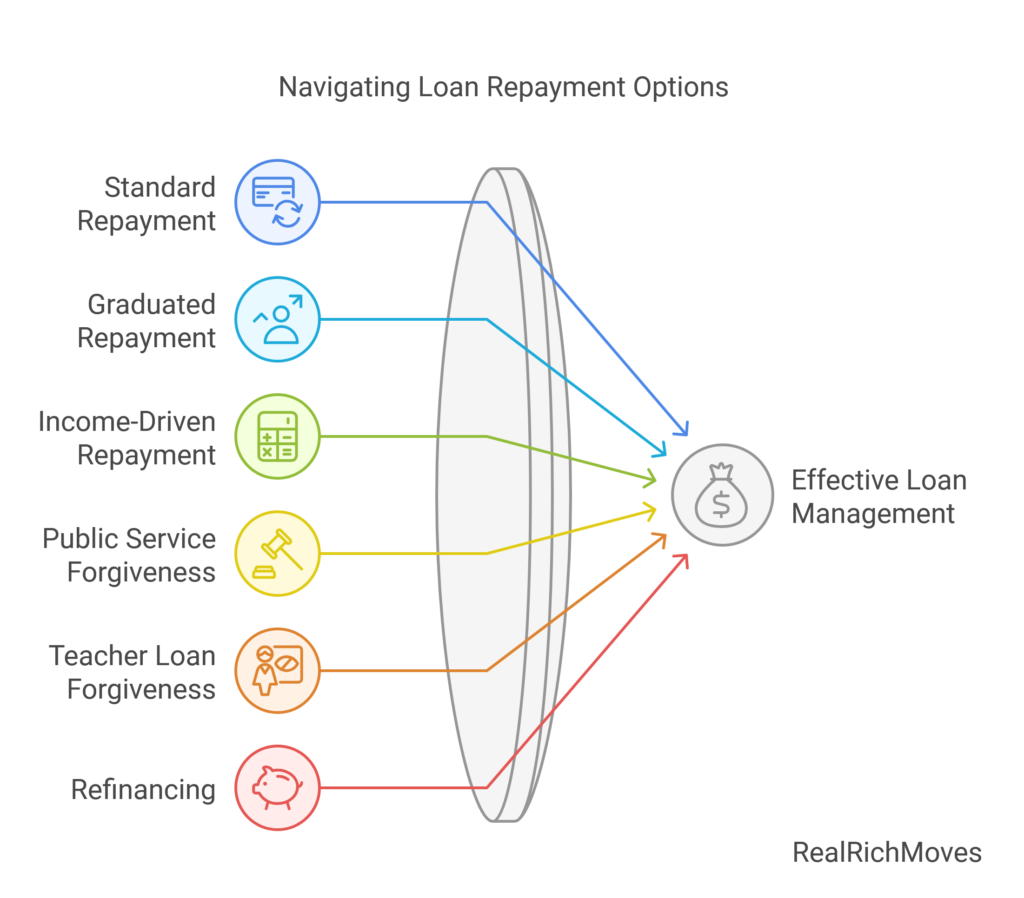

Mastering Loan Repayment Options

Federal Loan Repayment Plans

Federal loans offer a range of repayment plans tailored to diverse financial situations. Here’s how they work:

Standard Repayment:

- Fixed monthly payments over 10 years.

- deal for borrowers who want to minimize interest costs and pay off loans quickly.

Example: A $30,000 loan at 5% interest results in monthly payments of approximately $318.

Graduated Repayment:

- Payments start low and increase every two years.

- Suited for borrowers expecting a steady income growth, such as recent graduates starting entry-level positions.

Income-Driven Repayment (IDR):

- Payments are adjusted based on income and family size.

- Includes plans like PAYE (Pay As You Earn) and REPAYE (Revised Pay As You Earn), where payments are capped at 10-15% of discretionary income.

- Benefits those with fluctuating incomes or tight budgets.

Key Insight: IDR plans also forgive the remaining balance after 20-25 years of qualified payments.

Loan Forgiveness and Cancellation Programs

Public Service Loan Forgiveness (PSLF)

- Designed for borrowers employed in qualifying public service jobs, such as government or non-profit organizations.

- After 120 qualifying payments (approximately 10 years), the remaining loan balance is forgiven tax-free.

Example: A nurse working for a non-profit hospital can benefit significantly from PSLF.

Teacher Loan Forgiveness

- Offers up to $17,500 in forgiveness for teachers working full-time in low-income schools for at least five consecutive years.

- Specific subject teachers, like math and science, often qualify for the maximum forgiveness amount.

Pro Tip: Combining Teacher Loan Forgiveness with PSLF can amplify benefits for educators.

Refinancing vs. Consolidation

Refinancing:

- Offered by private lenders, refinancing allows borrowers to combine multiple loans into a single new loan with a potentially lower interest rate.

- Requires good credit or a creditworthy cosigner to secure favorable terms.

Example: Refinancing a 7% loan to a 4% rate can save thousands in interest over the loan term.

Consolidation:

- Combines multiple federal loans into one for simplified repayment.

- Does not reduce the interest rate but allows access to extended repayment terms or eligibility for forgiveness programs.

Example: Consolidating federal loans can streamline payments but may increase the overall cost due to extended terms.

With a clear repayment strategy, you can confidently manage your student loans while paving the way toward financial freedom—next, let’s dive into common challenges with student loans!

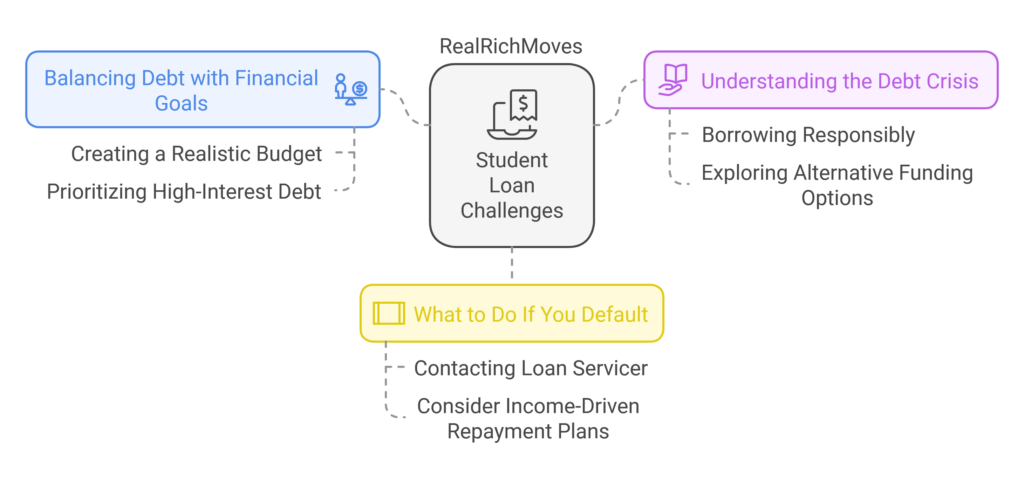

Common Challenges with Student Loans

Balancing Debt with Financial Goals

For many young adults, juggling student loan payments with broader financial aspirations feels like walking a tightrope. However, it’s entirely possible to achieve a balance with careful planning and disciplined actions:

Create a Realistic Budget:

- Allocate specific amounts for loan payments, saving, and day-to-day expenses.

- Use budgeting apps to track spending and ensure loan obligations are met without neglecting other goals.

Prioritize High-Interest Debt:

- Focus on paying off loans with higher interest rates first while maintaining minimum payments on others.

- Simultaneously, build an emergency fund to avoid financial setbacks.

Example: A graduate managing $35,000 in student loans can commit to repaying high-interest debt while saving $50/month for emergencies.

Understanding the Debt Crisis

The U.S. student debt crisis has reached alarming levels, leaving many young adults feeling trapped by financial constraints. Gen Z, however, is uniquely positioned to approach this challenge strategically:

Borrow Responsibly:

- Only borrow what’s necessary for essential education-related expenses.

- Understand the total cost of borrowing, including interest, before accepting loans.

Explore Alternative Funding Options:

- Maximize grants and scholarships to reduce reliance on loans.

- Take advantage of side hustles or part-time work to fund educational costs without excessive borrowing.

Pro Tip: Use tools like FAFSA and scholarship databases to uncover funding opportunities.

What to Do If You Default

Defaulting on student loans can feel like hitting a financial wall, but there are steps to regain control:

Contact Your Loan Servicer:

- Act immediately to discuss options such as deferment (temporarily postponing payments) or forbearance (pausing payments due to hardship).

- Inquire about loan rehabilitation programs that can remove the default from your credit report after successful payments.

Switch to Income-Driven Repayment Plans:

- Adjust monthly payments to align with your income, making repayment more manageable.

- Many IDR plans also offer forgiveness options after 20-25 years of qualifying payments.

Example: A borrower earning $40,000/year can reduce monthly payments from $400 to $150 under an IDR plan, avoiding default.

By tackling these challenges with informed strategies, you can transform student loans from a burden into a manageable step toward financial freedom—let’s explore ways to stay ahead of debt and build wealth simultaneously!

Practical Tips to Manage Student Loans Effectively

Borrow Smartly

Smart borrowing is the foundation of effective student loan management. Start by minimizing the amount you borrow and maximizing free resources:

Exhaust Free Aid:

- Seek out scholarships and grants before turning to loans. These resources don’t need to be repaid and can significantly reduce your financial burden.

- Apply for federal aid through FAFSA and explore niche scholarships tailored to your field of study.

Use Budgeting Tools:

- Track spending to identify areas where you can cut back and avoid unnecessary borrowing.

- Limit student loan use to essential educational costs like tuition and textbooks.

Pro Tip: Only borrow what you truly need, not what you’re approved for—it’s easier to manage smaller loan balances post-graduation.

Start Repayments Early

Starting repayment while still in school can make a huge difference in reducing your overall debt. Here’s how to get ahead:

Pay Off Interest During School:

- For unsubsidized loans, interest accrues while you’re in school. Paying off this interest prevents it from capitalizing and adding to your principal balance.

- Even small monthly payments can save thousands over the life of your loan.

Set Up Automatic Payments:

- Automating payments ensures you never miss a due date and may qualify you for a 0.25% interest rate reduction on federal loans.

- Use budgeting apps to ensure funds are always available in your account for automatic deductions.

Example: Paying $50/month toward accrued interest during school can save you hundreds in post-graduation costs.

Leverage Loan Servicer Tools

Your loan servicer offers valuable tools to simplify repayment planning and keep you on track:

Use Online Calculators:

- Estimate repayment timelines, monthly payment amounts, and the impact of paying extra toward your loans.

- Adjust your plan as your income grows or financial priorities change.

Monitor Loan Balances:

- Regularly review your loan details, including interest rates and repayment schedules, to stay informed.

- Set reminders to check your progress quarterly and reassess your strategy if needed.

Pro Tip: Many loan servicers offer mobile apps that make it easy to track payments and balances on the go.

With these practical strategies, managing your student loans can become a proactive part of your financial journey—paving the way for debt freedom and financial stability!

FAQs About Student Loans

With these FAQs demystified, you’re equipped to navigate student loans confidently and make decisions that align with your financial goals!

Summary: Take Charge of Your Student Loan Journey

Student loans are a valuable tool for achieving higher education, but they require careful management to avoid long-term financial strain.

From understanding loan types and interest rates to mastering repayment strategies, every step matters.

At RealRichMoves, we’re here to help you navigate the complexities of student loans and make smarter financial decisions. Take control of your loans today and start building a brighter, debt-free future.

Empower your finances with #RealRichMoves and let’s pave the way to financial freedom together!